Osaka’s IR Local Alliance is making its presence felt in the battle for influence over an Osaka integrated resort – no matter which overseas operator ultimately wins the bid.

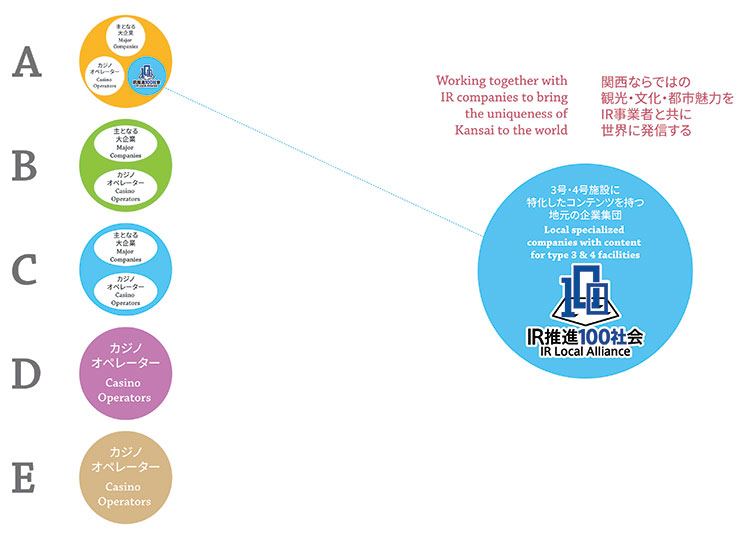

Osaka is Japan’s leading candidate city for an IR and also home to a private organization with an increasing presence in the IR debate – the “IR Local Alliance.” This organization is trying to take a leadership role in the new businesses that will accompany an IR opening, and the major overseas IR operators better take notice.

THE ENTHUSIASTIC BUSINESS NATURE OF THE OSAKA-ITE

The organization really embodies the nature of Osaka as a commercial capital. The IR Local Alliance is a group uniting many companies who believe that the IR planned for 2024 cannot be left entirely in the hands of overseas operators and big corporations. It was formed in July of last year and as of mid-February consists of over 60 member companies.

KEY FIGURES IN THE KANSAI REGION

A wide variety of companies have joined. It’s chock-full of key figures from numerous industries and a look at the list of members provides a who’s-who of companies that can provide services in tourism, F&B and transportation infrastructure. The restaurant name list alone, including Daruma (deep-fried skewered meat and vegetables “kushi-katsu”) and Ganko (sushi) is like a directory of Dotonbori and its “eat ‘til you drop” reputation. Kanji Hori, president of the alliance, told IAG, “We aren’t just in this to make money, we are a collection of the best companies in Kansai. Eventually we want to select 100 companies, but the most important thing is to become an organization that can beat the competition.

“It is tourism and city development that this alliance is trying to take charge of. There is an independence and spirit of business unique to the people of Osaka and eminently suitable for making the most of a new business. We like making things different.

“Casinos will only take up 3% of the IR properties. That means the remaining 97% will be city development. Most of all, the local community must benefit and we want Osaka to be prosperous. We possess the know-how to make that happen.”

THE OSAKA IR PROJECT STARTED IN 2010

Osaka prefecture and city first expressed interest in IRs back in 2010. Since then it has repeatedly been one step forward and one step back, although it was in 2014 that Yumeshima was selected as the candidate location.

In response to the 2016 IR Promotion Development Law two years later, the prefecture and city established the IR Promotion Bureau in 2017. As IAG has learned, the bureau will be enhanced to include 38 members this Spring, when the bidding activities really start to heat up, and JPY30 million (US$270,000) has been set aside in the 2019 budget bill.

OSAKA’S INFLUX OF INBOUND VISITORS

Meanwhile, foreign visitation to Osaka has increased dramatically. In 2010, when the IR vision was first announced, visitor numbers were only 2.35 million but by 2015 they had reached 7.16 million. By 2017 this number increased to 11.1 million. According to statistics of one major US credit company, it boasts the highest rate of growth of any city in the world.

But what is attracting all these inbound customers? One is the “eat til you drop” food culture. There are a number of tourist spots in Osaka including Dotonbori, Nipponbashi, Universal Studios Japan and Osaka Aquarium Kaiyukan, plus it’s within a stone’s throw of the historical cities of Kyoto and Nara.

A PARTNER, NOT A PRESSURE GROUP

Operator selection will come down to tourism and city development.

