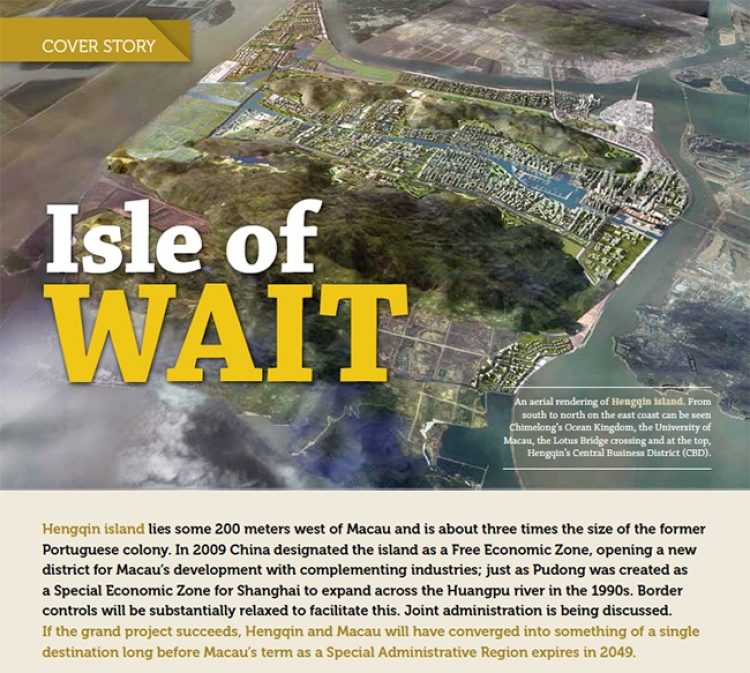

Hengqin Island, 200 meters across the water from Macau, is being developed as a new district to complement Asia’s gambling capital.

By Muhammad Cohen, Editor At Large

How you see Hengqin depends on what you’re looking for. A decade ago, Las Vegas Sands saw the island in Zhuhai municipality, back then with just a few thousand inhabitants, as a potential extension of Macau’s Cotai district and tried to lease it from Guangdong provincial authorities. Perhaps stirred by Sands, mainland authorities kept the island. Then in 2009 they made it one of China’s three pilot Free Economic Zones, a project overseen by Beijing and inaugurated under the guidance of then-Vice President Xi Jinping, who included Hengqin on his first trip outside Beijing as Chinese Communist Party chairman in 2012.

Despite the changes, some still see Hengqin as Cotai’s backyard. Some see it as a more broadly based annex for land-starved Macau. Some see Hengqin as China’s opportunity to get a piece of Macau’s tourism action. Some see it as a laboratory to create a model 21st century mainland city. Some see it as a groundbreaking transportation gateway to Macau featuring the world’s busiest border crossing. Some see Hengqin as China’s Orlando, the Florida city that’s become America’s leading theme park destination since Walt Disney World opened 45 years ago.

Hengqin can be all of these things and more. But realization will take time, especially since it involves so many possibilities and authorities with diverse, if not divergent goals.

In 2014 the opening of the University of Macau campus on leased land there, with free access via tunnel from Macau and no access from the mainland side, made the island the first example of “one island, two systems.” There has been 24-hour border crossing via the Lotus Bridge into Cotai since December of the same year. Today, guests at Cotai’s casino resorts look across the Qixin strait to see huge commercial and residential projects under construction, supported by nearly US$12 billion in new infrastructure and other facilities. Hengqin’s eight lane ring road, outfitted with fiber optic and power cables that can be serviced without ripping up the pavement, underscore that this pet project of President Xi is all about planning for the future and thinking big.

JUMP AHEAD

“Hengqin is about seeing Macau prosper and creating the entertainment capital of China,” GW Investment Consulting CEO Matthew Ossolinski, an advisor to Hengqin investors, says. “We don’t know what it will look like, but based on consumer behavior and government priorities, I’m pretty sure it will succeed. But like Cotai, it requires a leap of faith.”

