MGM China’s share price has fallen to its lowest in more than four years as investor sentiment becomes increasingly shaky on coronavirus fears.

At market close on Wednesday, MGM China’s stocks sat at HK$9.14, having reached as low as HK$8.81 on Tuesday – its lowest since 28 February 2016 and 62% down on its all-time high of HK$24.30 achieved on 14 January 2018. The decline was similarly felt by parent company MGM Resorts whose share price of US$17.53 on Monday was the lowest since 23 March 2016. MGM Resorts closed at US$18.08 on Wednesday.

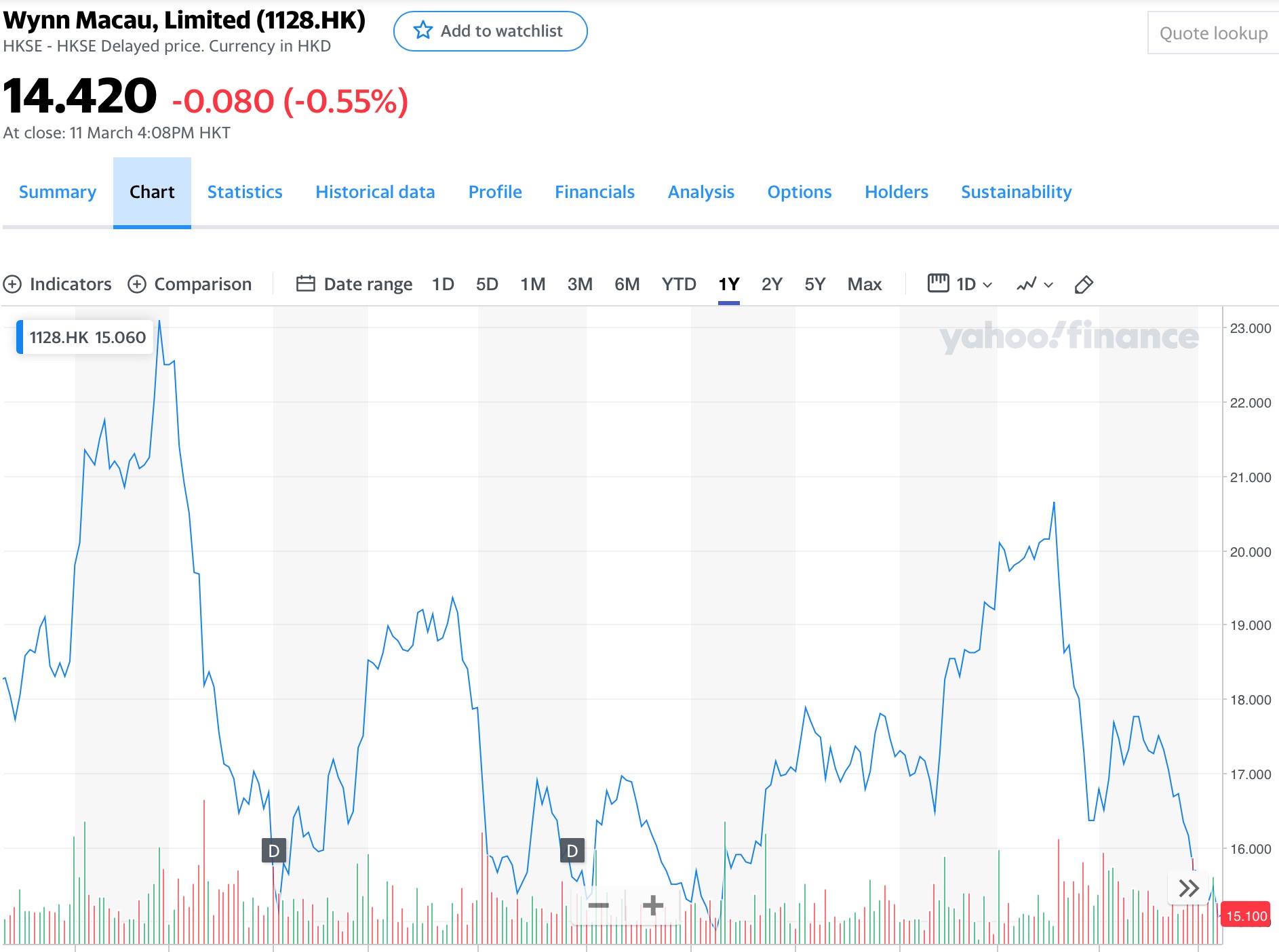

Wynn Macau fell to a three-year low on Tuesday with its price of HK$14.04 not seen since 5 March 2017. The decline compares with an all-time high of HK$30.15 on 8 April 2018 and represents a 29.8% fall in the space of two months from HK$20.65 on 12 January 2020. Similarly, parent company Wynn Resorts saw its share price fall to US$80.16 on Wednesday – the lowest since 27 December 2017 – before closing at US$80.87.

While MGM China and Wynn Macau have felt the brunt this week, stock market pain has nevertheless been a common theme for Macau’s gaming operators.

Melco Resorts & Development, listed on the NASDAQ, fell to its lowest share price since 19 November 2018 on Monday at US$14.96, Sands China to its lowest price since 30 December 2018 on Tuesday at HK$32.45 while Galaxy Entertainment Group slipped to its lowest share price since 13 October 2019 last Friday at an intra-day price of HK$48.15. Galaxy’s price had been as high as HK$62.20 as recently as 12 January 2020.

SJM’s price of HK$7.88 had reached a similar low on 1 December 2019 but had climbed to HK$10.50 on 12 January 2020 before falling again on coronavirus fears.

The industry-wide declines come in the wake of a massive decline in visitation to Macau due to tightened border restrictions aimed at preventing the spread of coronavirus. Authorities revealed over the weekend that there were no longer any active cases of COVID-19 in Macau following the release from hospital of the 10th and final confirmed case, however the news was less positive for operators with Macau’s GGR numbers tracking down 80% year-on-year during the first eight days of March.

Macau’s GGR fell 87.8% year-on-year in February to MOP$3.10 billion.