Consumer tastes are driving a move away from big boxes in cities, experts say, but casino resorts on the beach can’t replace the bright lights of Macau – yet.

By Muhammad Cohen

MACAU’S government has thrown down the gauntlet for casino concessionaires to increase non-gaming revenue. the city’s ve year plan released in April sets a goal for the industry of 9% non-gaming revenue by 2020, compared with 6.6% in 2014. Not an especially demanding target, but it is the first time the government has backed its longstanding aim, which Beijing echoes, with a number and potentially some teeth as the first casino concessions expire in 2020.

Secretary for Economy and Finance Lionel Leong says failure to expand non-gaming revenue can bite sooner, in the area of table gaming allocation. In an interview with Macau Business magazine published last month, Mr Leong said the government will only award new tables under the annual 3% growth cap and that it will be based on “the investment in non-gaming areas, the participation of SMEs in these projects, the capability to diversity sources of clients … all essential factors for Macau to become a world center of tourism and leisure.”

In case that didn’t come through clearly enough, last month’s G2E Asia heard Macau’s chief gaming regulator Paulo Martins Chan urge casinos to “expedite economic diversification,” declaring, “the Macau SAR government will continue to optimize Macau’s global reputation by actively promoting the non-gaming elements and increasing their share in the total revenue of Macau.”

A government consultation paper released the following week states, “Currently, gaming has exerted too much influence on the tourism branding of Macau … Macau has the potential to exhibit an impressive image by reconciling its resort facilities, MICE, arts, and festival events all into one integrated brand.”

Although some Macau operators complain that government authorities are pushing them where customers don’t want to go, the market seems to be signaling for Macau IRs to adapt.

“We’re already starting to see people’s reasons for coming to Macau change,” Galaxy Entertainment Group Chief Marketing Officer Kevin Clayton says. “People are looking to come to a resort.”

For now, at least, Macau isn’t delivering what they want. Year on year gaming revenue declined for a 24th consecutive month in May and is down 12% so far this year, following a 34% decrease in 2014. Visitor arrivals are falling, and visitor spending is falling faster. Hotel occupancy and room rates are declining.

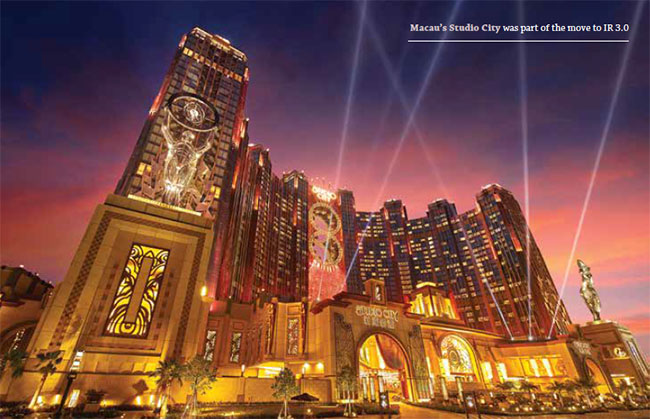

In the face of those numbers following the openings of Galaxy Phase 2 and Melco Crown’s Studio City last year, the “build it and they will come” strategy is a shambles. Yet building is precisely what Macau is doing, with four new IRs due to open within the next 24 months. that’s the good news and the bad news: bad because new resorts will further divide a stagnant market; good because they give Macau a chance to create innovative properties that can spark a turnaround. At G2E Asia, industry experts offered visions of how IRs in Macau and beyond can broaden their appeal and enhance customer satisfaction in these rapidly changing times.

HAIL CAESARS

HAIL CAESARS

The integrated resort has evolved over 70 years, combining gaming and entertainment into a package that, when done right, exceeds the sum of its parts for the customer and the operator. Early prototypes include Caesars Palace, which turns 50 in August, Sun City in South Africa and Atlantis in the Bahamas. the concept was further refined with the Las Vegas openings of Mirage in 1989, Bellagio in 1998 and the Venetian in 1999. the Innovation Group Chairman and CEO Steven Rittvo pegs Sands Expo and Convention Center in 1990 as starting today’s IR evolutionary chain. MICE was great leap forward that created IR 1.0, he believes, regardless of whether the convention facility preceded the resort, as in the case of Venetian, which came nearly a decade after its convention center, or as with Mandalay Bay Chairman and CEO of e Innovation Group Mr Steven Rittvo which became “a truly different property” once its convention center opened in 2003.

An urban planner by academic training, Mr Rittvo explains that the next step in the evolution of integrated resorts, IR 2.0, was explicitly focused on MICE and VIP gamers as primary revenue drivers. the Venetian Macao and its Sands Cotai satellites as well as Marina Bay Sands in Singapore are the best examples. Like their predecessors, IR 2.0 properties are located in or near urban areas that can support the convention component.

“The biggest single difference is that they’re not in urban centers but recreation destinations,” he explains. Ideally, these IRs are part of an integrated resort with the host community to increase tourism. His examples of IR 3.1 include the Grand Ho tram, some two hours from Ho Chi Minh City on the best beach closest to Vietnam’s commercial capital; Best Sunshine’s forthcoming Grand Mariana in Saipan which is more than four hours flight from the closest major cities in Japan, Korea and China but also a world apart with clear water, blue skies and numerous golf courses; and tony Fung’s proposed Aquis resort near Australia’s Great Barrier Reef.

