Theme parks and family entertainment are booming across Asia, but are thrill rides and treasure hunts Macau’s best path toward diversification fantasyland?

By Muhammad Cohen, Editor At Large,

Asia needs more family attractions to entertain its burgeoning middle class and Macau faces political and economic pressure to diversify beyond gaming. While that seems like a natural fit, industry insiders differ on whether family entertainment is the right complement to Macau’s casinos.

“I’m not that sure family entertainment and casinos are a good mix,” says Wynn Macau Director and Chairman of Hong Kong’s Ocean Park, Dr Alan Zeman. “I believe those kinds of activities are better off on their own. It’s a totally different customer … a total divergence of customers.”

The Innovation Group’s International Executive Vice President David Rittvo isn’t so sure.

“The customer profiles for theme parks and casino resorts may not be similar in terms of core participants or targeting segments,” he begins, “however, by having theme parks and other family entertainment amenities, casino resorts will be able to diversify their offerings to capture a broader range of customers, various age groups, distinctive preferences and more.”

WHEEL, WET AND WILD

Amid divergent opinions, Macau is betting heavily on family entertainment. Melco Crown opened Studio City last October with an estimated US$900 million in entertainment features, including simulation ride Batman Dark Flight, the world’s highest figure-eight observation wheel, multi-stage House of Magic, Warner Bros Kids Zone and a water park. Melco Crown’s Macau flagship City of Dreams has the House of Dancing Water fantasy adventure show, a kid’s play area and sand beach. City of Dreams Manila has DreamPlay – an interactive challenge course based on DreamWorks film characters. And all three resorts have brand name nightclubs for grown up fun.

“Our family-oriented entertainment attractions and the more adult-oriented facilities are all integral parts of the resorts, allowing us to attract a broad range of visitors, setting us apart from our peers,” Melco Crown explained in a written response to Inside Asian Gaming’s questions.

Sands Cotai Central has DreamWorks Experience character interactions and later this year will open high tech indoor adventure park Planet J. Sands China’s Parisian will feature water park AquaWorld, QUBE for kids – as found at its other Cotai resorts – along with its Eiffel Tower scale model and related streetmospheres.

“Family entertainment attractions are developed based on our strategy of diversification which has been our strategy and core value since we first opened the doors of The Venetian Macao in 2007,” Sands China Vice President of Marketing, Scott Messinger, says.

SJM Executive Director Angela Leong proposed a theme park featuring an indoor beach adjacent to the SJM Palace site in Cotai on land that she controls individually. Galaxy Macau’s phase two expanded its Grand Resort Deck, adding a river ride, water slides and an exclusive kids’ island to the wave pool and white sand beach. The resort’s next phases will include a “special and high tech” theme park, Galaxy Chairman Lui Che Woo says, though the company hasn’t provided further details.

“A theme park could be a sweet spot for Galaxy – the family spends the morning at the theme park and afternoon at the pool. It gives them a tool kit to keep people on the property all day,” adds Union Gaming Securities Asia Managing Partner, Grant Govertsen. “There’s a bunch of people next door [at Venetian, Studio City and Parisian] and a theme park could be a way to get them to cross the street.”

The Macau-based analyst sees the west side of Cotai focusing on mass business, with a “millionaire’s row” of Wynn Palace, MGM Cotai, City of Dreams and Lisboa Palace emerging to the east.

Mainland China theme park operator Chimelong has built Ocean Kingdom, the first of up to nine theme parks on Hengqin, separated from Cotai by just a few hundred meters of water. Hong Kong’s Lai Sun Group, the entertainment conglomerate originally behind Studio City, announced last month it would combine attractions from Hollywood studio Lionsgate and National Geographic into Novotown – a 22,000 square meter indoor amusement park on Hengqin to open by the end of 2018, projected to attract 5 million visitors annually.

CROWDED SPACE

The big question is whether Macau makes geographic sense as a global or Asian theme park destination? Bloomberg Intelligence Gaming and Lodging Analyst Margaret Huang doesn’t believe so.