In that spirit, leap ahead to 2025. A mainland family from outside Guangdong will ride China’s high speed rail system to Guangzhou and then high speed intercity line to Zhuhai in less than an hour. A spur line will take them to Hengqin in 15 minutes. There they’ll pass through what’s likely to be the world’s biggest and busiest border checkpoint, immigration formalities perhaps accomplished with a single swipe. They’ll cross the platform to board a Macau light rail train into Cotai. Alternatively, that family can fly into Zhuhai’s Jinwan Airport, avoiding China’s tax on foreign flights, board the other end of the spur line for a 15 minute ride to Hengqin station, swipe and take the train into Cotai. Either way, these millions of visitors will avoid the currently jammed Gongbei border crossing connecting to the Macau peninsula and, concentrated in Cotai, be less visible and burdensome to local residents.

Maybe the visitors will choose to stay in Hengqin to enjoy its multitude of diversions, including Chinese homegrown theme park giant Chimelong’s Ocean Kingdom, its first of nine planned entertainment facilities, David Chow’s Portuguese themed cultural and commercial center and Lai Fung’s Creative Cultural City featuring attractions from Hollywood and across the globe. For accommodations, they can choose from among Chimelong’s themed hotels, Galaxy Entertainment’s sprawling tropical beach style resort and Shun Tak’s hotel rising above the train station to Macau, poised to take advantage of multiple entries granted to Hengqin visitors.

That’s the vision for Hengqin in the minds of Macau’s tourism stakeholders. All of the pieces mentioned above are either under construction, proposed or already built. The rail link from Guangzhou to Zhuhai opened at the end of 2012. The Hengqin spur and Macau’s light rail are under construction, along with dozens of residential and commercial projects.

Chimelong’s Ocean Kingdom with its amusement rides, world record setting aquarium and water park, plus the Hengqin Theater featuring circus acts, opened for Chinese New Year 2014. Ocean Kingdom attracted 5.5 million visitors in its first year, and says attendance increased 30% last year. Chimelong has also built three remarkably grand hotels. The ocean themed Hengqin Bay Hotel with 1,888 rooms was the mainland’s largest when it opened with the park. It includes a 65,000 square meter (700,000 square foot) convention center that it says can accommodate 10,000 guests. The Penguin Hotel took the top spot with 2,000 rooms when it opened early last year, along with the 700 room Circus Hotel, modeled after a European village. Room rates are roughly on par with Macau, though it’s expected Hengqin will add lower cost alternatives as it develops.

Lai Fung Group, though its eSun Holdings subsidiary, was the original developer of Studio City Macau before selling its stake to Melco Crown in 2011. Now, again drawing on its Media Asia Group entertainment division’s expertise in film, television and music production, Lai Fung is building Creative Cultural City in Hengqin, an estimated HK$22 billion (US$2.8 billion) joint investment by its Lai Fung Holdings and eSun arms, including attractions, performances and production facilities. In November, Lai Fung put more flesh on the project, announcing deals for an “Immersive Experience Center” from movie producer Lionsgate – think Hunger Games, The Divergent, and Now You See Me – and, separately, a National Geographic family entertainment center.

NON-GAMING BETS

Galaxy is the only Macau gaming concessionaire with a confirmed site on Hengqin, though insiders say all six have shown interest in putting non-gaming facilities on the island. Galaxy’s site on Hengqin west coast, farthest from Macau, near an area famous for oyster beds, is away from proposed train lines and reached via a road tunneled through the mountains in the center of Hengqin. Galaxy’s 2015 annual report released last month states, “GEG continues to advance its conceptual plans to develop a world class destination resort on a 2.7 square kilometer land parcel on Hengqin. The low rise, low density resort will complement the Group’s high energy properties located in Macau.” The property is envisioned as a tropical island style resort, highlighting water sports and other outdoor leisure activities.

Preliminary work on the site began last year, and Galaxy Deputy Chairman Francis Lui has indicated the resort would take seven to eight years to complete, no cost estimate given. Last year, he told local media, “Hengqin is a place that Macau people should cherish as its future law, tax as well as culture will be similar to those in Macau. [Hengqin] will offer more opportunities for development, which young people in Macau should grab.” Galaxy did not respond to inquiries from Inside Asian Gaming about the Hengqin project or its decision announced in March to construct a theme park style attraction as part of the final phases of Galaxy Macau in Cotai, rather than placing that entertainment facility on its vast Hengqin tract.

In December 2014, MGM China CEO Grant Bowie confirmed the company had identified a site on Hengqin where it wanted to invest and was awaiting government approval to proceed. Nearly a year and a half later, it’s still waiting and the nature of the project remains unknown. While expressing enthusiasm and gratitude for its upcoming Cotai opening, MGM tells Inside Asian Gaming, “We continue to look for future growth opportunities and Macau has limited land and employment resources and we see Hengqin as an opportunity to continue to develop in this region, for example, by developing additional training facilities for our staff.”

