“Even in the high tech world of today’s casino operations, sometimes it‘s the simplest solutions that work best” says industry veteran Steve Karoul.

This has been a very volatile year for a number of reasons, not least of them the coronavirus pandemic which has disrupted casino businesses around the world.

I was asked recently to be one of the moderators for a webinar, hosted by ICE Digital, which attracted attendees from across the globe. The subject was Casino Marketing: Back to the Basics. The webinar ran for three days and had some very accomplished and professional speakers involved.

The objective was not only to look at the way we do business today but also to look back and see if there were any really good ideas from years ago that could be implemented today to try to help improve business or allow casinos to operate more efficiently and profitably.

Over the past few years we’ve heard about several very high-profile cases involving anti-money laundering (AML) issues. Money laundering is one of the most serious, egregious and offensive problems a casino will ever have to deal with. It is also an issue that warrants the most severe penalties from regulators – often with fines running into the millions of dollars. Casinos or individuals can even lose their gaming licenses, forcing the casino’s closure or sale or resulting in an employee or executive being expelled from the industry forever.

One current case involves Crown Resorts in Australia, which recently admitted at an inquiry into its suitability to hold a casino license that some of its international bank accounts may have been used for money laundering purposes. This is a current and ongoing case so I will not focus on the what, why, when, where or how, but rather on preventative measures that could have been taken in the past to possibly help prevent what happened. The recent ICE Digital Webinar that focused on Back to the Basics reminded me of a simple but basic preventative measure that works.

Many years ago, I worked for a well-known major casino company that was becoming very aggressively involved in international casino marketing, opening numerous branch offices and bank accounts all around the world to support the marketing efforts of its international staff. Many of these employees were relatively new, to the field itself and to the casino cage and marketing. Therefore, our concern was to learn more about banking systems and procedures, bank wire transfers, and handling of cash deposits from players, junkets and independent reps. Looking back, I realize today how naïve and vulnerable we were at the time. Nevertheless, we made a very concerted effort to learn as much as we could about money laundering and how we could help prevent it in our casino.

Many years ago, I worked for a well-known major casino company that was becoming very aggressively involved in international casino marketing, opening numerous branch offices and bank accounts all around the world to support the marketing efforts of its international staff. Many of these employees were relatively new, to the field itself and to the casino cage and marketing. Therefore, our concern was to learn more about banking systems and procedures, bank wire transfers, and handling of cash deposits from players, junkets and independent reps. Looking back, I realize today how naïve and vulnerable we were at the time. Nevertheless, we made a very concerted effort to learn as much as we could about money laundering and how we could help prevent it in our casino.

Our international bank at that time was Mellon Bank, headquartered in New York City. I was part of a team assigned to visit with the top executives of the bank who oversaw wire transfers and AML efforts.

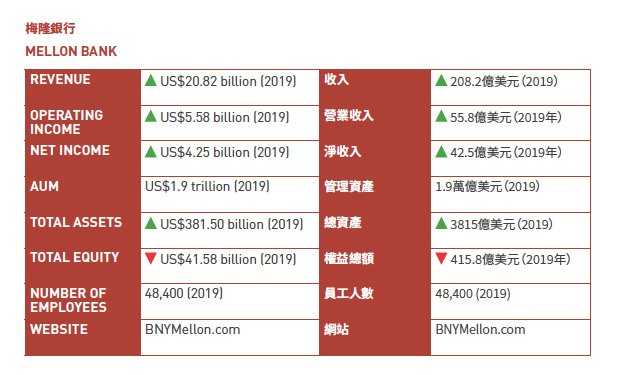

Mellon Bank has an interesting history. According to Wikipedia, “The Bank of New York Mellon Corporation, commonly known as BNY Mellon, is an American multinational investment banking services holding company headquartered in New York City. BNY Mellon was formed from the merger of The Bank of New York and the Mellon Financial Corporation in 2007. It is the world’s largest custodian bank and asset servicing company, with US$1.9 trillion in assets under management and US$37.2 trillion in assets under custody as of the second quarter of 2020. BNY Mellon is incorporated in Delaware.

“Through its Bank of New York predecessor, it is one of the three oldest banking corporations in the United States, and among the oldest banks in the world, having been established in June 1784 by a group that included American Founding Fathers Alexander Hamilton and Aaron Burr. Mellon had been founded in 1869 by the Mellon family of Pittsburgh, which included Secretary of the Treasury Andrew W. Mellon.”

“Through its Bank of New York predecessor, it is one of the three oldest banking corporations in the United States, and among the oldest banks in the world, having been established in June 1784 by a group that included American Founding Fathers Alexander Hamilton and Aaron Burr. Mellon had been founded in 1869 by the Mellon family of Pittsburgh, which included Secretary of the Treasury Andrew W. Mellon.”

I was extremely impressed by what I saw and what I learned during my trip to Mellon Bank.

We were told that on an average day the wire transfer room would process over US$1 billion in bank transfers from and to destinations all around the world. Our casino cage seemed miniscule in comparison.

Mellon also had over 48,000 employees, which meant that someone had to be responsible for training all of these employees in policies, procedures and what to watch for regarding any suspicious transactions.

However, what really fascinated me and surprised me the most was seeing numerous bright fluorescent orange stickers stuck on numerous files and documents in their wire transfer room. I asked our host what they meant, and he brought one file over and showed us. The orange sticky note said, “BIG MONEY.” He further explained that they, like many other large corporations, had to depend upon human interaction to help avoid making mistakes or missing important pieces of information.

I thought to myself, “Imagine a billion dollars or more passing through your office. How much of that could be tainted or associated with money laundering or other problems?” Our host agreed with me and explained that they had tried numerous ideas to guide employees to focus on potential areas of concern. In the end, the solution they settled upon turned out to be the least expensive and simplest to implement.

He further explained that everyone understood the term “BIG MONEY” and that the bright orange color was a visual reminder for staff to take a second or third look at that particular transaction to verify conformity to the bank’s policies. He told us that this one simple idea worked like a charm and their percentage of errors had dropped dramatically.

He further explained that everyone understood the term “BIG MONEY” and that the bright orange color was a visual reminder for staff to take a second or third look at that particular transaction to verify conformity to the bank’s policies. He told us that this one simple idea worked like a charm and their percentage of errors had dropped dramatically.

I was impressed and thought about how we could implement something similar in our casino cage and International Branch Offices. So I developed our own “BIG MONEY” sticker which helped us tremendously. It did not cost a lot of money, was easy to implement and, more importantly, was easy to understand.

Of course, the casino industry today is almost totally controlled by software and computer programs. However, mistakes still happen, and it can be helpful to have a backup plan. This is especially important for casinos that are required to control, report and eliminate all money laundering activities in their casinos.

We may not have to spend millions of dollars on more software, computer programs or consultants. Sometimes the simple solutions work best. In the end, it’s up to all of us to think outside the box. Good luck!