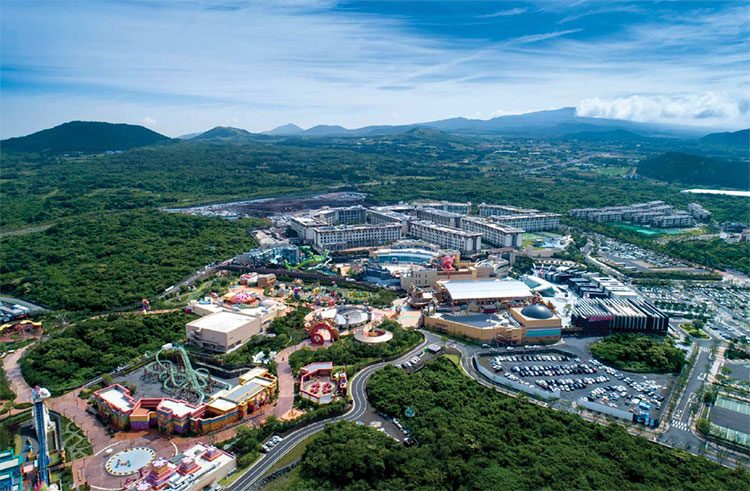

Jeju Shinhwa World beat long odds to raise the bar for South Korea’s holiday island. Has Landing International’s US$1.5 billion integrated resort launched a casino takeoff for Jeju and Korea?

Landing International’s US$1.5 billion Jeju Shinhwa World opened its casino on 25 February 2018 and for the first half of this year reported gross gaming revenue of HK$2.4 billion (US$307 million), 50% more than the combined GGR for Jeju’s eight casinos for all of 2017.

That’s a result worthy of a US$1.5 billion integrated resort, achieved under difficult circumstances. The challenge for Landing, and for Jeju, is to build on that impressive launch.

Shinhwa World brings first-class gaming and visitor amenities to what’s already a top tourist destination, attracting 15 million visitors last year. A volcanic island off the Korean peninsula’s southwest coast, Jeju has a trio of UNESCO World Heritage sites, with Mount Halla, Korea’s tallest peak, at its center. Two and a half times the size of Singapore with a more temperate climate than peninsular Korea, Jeju is a lush green lung for urban dwellers with a network of hiking trails, dramatic vistas and dozens of conventional and quirky museums.

Jeju is also home to half of South Korea’s 16 foreigner-only casinos and, as a special self-governing province, offers visa-free access for visitors from mainland China and nearly every other jurisdiction. It’s just a 55-minute flight from Shanghai, 1 hour 20 minutes from Osaka and within 2 hours 30 minutes of Beijing and Tokyo. With an effective tax rate around 15%, less than half of Macau’s levy, it can offer greater incentives to VIPs than many other jurisdictions.

BLACK TO WHITE

Yet last year, Jeju reportedly mustered GGR of US$200 million, just over 0.5% of Macau. Jeju has suffered from a reputation for so-called “black casinos” that don’t play honest across the board. One executive recalls joining a casino and finding surveillance didn’t extend to the counting room. In 2015, Jeju established a Casino Regulatory Division, affiliated with the police department. CRD “turned casinos from black to white,” one executive says, and gets high marks from the industry for its cooperative attitude. But in some circles, Jeju’s bad reputation persists.

A recent hurdle is China–South Korea tension over deployment of the US supplied THAAD missile defense system last year to counter North Korean missile threats. China barred group tours to South Korea and Jeju’s mainland China visitor arrivals fell from 3.06 million in 2016, 85% of Jeju’s total foreign arrivals, to 747,315 last year, then fell another 46% through the first seven months of this year, according to Jeju government statistics. Overall foreign arrivals are down from a daily average of 9,871 in 2016 to 2,842 this year. While Jeju’s tourism industry draws from the full arrival pool, projected at 14.3 million this year, including 13.5 million Koreans, gaming relies on foreign visitors, particularly Chinese.

Industry insiders report Chinese arrivals picking up recently. China has relaxed the group tour ban selectively by province, starting with Beijing and Shandong. The crowds swarming Jeju’s three-storey Lotte Duty Free Shop – South Korea’s Lotte Group became a particular target of Chinese officials after military authorities placed a THAAD battery on a Lotte golf course – suggest the worst may be over.

Landing also has its own issues, with Chairman Yang Zhihui unavailable since August, reportedly detained by Chinese authorities, and its proposed IR project in Manila under fire from Philippine President Rodrigo Duterte. Landing says neither situation impacts Shinhwa World operations and a recent visit by Inside Asian Gaming supports that assertion.