Knowledgeable sources indicate no other Macau gaming concessionaire has Hengqin plans as grand as Galaxy’s but companies are tight-lipped and details remain scarce. Macau media reported SJM Holdings planned to invest in Hengqin’s Guangdong- Macau Industrial Park, an area reserved for Macau investors, but the casino operator did not respond to a request for confirmation and details.

SJM satellite casino operator David Chow acquired a 30,000 square meter plot near the Lotus Bridge border crossing for RMB250 million (US$39 million) in 2013. He says the MOP$2 billion (US$250 million) development will introduce visitors to Portuguese culture with replica 17th century architecture and stage shows, highlighting Macau’s role as China’s bridge to the Portuguese-speaking world. The project received a HK$680 million loan from mainland lender ICBC’s Macau arm in 2014 and aims for completion in the early 2020s. Mr Chow, a former Macau legislator, is building the project separate from his Hong Kong listed Macau Legend Development that runs casinos.

Shun Tak paid RMB721 million in July 2013 for a 23,834 square meter site adjacent to the rail transport hub to create the Hengqin Integrated Development. A subsidiary of Singapore based mixed use project specialist Perennial Real Estate Holdings took a 30% stake in 2014, after working on a similar project in Beijing with Shun Tak. Under construction, the development will feature office and retail space, serviced apartments and hotels, and is expected to be completed in 2019.

In a January 2014 news release, Shun Tak Managing Director Pansy Ho – also co-chair of MGM Macau and a leading stakeholder in SJM – describes the Hengqin Integrated Development as “an epitome of the synergistic relationship between Macau and Hengqin, representing the future of tourism development of this region. The integrated development shall fulfill a lynch pin [sic] role in a multiplestop itinerary.”

REPEAT CUSTOMERS

Hengqin’s success will of course depend on ease of crossing to and from Macau. Experts such as University of Macau Associate Professor of Business Economics Ricardo Siu, see multiple-entry visas as a key element to foster “win-win” collaboration between the two sides. “The potential benefits are subject to related policies, especially if the mainland visitors who enter Hengqin could also be allowed to travel to Macau on a multiple basis and vice versa,” Professor Siu says, noting that some Macau legislators have requested that Beijing allow mainland visitors to Macau to make multiple return trips to Hengqin.

Without immigration changes, prospects for Hengqin and Macau to converge into a single tourist destination are limited. “For mainland Chinese visitors to Hengqin, they will still need an exit visa to come over to Macau,” IGamiX Management and Consulting Managing Partner Ben Lee explains. “The tales I have heard about how Dad will leave his family to frolic over at Chimelong whilst he pops over for a couple of days [in Macau] to play is sheer pipedream: a) he still needs a visa; and b) once he has been and returns to Hengqin, he has used up his visa.”

Numbers show little current tourist traffic between Macau and Hengqin. About one in 12 visitors to Macau, an average of less than 7,000 daily, arrive via the Lotus Bridge crossing, up marginally over the past year, compared with an average of nearly 45,000 daily at Gongbei. Perhaps more telling, a 2014 survey by Union Gaming Group found just one in five visitors to Chimelong planned to cross into Macau as part of their trip. Similarly, surveys by Macau’s Institute for Tourism Studies’ Tourism Research Center (ITRC) found that over the past three years, no more than 8.8% of visitors to Macau had or planned to visit Hengqin (or the rest of Zhuhai) on their trip, compared with about 20% of visitors saying they had or would visit Hong Kong.

ITRC sees those numbers indicating visitor interest in multiple destinations and the role Hengqin could play to boost the region. “The development of Hengqin can be viewed as beneficial to all the neighboring cities as this may enable or even encourage visitors to consider a multi-destination stay for a longer period,” ITRC wrote in a collective response to questions from Inside Asian Gaming. “A restaurant owner may not worry about competition from neighborhood restaurants; as long as they are all of good quality and sufficient variation, ultimately the whole street will be crowded and full of good food hunters.” But those foodies will need permission to visit any restaurant in the neighborhood to maximize the benefit to all.