The aim of the Local Alliance is to expand the reach of the charms of Kansai further. The key to achieving this are initiatives for tourism and city development. Once open, the IR will consist of many different features. In addition to the F&B, tourism and entertainment industries, there will be transportation infrastructure, including taxis, buses and watercraft, connecting the facilities with the tourist locations. Of course, with large casino hotels also comes a massive sheet and towel cleaning task. Hori continues, “We have professionals for all aspects of the business, including hiring and securing personnel. Our ideas will be presented to the IR operators. We have the casting vote.

“But this alliance is not out to become a so-called pressure group. As a partner to take on the competition, we will actively engage our know-how with any overseas operator vying to join the Osaka IR venture.”

IR OPERATORS MUST REMAIN ON GUARD

The companies currently keeping office at the front line in Osaka city include MGM Resorts Japan, Melco Resorts and Entertainment and Genting Singapore. We heard from one operator that, “An organization like [IR Local Alliance] can’t be ignored.”

The Osaka IR calendar is pulling ahead of the national government’s timeline, looking for a 2024 opening, meaning that the process of narrowing down candidate operators will happen in July of this year. After all, it would be ridiculous to have an IR property under construction right next to the Osaka/Kansai World Expo in 2025.

Not only that, it is expected to take three years to complete transportation and airport access to Yumeshima. Therefore, Osaka prefecture and city plan to independently start public offerings of operator plans in the Spring. That means the Local Alliance decision will inevitably be made quickly.

“The game of musical chairs has begun,” adds Hori. “We want to partner with whoever will be the best for Osaka. In other words, the best is whoever will incorporate our wishes. Right now MGM has a leg up, but I hear that Melco is catching up. We want to establish our position by March, before the public offerings begin.”

Osaka prefecture and city have announced the “Osaka IR Fundamentals Plan” and are approaching the goal line. The question is, will it be an IR of Osaka, by Osaka and for Osaka?

Local allegiance

IAG speaks with IR Local Alliance President, Kanji Hori

IAG: What brought about the IR Local Alliance?

Kanji Hori: At first the prefecture’s attitude was leaning in the direction of just leaving everything to an overseas IR operator and we knew that just wouldn’t do. Foreign companies have a strong tendency to prioritize their own interests and those of stockholders. But we know the region must benefit.

IAG: There are some really prominent corporation members.

KH: This is a group of professionals, be it F&B, tourism or transportation infrastructure. All the companies have something to offer. We aim to be a group that can beat the competition.

IAG: And what is your position?

KH: Kansai has its own tourism and culture. It’s important for local companies with a passion for city development to be active in planning, instead of just passively taking the blows of overseas operators and big businesses.

IAG: Kansai is also a treasure box of national treasures and cultural heritage.

KH: That is another strength. We’ve been sharing Osaka’s charm with the world, but it must go deeper. There are temples and shrines, Japanese food, geisha, Noh theater and so much more. We have proven results and know-how.

IAG: What direct steps are being taken for IR development?

KH: We have made use of the video screens in 3,000 of Osaka’s taxis and also wraps on the outside of tourist buses in the cities to promote an IR. We are also taking initiatives for problem gambling.

IAG: The Osaka IR Fundamentals Plan is forecasting annual sales of JPY480 billion for an Osaka IR. What are your thoughts?

KH: We are involved in the attraction enhancement facility and the customer service facility known as facilities #3 and #4. Our specialties are conveying our charms, such as food, history and culture, and bringing people to these sites. It is critical that the entire region benefits.

IAG: What will be the deciding factor for the IR bid?

KH: The IR will include facilities #1 (international conference center) and #2 (exhibition hall) among others, but what will set us apart are the #3 and #4 facilities as with Singapore, which Japan is using heavily as a reference. It goes without saying, that is the key in this case too.

IAG: What would the conditions be for a partnership with an overseas operator?

KH: They have to be thinking of how to contribute to Osaka first. In other words, we will partner with someone who will incorporate our wishes. The goal is to beat the competition. If we do partner with someone, we will discuss the final conditions and enter into a contract.

IAG: What is the response so far?

KH: The IR operators have become more conscious of contributing to the region. From that perspective, MGM has a leg up. But I hear that Melco is catching up.

IAG: What does the Local Alliance have in mind for the immediate future?

KH: We want to expand employment from both inside Japan and overseas, especially employment from Western Japan. We want to take initiatives for personnel training as part of that. Expanding employment is the top priority.