The forced closure of casinos during the COVID-19 pandemic is both a short-term revenue risk and a unique opportunity to gain market share, according to research from Differential Labs.

During a balmy Sunday afternoon last August, Zhang Wei, a paunchy middle-aged punter from Guangzhou, travelled to Macau for his monthly afternoon of baccarat and dim sum. Within 40 minutes of crossing the border he had boarded a shuttle bus to his favorite property, redeemed an offer for HK$1,000 in free-play and settled in front of a table with a promising trend – a ritual which is both mindless and filled with excitement.

Mr Wei epitomizes the stickiness casino patrons feel for their preferred property, which makes market share gains tedious and time consuming. We estimate that only one in five players in Macau are loyal and regular visitors to a given property, but those loyal players can contribute between 60% and 80% of revenues. This statistic is consistent globally.

The forced closure of casinos during the COVID-19 pandemic is both a short-term revenue risk and a unique opportunity to gain market share while players, like Mr Wei, are out of their typical visitation pattern.

The forced closure of casinos during the COVID-19 pandemic is both a short-term revenue risk and a unique opportunity to gain market share while players, like Mr Wei, are out of their typical visitation pattern.

There is, of course, a yawning gap between knowing this is an opportunity and doing something about it. In better times we could have simply juiced up offers and hoped for the best, knowing that a handful of great players would subsidize a lot of inefficiency. In a post-COVID world, marketers may need to be more efficient.

We think operators can reduce reinvestment while gaining market share by getting more strategic and segmented in their thinking and leveraging analytics more deeply. To do this, we think operators need to rethink their marketing in at least three ways: consolidate patrons who are loyal elsewhere, reactivate patrons who are defectors and reinvest with clear behavioral objectives.

