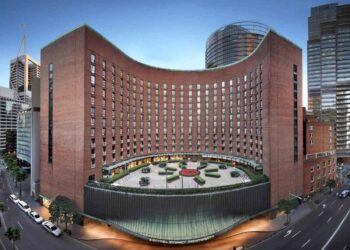

The expert committee charged with setting the framework for Japan’s casino legislation held its final meeting on Monday amid concerns that excessive restrictions will drive operators away.

According to Reuters, senior casino executives have been quietly lobbying politicians and bureaucrats following rumors that the government will enforce a limit of 15,000 square meters of casino floor space, heavy restrictions on locals and a possible entry fee.

“The current plans risk missing the mark on achieving public policy objectives,” Reuters reports one casino executive as having told officials. “It’s serious enough to halve the maximum investment we’re willing to make.”

The expert committee is expected to hand its proposal to Prime Minister Shinzo Abe this week.

The biggest concern among operators is that bureaucrats will put extra restrictions in place to placate a Japanese public known to be opposed to casinos due to concerns about problem gambling and increased crime.

According to Seth Sulkin, chairman of a taskforce at the American Chamber of Commerce Japan working on casino resorts, such restrictions would rule out any possibility of the US$10 billion investment famously flagged by Las Vegas Sands kingpin Sheldon Adelson.

“Gaming companies are very rational – they’ll calculate how much revenue they can generate with a 15,000-square-metre casino floor and they will only invest as appropriate for that, which certainly won’t be $10 billion,” Sulkin told Reuters.

Union Gaming analyst Grant Govertsen recently released a report in which he listed eight key concerns in regards to Japan’s casino legislation. They are:

– Who’s advising the government?

– Making decisions based on self-preservation

– Extreme constraints on casino square footage

– Pachinko regulations show that casino rules will likely (and persistently) change for the worse

– Costs increasing and ROI potential decreasing

– Are local partners really necessary?

– Being reliant on Chinese visitors is dangerous

– Singapore’s dirty secret – locals entry levy has perverse effects

“The framework seems to become more restrictive by the day and when coupled with what are likely to be astronomical project costs, could result in some of the biggest operators sitting this one out,” Govertsen said. “In other words, Japan is on the verge of one-upping the failed gaming expansions of Korea and Vietnam by moving forward with a gaming construct that 1) can’t fulfill the #1 stated goal of Japan’s IR development – tourism growth, and 2) is so poorly designed that ROIs shrink to a level that makes participation on the part of the global IR developers much less likely.”