“Theme parks may be a challenge for Macau, given Hengqin’s development of Ocean Kingdom next door,” she explains. Ocean Kingdom was Asia’s most popular theme park outside Japan last year, ranking 13th globally and attracting nearly 7.5 million visitors according to the 2015 Theme Index from the Themed Entertainment Association and engineering firm AECOM’s Economics practice.

“Competing in this space may not the best strategy for Macau given the possible saturation of theme parks in China with a pipeline of attractions.”

The US$5.5 billion Shanghai Disneyland opened in June, forecast to attract at least 15 million visitors annually. Universal Studios is coming to Beijing with Six Flags and DreamWorks attractions on the drawing board. China’s homegrown Chimelong, OCT Parks and Songcheng Worldwide all rank alongside Disney and Universal among the world’s top 10 most popular theme park groups.

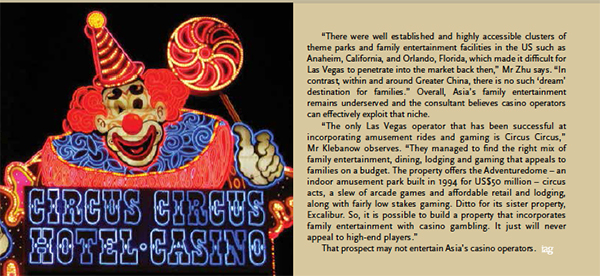

“Why would I want to go to Macau for a theme park experience when there is a perfectly acceptable, internationally branded theme park an hour away in Hong Kong?” asks Global Market Advisors Senior Partner Andrew Klebanow in reference to Hong Kong Disneyland. “Do you think my niece would find meeting a fluffy panda superior to getting a hug from Sleeping Beauty or Mickey Mouse? Oh, and that Hong Kong theme park happens to be one train stop from one of the greatest airports in the world.”

One key reason behind Macau’s own theme park push is how successful they have been at Genting Group IRs. For decades, an amusement park has drawn customers to Genting’s Highlands resort outside Kuala Lumpur – and the property’s mass market appeal delivers juicy margins. Renamed Resorts World Genting, the IR is upgrading to a Twentieth Century Fox World theme park as part of its US$1.3 billion Genting Integrated Tourism Plan.

Genting took the same model to Singapore with Universal Studios at Resorts World Sentosa (RWS), which saw attendance grow by 9% last year to 4.2 million visitors, 12th best in Asia. RWS’s Adventure Cove visitation also grew substantially by 7.5% to 660,000, enough for 20th in regional water park rankings.

“Resorts World Sentosa welcomed a total of 7 million visitors to all its attractions in 2015, accounting for a third of all visitor arrivals to gated attractions in Singapore,” RWS Senior Vice President of Attractions, Jason Horkin, says. “In the first quarter of 2016, RWS saw approximately 1.6 million visitors to all its attractions,” comprising Universal Studio’s best quarterly revenue and attendance, despite a year on year fall in gaming revenue.

Genting plans to use the model in Korea, with a Heroes and Legends theme park at Resorts World Jeju, a joint venture with mainland China’s Landing International on the popular resort island with visa free access for mainland Chinese. Outside Korea’s capital Seoul, US tribal operator Mohegan Sun plans a theme park centerpiece to its US$1.6 billion Inspire resort at the nation’s gateway Incheon airport.

TRIBAL FUSION

“In our industry you often see a small gesture in resorts that provide limited entertainment outlets for families. However, at Mohegan Sun we have always leveraged entertainment as a draw,” Mohegan Sun Senior Vice President for Business Development, J Gary Luderitz, says. The Experience Park Incheon, Korea (EPIK) includes a Paramount Studios theme park, indoor rainforest with rock climbing and zip lines plus a “next generation” Virtual Science Center alongside the largest indoor arena in South Korea.

“Korea is unique in that we have a foreigner-only gaming license and accordingly we will leverage EPIK as a draw for mass international tourism, transit passengers through Incheon Airport, residents of neighboring Seoul and other parts of South Korea,” Mr Luderitz says.