QUANTUM LEAP

Beyond current rows, the key impediment for Jeju realizing its gaming potential has been lack of investment in visitor “infrastructure” to expand foreign arrivals, Landing Chief Operating Officer Jay Lee explained to IAG at G2E Asia in May.

“Infrastructure in terms of new hotels and F&B outlets, the whole entertainment options for the tourists,” he said.

Shinhwa World is the largest foreign direct investment in South Korea’s history, a quantum leap beyond anything previously seen in Jeju. When phase one is completed in the coming months, Shinhwa World will top 2,000 guest rooms, along with family attractions, a full range of F&B, retail, the first hotel-linked convention center in Jeju and the island’s largest casino.

In February, Landing transferred casino operations from the Hyatt Regency in Jungmun, Jeju’s south-shore beach resort area. The Hyatt had 28 gaming tables and 16 slot machines in 800 square meters with GGR of HK$235 million in 2017. Shinhwa World’s casino measures 5,775 square meters and, for the first half of this year, GGR hit HK$2.4 billion.

The jump stems from more than size. Executives cite room availability as a key advantage of operating a casino where your company controls the hotel. If you want to bring in a VIP, or one shows up unexpectedly, you don’t have to beg for rooms from a different ownership with its own priorities. Landing has taken advantage of controlling guest rooms by staging poker and baccarat tournaments.

Promotions are a key to drawing customers to a new property in what’s a new destination for many players, and more are in the cards. In this “acquisition phase,” a knowledgeable source says Landing is offering commissions up to 1.5% and generous perks, “the kind of deal you’d get in Sihanoukville.”

FIRST IMPRESSION

After the passport check, Shinhwa World casino customers enter a dramatic rotunda with an elegant chandelier and 20 mainly high-limit tables. The main floor stretches to the left with 65 tables and most of the property’s 239 machines, including a 40-seat multi-game stadium. VIP areas extend to the right. In-house VIP club D’Solitaire – Ding Sheng or “great prosperity” in Mandarin – has 37 tables, with another 52 tables in private suites for junkets, the largest room holding 10 tables, high-limit slots and a bar featuring Scotch whiskey. Macau junkets visit on a casual basis.

VIP play starts at KRW300,000 (US$263) with a maximum bet of KRW300 million. On the mass side, bets are as low as KRW10,000 for roulette and blackjack, KRW20,000 for baccarat, but KRW200,000 for a “squeeze game” where bettors can handle their cards. Landing says mainland Chinese customers account for about 70% of casino revenue with 15% from Taiwan – “a good surprise,” COO Lee says – and the rest widely shared among Southeast Asia, Japan and Hong Kong.

The mass gaming floor has a food court offering Korean, Chinese, Japanese and Western options that resembles the one at Resorts World Sentosa, a reminder that Genting was a Shinhwa World partner until November 2016, just six months before roll out. Many management figures have résumés including Genting or Les Ambassadeurs, the high-end London gaming club Landing acquired in April 2016 and sold 18 months later for a HK$447 million profit.

“THE WHOLE WORKS”

Shinhwa World, 30 minutes by car from the airport, also resembles Resorts World Sentosa in its genuine integrated resort ambitions. Strong non-gaming elements are essential because Koreans normally comprise three-quarters of Jeju visitors – the 50-minute Seoul-Jeju air route was the world’s busiest last year – and they are barred by law from entering Jeju casinos.

“With that in mind then we took the option of, ‘Okay, build something that is more resort oriented and complementary with families, for holidays and things like that.’ And that’s why we came up with Jeju Shinhwa World,” Lee says. “We have hotels, F&B, theme park, water park, K-pop, casual dining, retail, the whole works.”

Lee notes Jeju room rates hover around US$300, “by far the highest in Korea.” Shinhwa World accommodations include a 486-key Marriott above the casino, 615-room Landing Resort, 342 Somerset-branded three-bedroom townhouses and, launching by early 2019, Shinhwa Resort with 538 rooms plus an additional Marriott wing raising its room count to 627. Occupancy runs 80% on weekends, 40% during the week. Phase two, opening 2020, features a 200-key Four Seasons, Jeju’s first, and Lionsgate Movie World.

Current family offerings include Shinhwa Theme Park featuring Larva, a Korean cartoon series for all ages, an indoor-outdoor water park opened in August with 18 slides and pools plus a jimbilbang (Korean style sauna) and Transformers Autobots Alliance, a virtual reality activity center based on the film series. A combination ticket for the three attractions costs KRW49,000, and no one goes alone. The resort offers room packages including attraction admissions, and entertainment areas include places parents can regroup over a cold beer.