“REAL” RESORTS NOT MACAU

IR 3.1 also represents a return to “a real resort” with a casino, rather than a casino with a resort, Mr Rittvo says. Although Best Sunshine and Aquis have bandied around total development costs in the US$5 to $7 billion range, he says IR 3.1 properties will be smaller, at least initially, with development costs below US$2 billion.

“They will not substitute for Singapore or Macau,” he stresses, “but [players] can go one or two times a year.”

YWS Design and Architecture CEO Tom Wucherer agrees, stating that, “Consumers are moving away from mega resorts. New IRs must include culturally authentic attractions and stories, allow for rapid consumption of multiple experiences and promote interaction and exclusivity.” they allow customers “to be part of a bigger picture, but experience it on their own terms.” Gaming will remain the anchor, but it needs to be integrated with the other amenities rather than integrating other amenities around gaming.

“The new IR is a market-driven leisure and entertainment district,” he says. “Although gambling continues to lead revenue in Asian markets, it would be a mistake to ignore consumer trends which point to the importance of diverse entertainment experiences for sustainable, healthy IRs of the future.

Mr Wucherer, an architect who founded YWS in 2001, sees the evolution of IRs in terms of “the relationship between the customer and the house.” IRs should still focus on their traditional “foundational” elements of gaming, hospitality, leisure, retail and entertainment but realize that customers want to experience them in new and different ways.

Retailing is one segment where IRs have been forced to adapt. Once upon a time IRs could rely on luxury retail to drive visitation from designer deprived mainland tourists.

“Everyone thought they’d died and gone to heaven,” Wynn Macau Vice Chairman Allan Zeman, who made his first fortune in clothing, says. “Now China has an overabundance of shopping malls. Luxury retail is overbuilt in China.”

Moreover, with online shopping prevalent, “People want more experiential shopping,” Mr Zeman, creator of Hong Kong’s Lan Kwai Fong entertainment district, says. “Millennials have different tastes, different attention spans.”

Adds Galaxy’s Mr Clayton, “We’re seeing a diminishing number of traditional shoppers for the top eight brands. New Age consumers are cool hunters, looking for something that sets them apart. they want something unique: first in Asia, first in Macau, first for me.”

Mr Clayton does, however, note one strength of IRs in this brave new world of shifting customer preferences.

“We have a conversation with thousands of consumers every day,” he says, an advantage that gives IRs an inside track to spot trends that can help retail tenants, the operator and the destination better match what customers want.

It’s not just about shifting the mix of stores in IR malls from a luxury flagship or department store to H&M or Uniqlo, Bloomberg Intelligence analyst Catherine Lim notes, but shifting presentation with innovations such as interactive panels and pop-up stores to make shopping experiential.

CLUBBING REIMAGINED

CLUBBING REIMAGINED

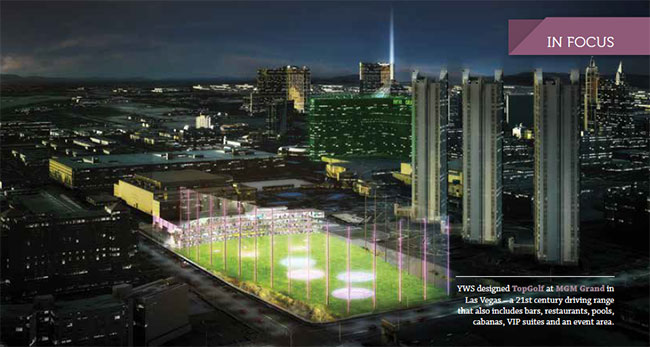

In that same vein, Mr Wucherer says IRs have to be designed, or re-designed, as “targeted, re-envisioned micro-environments” – settings that bring people with common preferences and behaviors together. Rather than simple demographics, the new determinant is “psychographics” – segmentation that divides the market into groups based on social class, lifestyle, values, opinions, attitudes, interests and personality characteristics. At MGM Grand in Las Vegas, YWS designed topGolf, a 21st century driving range that appeals to golfers of all skill levels. This flagship location includes bars, restaurants, two pools with cabanas, VIP suites, event areas plus a pro shop.

TopGolf is a standalone facility, but overall Mr Wucherer sees similar “fluid but focused micro experiences” taking place within a more “porous” casino environment.

“Consumers switch quickly between different activities,” Mr Wucherer says. “You can’t expect them to walk a mile and a half from where they’re gaming to where they want to dine.”

He acknowledges that softening the boundaries of casino floors may conflict with governments’ desire to restrict gaming access but, “It’s a matter of understanding the goals of stakeholders, including the owner/operator and government and evaluating the specific setting.”

According to Mr Rittvo, “Regulators will have to change their views” to get a better mix of gaming floor activities and better YWS designed TopGolf at MGM Grand in Las Vegas – a 21st century driving range that also includes bars, restaurants, pools, cabanas, VIP suites and an event area. interaction between the IR and its surroundings. More links with IRs’ host destinations can help create the authenticity consumers seek.

“Governments want the casino encased in the facility, but they also want the building more integrated into the local environment,” he observes. “If governments want this revenue generator but with gaming as only 5 to 10% of the floor area, then it needs to be more porous. Otherwise, people go in to IRs and don’t leave, so spending doesn’t permeate the community.”

The shift away from simply gaming is evident in the US but, noting continued low levels of non-gaming spending in Macau and undersupply of casinos relative to population and income in the region, Mr Rittvo asks, “Are Asians 15 years behind the US in terms of customer preferences?”

Not according to Mr Wucherer who recalls hearing “several years ago that Chinese would never use social media. I believe things will change faster than we think.”