The impending takeover of Caesars Entertainment by Eldorado Resorts has put an end to the Las Vegas giant’s Japan ambitions and cast doubt over its Korean IR while the company focuses on US gaming and debt reduction.

The empire of Caesars appears destined to be turned away from Asia again. In the wake of Eldorado Resorts’ US$17.8 billion takeover, Caesars has ended its pursuit of a Japan integrated resort license and, industry analysts believe, may abandon its casino resort under construction in South Korea. However, the merger isn’t slated to close until the first half of next year, and until then, Caesars continues to seek its long sought foothold in Asian gaming.

Founded in 1973, Reno based Eldorado owned two and a half properties with EBITDA of US$35 million until 2014 when it began a series of acquisitions, expanding the portfolio to 26 properties and, Union Gaming estimates, US$644 million in EBITDA this year. Eldorado’s four previous deals were all in the US outside Las Vegas, and they’ve all been accretive thanks to management finding operational efficiencies, business synergies and cost cuts.

Caesars, with 55 properties on four continents and estimated EBITDA in excess of US$2.3 billion, represents a quantum leap for Eldorado. With US$13.5 billion debt in the deal – half assumed from Caesars – Eldorado claims to have identified US$500 million in first year synergies and expects more ahead.

“BLOCKING AND TACKLING”

Against that background, during the 24 June 2019 conference call discussing the acquisition, Eldorado CEO Tom Reeg, slated to helm the merged company, asked about Caesars’ international ambitions, replied, “We’ve not made firm decisions on international yet. You know us as a company that’s been domestically focused and focused on blocking and tackling. So the opportunity internationally is going to have to be, frankly, stupendous for us to be running in that direction.”

“Eldorado’s expertise – and Caesars’ – historically has been in domestic US gaming,” Union Gaming Director John DeCree says. “Until that business is operating and performing optimally, it’s unlikely the combined company will spend any meaningful resources to pursue international opportunities.”

Adds Global Market Advisors’ Director of Government Affairs Brendan Bussmann, “This is about taking two of the largest US gaming companies and turning them into one robust operation. Eldorado’s no nonsense approach will be to maximize the existing properties while selling off some assets to bring down the total amount of debt.”

“With the merger, leverage levels will be high and appetite to put much money to work in Asia development will be very low,” Sanford Bernstein Senior Analyst Vitaly Umansky tells Inside Asian Gaming.

Internationally, Caesars already owns eight casinos in the UK – the largest with 50 tables and 130 machines – two in Egypt and a 190 room casino hotel in South Africa, plus management contracts on Caesars Windsor in Canada near Detroit, a small casino in the Cairo Hilton and Caesars Dubai, a 570 room non-gaming resort.

BUSINESS AS USUAL

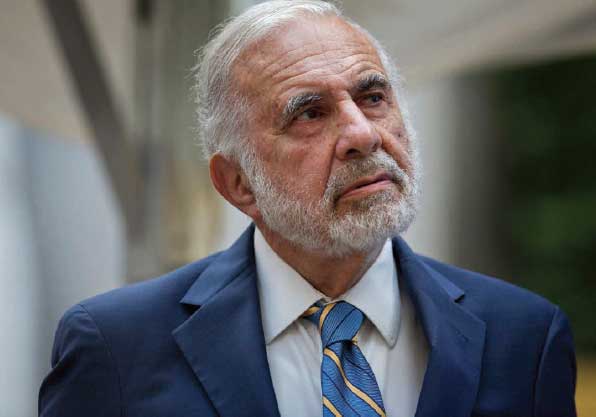

Caesars has adopted the mantra “business as usual” regarding the merger, and, like Eldorado, gave IAG no comment beyond public statements. The merger, involving 81 properties, more than 60 in the US, needs approval from multiple regulators as well as shareholders. It’s overwhelmingly likely that the deal, already endorsed by Eldorado’s founding Carano family and Caesars’ largest shareholder Carl Icahn, will come to fruition. Chances of consummation rise further since Caesars CEO Tony Rodio served in a similar capacity at Tropicana Resorts and helped Eldorado complete its 2018 takeover there.