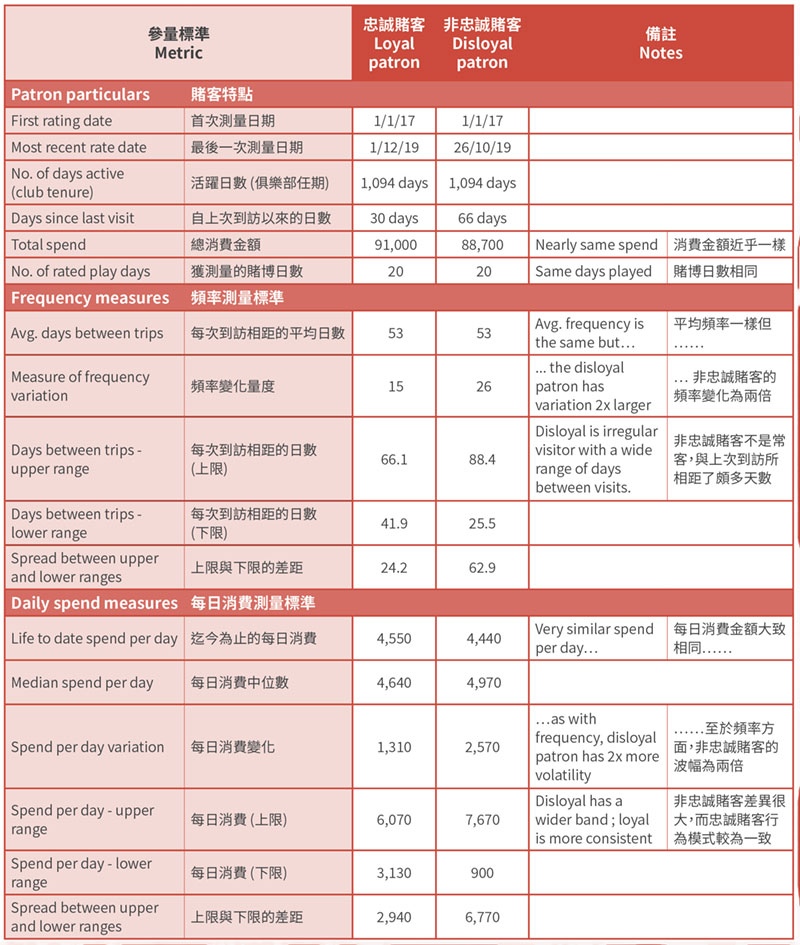

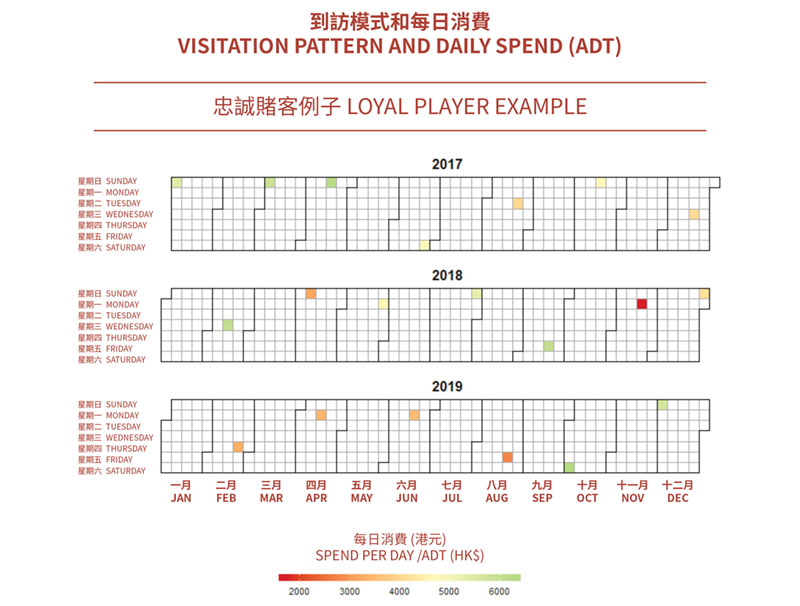

To illustrate the analytics behind these strategies, consider two fictitious patrons – one loyal and one promiscuous. See Exhibit 1 for a numerical illustration of these two patrons.

TAKE CONSOLIDATED DISLOYAL PATRONS FIRST

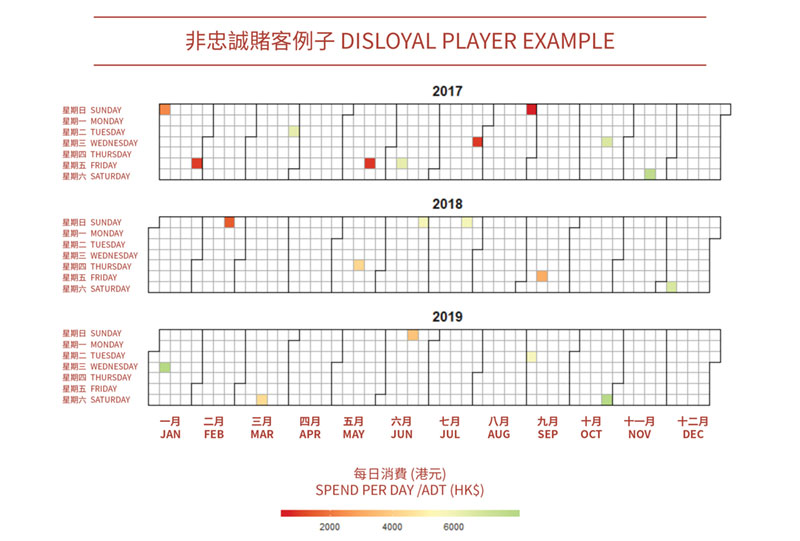

These patrons are active but mostly play elsewhere and by extension only show us part of their wallet. Consolidating these patrons’ trips is often the lowest hanging fruit. These patrons have an indelible play pattern which is characterized by the vagaries in their behavior (see Exhibit 1).

For instance, the two players in Exhibit 1 have the same daily spend (ADT) but player two is clearly non-loyal: he visits irregularly and varies his spend per day substantially. Consequently, we likely have significantly more upside with the disloyal player. For instance, based on this player’s intermittent visitation pattern, converting them from disloyal to loyal (and thus consolidating their trips) would increase annual visitation from 6.9x per year to 14x per year. Likewise, we are probably getting the second bite at this player’s wallet and they are likely worth HK$10,000 per day, not the observed HK$4,440.

Consequently, we are advising properties to target these disloyal patrons aggressively in their reopening marketing, as consolidating these patrons will lead to share gains. Finding these players is fairly easy by looking at a patron’s variation in behavior versus their averages (as in Exhibit 1).

We have had the best results by first segmenting patrons into like groups (using statistical segmentation) and then running this comparison within each segment independently.

The strategy in this segment requires a leap of faith: loyal patrons have less upside so it’s better to reinvest in disloyal patrons until loyal patrons show signs of waning. Consequently, the key to success in this segment is active monitoring of loyal patrons and developing offers to incentivize disloyal patrons to become more regular visitors. We worked recently with a casino in Asia to develop disloyal visitation offers which are delivering a +30% lift over previous offers.