The Platinum Ltd Managing Director Mary Mendoza notes these major entertainment investments are happening in markets where gaming is restricted in the local market. In South Korea, citizens can only gamble at remote Kangwon Land casino. Malaysian Muslims are barred from gambling at Resorts World Genting but are welcome to enjoy the rides, shopping mall and other attractions. Singapore residents don’t have to pay the US$70 casino entry tax for Universal Studios or Marina Bay Sands’ rooftop observation deck.

“All these components target different market segments,” Ms Mendoza says. “They offer something for everybody” even if they can’t gamble. The Macau based consultant, a former marketing executive for Sands China and more recently Best Sunshine in Saipan, suggests Macau operators “do what the regulator wants,” noting the local Five Year Plan calls for non-gaming revenue to rise by more than a third to 9% by 2020. “It’s time to diversify tourism products and get a more healthy mix of revenue,” she says.

LONG ON QUICKIES

The best alternative for Macau, rather than fully-fledged theme parks, may be shorter duration family entertainment attractions – 15 to 20 minute “diversions” as Melco Crown Chairman and CEO Lawrence Ho calls Studio City’s Batman ride and Golden Reel wheel, or two hour attractions such as The House of Magic.

There’s no modeling technique to quantify which type of family entertainment works best, CLSA’s Aaron Fischer says. He believes Macau’s land shortage inflates the opportunity cost for theme parks, but there’s “not a huge downside” to smaller scale attractions. “The amount of space and cost is quite nominal,” he says. “It’s something the government would like to see. It gets visitors to stay longer. Someone will gamble.”

The other benefit, according to AECOM Vice President for Economics Chris Yoshii, is that, “A resort with theme park elements is seen as an entertainment destination rather than just a gaming destination.

“Land near a major casino is very valuable, so the smaller the footprint the better,” he adds. “Smaller and indoor parks are likely to have a shorter length of stay, but more intense experience, which saves time for the dining and gaming.”

Third party attractions also democratize entertainment. Planet J Vice Chairman Francis Chan notes many family entertainment features, such as Marina Bay Sands’ rooftop infinity pool and Galaxy Macau’s Grand Resort Deck, are exclusively for guests of the host property. “Planet J is open to the public. Anyone who can get a ticket is allowed to play in our park.”

Entertainment returns run below those of other IR segments and experts disagree on whether they can delight investors.

“As a company we do not do loss-leading attractions,” Mr Luderitz declares, citing Mohegan Sun’s experience with its Connecticut IR. “Our vision in Korea is to develop a number of unique profit centers by combining gaming, entertainment, culture and the arts, conference and hospitality under one roof.”

“Ideally, we would like all our non-gaming entertainment attractions to be self-sustainable,” Melco Crown agrees. “However, currently, the majority of our profit is still attributed to our gaming business, which supports our investment and development in the non-gaming business.” For example, Lawrence Ho claims the Batman ride cost too much for a standard theme park to build.

“In the bigger picture though, these non-gaming attractions also play the ‘brand differentiator’ role, helping to draw new visitors to the properties and differentiating us from our competitors,” Melco Crown explains. “They also create brand stickiness and even brand loyalty in the long-term, which would ultimately become profitable and self-sustainable. Hence, we believe it is important that we maintain high standards of our non-gaming products and services, not only to generate revenue but also to grow a loyal customer base.”

The Innovation Group Vice President, Operations Planning and Analysis, Michael Zhu offers a similar stance.

“We do not expect the family entertainment attractions to be a profitable standalone division, especially during the initial years of operation, in that most of these facilities are likely to be utilized as marketing tools to drive gaming volume and overall visitation to the property,” he says. “In the long term, however, these attractions can be profitable by themselves once the brand’s public awareness is established.”

Profitable or not, family entertainment offers a vital avenue for Macau to raise its game.

“Lack of natural attractions, such as beaches or mountain views, means Macau needs to come up with something unique and exclusive to compensate,” Mr Zhu says.

Time will tell whether theme rides and treasure hunts will lift Macau to new heights or run off the rails.