“While the transaction has a high probability of closing, things can happen,” DeCree says. “Caesars will need to operate business as usual until the transaction closes but it wouldn’t be surprising if efforts slowed down a little bit.”

“While the transaction has a high probability of closing, things can happen,” DeCree says. “Caesars will need to operate business as usual until the transaction closes but it wouldn’t be surprising if efforts slowed down a little bit.”

“If Caesars has any interest in Japan or Korea as part of a long term growth strategy, they will need to continue the efforts as they did prior to the announcement of the merger,” Bussmann says. “Partners and governments will pick up quickly if there is lack of interest in the project.”

On 29 August, Caesars announced that it “will not pursue a license for an Integrated Resort in Japan at this time.” Instead, it will “focus on its current plans and commitments.”

In the statement, issued in Japanese and English, Caesars CEO Tony Rodio explained, “The timing of our decision is driven by sensitivity to the significant decisions Japan’s government and business partners will likely be making later this year to advance the process.”

Reeg’s 24 June statement also fuels doubt about Caesars Korea, a long brewing US$700 million integrated resort under construction outside Seoul on Yeongjong island, near the Incheon International Airport, Korea’s main gateway for foreign visitors. However, a source in Incheon reports no change in the pace of work at the Caesars Korea site and Caesars itself is adamant that Reeg’s comments on international opportunities are not reflective of the company’s Korea ambitions.

ATONEMENT

Caesars Korea, also a joint venture, would finally give the company a gaming presence in Asia, partially atoning for what former Caesars Chairman and CEO Gary Loveman called his biggest mistake – the failure to obtain a Macau casino license. Caesars’ corporate predecessor Harrah’s didn’t bid for a Macau concession in 2001, and, as Caesars, it turned down a chance to purchase Wynn Resorts’ subconcession that Melco Crown bought in 2006 for US$900 million. Caesars followed in 2007 with the ill-fated acquisition of the Orient Golf Club at the edge of Cotai for US$578 million, a deal that failed to yield a Macau gaming license and produced a US$140 million capital loss for Caesars.

Initiated in 2014 and scheduled to open in 2021, Caesars Korea plans more than 720 guest rooms, suites and villas.

“With classic and contemporary blends of Greco-Roman architectural influences, it will be unmistakably Caesars,” the project website says. Beyond the foreigner-only casino, features include a conference center, multiple live entertainment venues including a multi-purpose theater, celebrity chef restaurants, Caesars’ Qua Baths and Spa and a “signature indoor-outdoor pool experience.”

During Caesars’ second quarter earnings call in August, an analyst asked Rodio for an update on the Korea project.

“Well, it’s certainly a focus of ours. We’ve got US$80 million that we put into it to date,” Rodio replied. “That’s going to be a focus of our attention over the next month or two to come up with a recommendation for the board.”

Caesars CFO Eric Hession added, “Our maximum future contribution to the project is US$60 million.” On Eldorado’s earnings call a day later, Reeg wouldn’t elaborate on what Caesars executives said.

The cash demand Hession cites may not seem overwhelming but Caesars’ 2018 annual reports envisions financing the balance with more than US$500 million in debt, unappealing at a time when the acquirer is looking to reduce debt. Perhaps most important, as a foreigner-only casino, Caesars Korea likely falls short of Reeg’s “stupendous” requirement. Paradise City, launched in April 2017, has minted operating losses of US$55 million on revenue of US$578 million to date.

“While still a good market in Asia, South Korea is a hard opportunity to move forward with because of the local restriction,” GMA’s Bussmann says. Bernstein’s Umansky believes Caesars Korea “will most certainly be extinguished” under the merged company.