Mr Ossolinski expects easier movement between Hengqin and Macau, possibly with a single electronic permit, will come as more projects create more demand for it. “Right now, Hengqin is mainly just construction plus Chimelong,” he says. He also believes that easing movement between Hengqin and Macau will likely mean restricting movement into the Hengqin Free Zone from the Zhuhai side, noting that access to other Free Zones is restricted. A border station has been built at the north end of Hengqin, on the island side of the bridge to Zhuhai, but is not yet in operation. Free access to Hengqin for Macau vehicles without the currently required mainland license plates has been agreed to in principle for more than a year but hasn’t yet happened as officials struggle with the mechanics, which may entail instituting Hengqin-Zhuhai border controls. Whatever the details, over the long haul, Mr Ossolinski is confident the authorities will act to support the convergence of Macau and Hengqin tourism. “They’ll make it happen, one way or another. It defeats the purpose if they don’t.”

PIGGYBACK RIDERS

Who will gain from Hengqin’s development? Few doubt that mainland authorities want Hengqin to help Macau. However, not everyone is convinced Macau’s tourism and gaming sectors are the intended major beneficiaries. “The Chinese government doesn’t care about the gaming industry or the casino concessionaires in Macau. It doesn’t benefit from Macau per se,” an industry executive who asked not to be identified says. “China is using Hengqin to piggyback onto Macau.”

The 4.5 square kilometer Guangdong-Macau Industrial Park on Hengqin reserved for Macau companies includes 19 projects in tourism as well as logistics, trade and technology, with projected investment of US$1.6 billion and the first flowers to bloom in about two years. In March, four participating companies signed land leases: a Sino-Portuguese trade and services center; Hengqin World, combining business and travel services with a duty-free shopping mall; a headquarters building with hotel and shopping mall for Nam Kwong, the Macau-based Chinese state-owned conglomerate whose wide ranging activities include acting as the city’s leading food importer; and West Meets East, featuring cultural projects and catering to small and medium enterprises. Other Macau oriented projects in Hengqin include the Guangzhou-Macau Traditional Chinese Medicine Science and Technology Park, launched in 2011, and Inno Valley, an incubator with a special focus on young entrepreneurs from Macau that opened last June under the auspices of state-owned Hengqin Financial Investment Company.

“Hengqin is positioned as an emerging city which could be developed to support Macau’s diversification, and the focus there is on business, finance and technology, with tourism only a small part, yet the last is all we hear about in Macau,” Mr Lee says. “There seems to be a huge gap between what they want and what investors in Macau are being told.”

He adds, “Hengqin is there for Macau to show their appreciation to Beijing and for it in turn to be the backbone of new emerging businesses in Macau. Unfortunately all Hengqin gets are applications for foreign workers dormitories, bus depots and … more foreign workers dormitories.” He believes “The easing of restrictions are mainly for Macau people to go over to Hengqin, presumably to set up and incubate their SMEs. Anything else is merely wishful thinking with no basis whatsoever. ”

Tourism and recreation is just one of seven key industrial sectors designated for development by the Hengqin New Area Authority that oversees the island. They include logistics, financial services, traditional Chinese medicine and other health services, science and educational research and development, cultural and creative industries, and advanced and new technology. Authorities also aim for ecologically friendly, sustainable development of Hengqin, in line with Zhuhai’s reputation as one of China’s greenest and most livable cities.

But the real key to connecting Macau and Hengqin remains the rail links. The spur from Zhuhai to Hengqin and the Jinwan Airport is expected to be completed in mid-2018. The Macau link, however, remains a wild card. The Taipa section of Macau’s light rail will be running in 2019, Secretary for Transportation and Public Works Raimundo do Rosário declared in December, but that may not include the connection to Hengqin.

“We will have to wait another 10 to 20 years to see that happen given the delays in our light rail construction so let’s not get too ahead of ourselves,” Ben Lee cautions.

Mr Ossolinski, more optimistic about the timing, says, once the infrastructure and policy pieces are in place, convergence of Macau and Hengqin as a single tourist destination will be worth the wait. He notes that Zhuhai already caters to visitors that can’t get visas to Macau with replicas of Macau landmarks such as Saint Paul’s ruins for photos and offers cruises around Macau. “If that doesn’t speak to pent up demand, nothing does,” Mr Ossolinski says. “To American investors, I say, let’s move Las Vegas and Orlando into one city.” Those two destinations, with a domestic market less than onethird the size of China, combined to welcome more than 100 million visitors last year.