REACTIVATE DEFECTORS WHO ARE NOW PLAYING EXCLUSIVELY ELSEWHERE

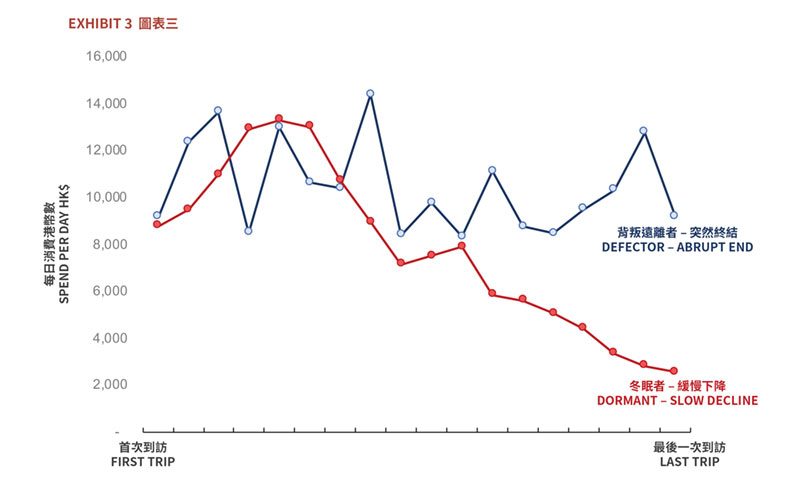

Reactivation programs typically are low ROI except for patrons who are defectors. Defectors are still active but only play with a competitor. They can often be reactivated versus dormant patrons who are no longer active gamers with anyone and are challenging to reactivate.

Parsing decliners from dormant patrons requires understanding how these patrons lapsed. We have found that patrons who stop playing abruptly are more likely to be reactivated than patrons who burn out slowly (see Exhibit 3).

Using this targeting technique, we have been able to increase the ROI or reactivation campaigns by 3x. The trick in reactivation campaigns, we have found, is not in the initial reactivation, but rather in rewarding three to four trips within a narrow time band. When formulating re-opening strategies, we think it is wise to target these patrons aggressively rather than casting a diluted but wide net.

REINVEST WHERE THERE IS CLEAR UPSIDE

In Macau, we often reinvest according to a very generic value-based matrix. By strategically setting an objective for each patron and personalizing the offer mechanics to achieve that objective, we often increased reinvestment ROI by 1.5x.

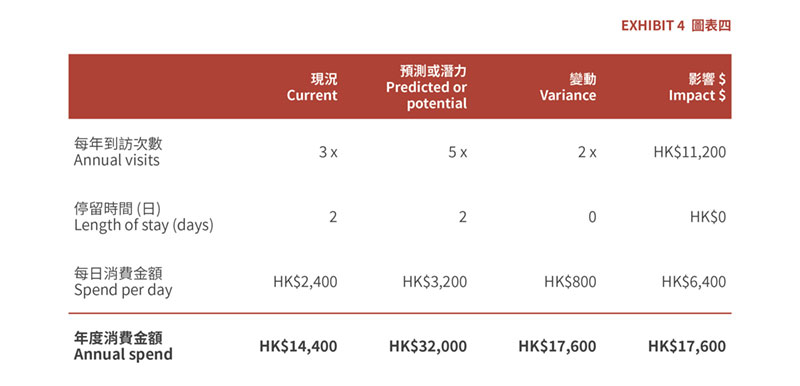

There are many different frameworks for setting these objectives but the most proven in the casino industry is using a lifecycle type framework. We have the greatest success by using the lifecycle framework generally and then sub-segmenting regular/loyal visitors into more nuanced behavioral objectives (see Exhibit 4).

Strategically, we then want to create an offer which incentivizes a specific change in the behavior that has the most upside. For instance, reference Exhibit 4 which describes a patron who we believe can visit five times a year versus their current three and spend HK$3,200 per day versus a current spend of HK$2,400. For this patron we don’t see any length of stay upside. With the patron in Exhibit 4 the largest prize is to reward increased visitation. We could consequently create a reward after the x visit within y days.

In a post-COVID world where hard dollars are precious, getting more strategic with reinvestment is wiser than the blanket reductions mentioned by some operators.

We think the COVID shutdown has the potential for being a great platform for future growth. As most properties are keeping a tighter eye on the checkbook, we believe the above three strategies are an effective way to harvest this upside while not breaking the bank.

Clayton can be reached at clayton@diffgaming.com.