“HIGHLY SALEABLE”

Former casino executive Howard Jay Klein writes on the Seeking Alpha website that Caesars Korea could be “highly saleable” to an Asian gaming company. It may also appeal to a company absent from the region that, like Caesars, craves an Asian entry point. But Incheon offered two gaming licenses in 2015 and, after 10 parties expressed initial interest, it received only two completed applications and awarded just one license, to US tribal operator Mohegan Sun, developing Inspire, an integrated resort at Incheon airport. The second license remains available.

Caesars had also been actively seeking a license in Japan, which analysts believed did meet Reeg’s “stupendous” opportunity requirement before the company’s 28 August announcement that it had pulled out of the Japan race.

Japan’s timing could still work in Caesars’ favor in the long-term. A recent report from CLSA says, despite Osaka’s efforts to complete an IR before the May 2025 opening of its World Expo, Japan’s first IR won’t debut before 2026. CLSA’s “It’s Almost Raining Yen!” by Research Analyst Jay Defibaugh in Tokyo, and a more recent “Long View” from Sanford Bernstein, both forecast Japan’s selection process to begin in earnest during 2021. CLSA ultimately expects 10 IRs in Japan, with the second wave of selections in the late 2020s.

Asked during the merger call about potential future acquisitions, Reeg conceded “the piece that’s missing in this combined entity is international markets, where we don’t have a presence. But I would expect that to the extent we went that direction, that would be several years out.”

Says DeCree, “Over the long-term, if the new management is successful, the new Caesars will have a substantially lower cost base and more flexible capital structure, which in theory would make Caesars more competitive for larger international opportunities in the future – if that’s the direction the management team takes.”

Strip tease

Strip tease

Acquiring Caesars Entertainment gives Eldorado Resorts a Las Vegas Strip beachhead. But Caesars’ eight Strip properties with some 20,000 rooms and 600,000 square feet of casino space may be “more Strip exposure than we would need,” Eldorado CEO Tom Reeg suggested on the call announcing the merger.

On Eldorado’s second quarter earnings call in early August, Reeg reiterated, “In terms of the Caesars transaction, we have been clear that we are considering, strongly considering, the sale of a Las Vegas Strip asset.”

Reeg, tapped to head the merged company, said any Strip property transaction would take place after the merger deal closes, expected in the first half of next year, “closer to 1 January than 30 June.” If Eldorado does sell any of what it terms Caesars’ “irreplaceable assets on the Strip,” it’s likely to find plenty of buyers.

Caesars’ eight hotels are clustered around the geographic center of the Strip. Flagship Caesars Palace, a trailblazing integrated resort opened in 1966, is located on the west side of the Strip, but the other seven are on the east side, plus The Linq, a retail and entertainment promenade opened in 2014 featuring the Strip’s only zip line and The High Roller, the world’s tallest observation wheel at 550 feet (168 meters), plus land for further development behind it. West of Caesars Palace, it owns the Rio All-Suites Hotel, with 2,520 keys and a 117,300 square foot casino.

“Rio has long been described as being on the block, possibly to be demolished to build something that isn’t a casino,” Convergence Strategy Group Managing Partner Scott Fisher says. “Several of the other casinos are rather dated but have excellent locations, so the real estate values are high.”

Caesars is in the midst of a US$1.2 billion room refurbishment program expected to be completed by 2021.

“I think there will be a few [Strip] properties on the block with conventional wisdom suggesting Planet Hollywood, Paris and Bally’s,” Global Market Advisors Government Affairs Director Brendan Bussmann says. “Most people believe that Caesars will retain the block of Linq, Harrah’s, Flamingo, because of its proximity to Caesars Palace and the Forum Convention Center. There will likely be an existing Strip operator or two that may have an interest in these properties but also new market players are likely to emerge.”

“Our view is that Eldorado would part with any of the Las Vegas Strip properties for the right price, so we would say any and all are on the table,” Union Gaming Director John DeCree says. “In terms of potential buyers, the pool is also quite large. During the Caesars sale process, Landry’s Tillman Fertitta – who owns the Golden Nugget Casinos – made a bid for Caesars.”