K-CUISINE

Shinhwa World’s two dozen food options run Korean, Chinese and Japanese fine dining to American chain Johnny Rockets and local fast food. YG Republique is inspired by talent agency YG Entertainment’s performers, notably K-Pop icon G-Dragon, a member of boy band Big Bang. The G-Dragon-designed cafe Untitled 2017 echoes his solo single Untitled 2014. His creative input went into an urban chic bowling alley cum lounge pub that, like the precinct’s four Asian and international casual restaurants, pays homage to G-Dragon with local specialties such as seafood and black pork plus seasonal ingredients.

Jeju’s attractive setting and visa-free entry present a major MICE opportunity. Shinhwa World’s 12,180-square meter convention center, opened a year ago in November 2017, is Jeju’s first with accommodation attached. The ballroom seats 2,000 theater style or 1,000 for dinner. Shinhwa World casts a wide net for MICE, starting with Korea and China, extending to Southeast Asia.

The 230-hectare development also includes Shinhwa Villas – 350 townhouses and villas available for purchase. Foreigners can obtain local residency with a KRW500 million purchase. With these varied income streams, Shinhwa World’s first-half net revenue was 80% gaming, 20% non-gaming, toward its goal of a 50-50 split. It’s another indicator of a great takeoff for Landing.

Towering ambition

With its Genting ties, theme park, suburban setting and low-rise profile, Jeju Shinhwa World evokes Singapore’s Resorts World Sentosa. Jeju Dream Tower aspires to the Marina Bay Sands role, an iconic downtown integrated resort cementing Jeju’s place on the regional gaming map. A tall order for 169 meter twin towers soaring above Jeju’s usual 55 meter limit with views of Mount Halla, the city and the sea.

Developed by Lotte Tour – with distant family ties but no business relationship to Korean top-five conglomerate Lotte Group with its own Dream Tower in Seoul – Jeju Dream Tower will be the vacation island’s second US$1 billion-plus IR. Features include Asia’s flagship Grand Hyatt with 1,600 suites, Korea’s largest outdoor pool deck, a 38th-floor observation deck by day, ultra lounge by night and, if the Jeju government approves, a casino with net gaming space of 4,800 square meters (51,648 square feet).

“We believe Dream Tower is a game changer,” Lotte Tour COO and Executive Vice President Lawrence Teo says. “The more IRs, the more visitors, the bigger the pie.”

“We believe Dream Tower is a game changer,” Lotte Tour COO and Executive Vice President Lawrence Teo says. “The more IRs, the more visitors, the bigger the pie.”

Dream Tower is scheduled to open next October, giving relations between China and South Korea 11 months to continue thawing. In a capital-light construction model, Lotte Tour used Chinese developer Greenland to finance one hotel tower then sell rooms to individual Korean investors for leaseback to Lotte Tour with a guaranteed annual return and 24 days’ annual room use.

“That’s US$500 million we didn’t have to invest,” Teo, previously a top Melco Entertainment executive in Macau, notes.

SHANGHAI STRATEGY

Lotte Tour sees competitive advantage in its inbound tourism experience. It’s learning about gaming running LT Casino, the former Paradise Jeju Lotte, with 27 tables and 24 machines on the island’s south shore, acquired in July for US$38 million. It’s also banking on Dream Tower’s downtown location, in the midst of 5,000 registered hotel rooms and potentially six of Jeju’s eight casinos, all minutes from Jeju’s airport and cruise terminal. From Shanghai, Jeju is a 55-minute flight or overnight cruise away, with visa-free entry.

A “tougher competitive landscape” has driven Bloomberry Resorts to begin a long-contemplated US$15 million renovation of Jeju Sun casino hotel’s 200 guest rooms, CFO & Treasurer Estella Tuason-Occeña says. Bloomberry, operator of Manila’s Solaire IR, purchased Jeju Sun, a 10-minute walk from Dream Tower, in 2015 and has already renovated the 50-table, 51-machine gaming floor.

“It’s got potential specifically in terms of location close to China and visa-free access,” says non-executive director of junket promoter Rich Goldman Holdings, Nicholas Niglio, of Jeju. “Disincentives could go away pretty quickly.”

Niglio, previously CEO of Rich Goldman predecessor Neptune Group, calls Jeju’s “medium term good, long term very good.”