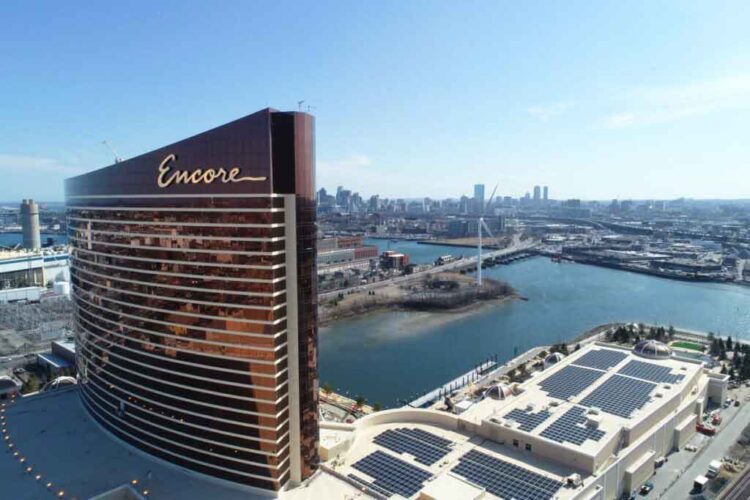

US casino giant Wynn Resorts Limited announced early Friday (Asia time) that it has completed the sale of the land and real estate assets of its Massachusetts integrated resort, Encore Boston Harbor.

The sale, to Realty Income Corporation, will net Wynn US$1.7 billion in cash, with the transaction having received all necessary regulatory approvals.

Wynn said the net proceeds of the transaction will further strengthen the company’s global liquidity position to US$4.4 billion.

Under the terms of the transaction, Wynn will continue to operate Encore Boston Harbor via a triple net lease arrangement that will see the company pay initial annual rent of US$100 million for a term of 30 years – escalating at a rate of 1.75% for the first 10 years and the greater of 1.75% or CPI (capped at 2.5%) over the remaining initial lease term.

Wynn also holds one 30-year lease renewal option.

Wynn Resorts recently announced a US$142.9 million loss for the three months to 30 September 2022, with record Adjusted Property EBITDA at Wynn Las Vegas and Encore Boston Harbor offset by significant losses in Macau.

The company previously announced in June that it had reached an agreement to supply a US$500 million loan facility to its Macau subsidiary, Wynn Macau Ltd.