A probe into potential anti-money laundering breaches by Marina Bay Sands – the Singapore casino owned and operated by Las Vegas Sands – could result in domestic rival Resorts World Sentosa gaining substantial VIP share, according to Maybank analyst Samuel Yin Shao Yang.

Bloomberg reported on Friday that the US Department of Justice (DOJ) has issued a subpoena to a former MBS compliance chief to supply documents and any other information related to the accounts of VIP players. The report alleges US prosecutors are investigating possible violations regarding the use of junkets or third-party lending using casino credit, as well as whether there has been any retaliation against whistle blowers.

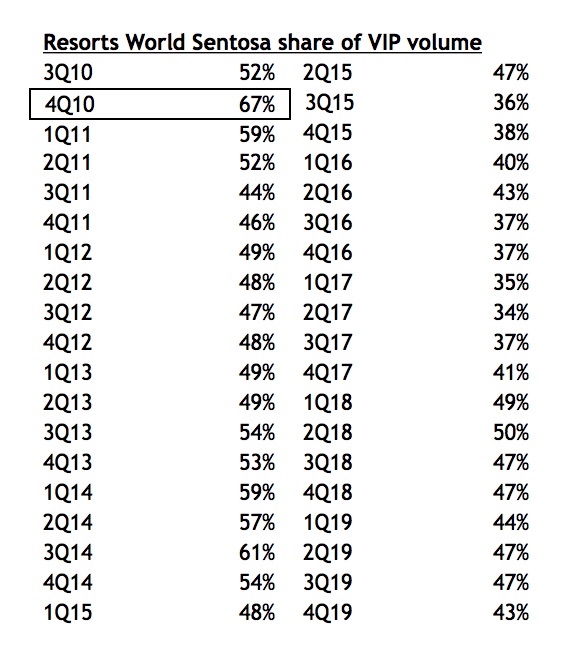

In a note, Yin recalled that MBS also faced a DOJ investigation in 2010 in relation to a lawsuit filed by Steven Jacobs, the former CEO of another LVS subsidiary, Sands China. On that occasion, RWS saw its share of Singapore’s VIP market soar to a record high of 67%, and remain above 50% for the next two quarters. By comparison, since opening in January 2010, RWS has averaged 47% of Singapore VIP volume.

“We do not presume that either MBS, Sands China or LVS was or is guilty or innocent of any charges – which company has never had to deal with disgruntled ex-employees?” Yin said.

“What we gather is VIPs tend to avoid casinos which are under investigation, especially by the DOJ.

“Learning from history, we gather that RWS could benefit from higher share of VIP volume. All it needs to do now is just reopen.”

Operations at both MBS and RWS have been suspended since 7 April due to COVID-19.