Growing fast in Asia, cruises may not float the boat for serious gaming customers, but they’re another option to casinos for the wave of leisure travelers Macau covets.

By Muhammad Cohen, Editor At Large,

Shipboard gaming undoubtedly developed as soon as two sailors weren’t yanking an oar or pulling a sheet – that’s a rope for you lubbers. The riverboat gambler is a staple of American folklore, and the phrase resides in the American lexicon as a synonym for big risk taker. After New Jersey became the second US state to legalize casino gambling in 1976, some Midwest jurisdictions bet on a revival of riverboat gaming with mixed results. In India’s Goa state, table games are only permitted on ships. Grand Korea Leisure floated the idea of gaming cruises and got torpedoed by South Korean authorities. Floating casinos that didn’t leave the pier were fixtures of pre-liberalization Macau and gave NagaWorld in Phnom Penh its start in 1995.

Shipboard gaming undoubtedly developed as soon as two sailors weren’t yanking an oar or pulling a sheet – that’s a rope for you lubbers. The riverboat gambler is a staple of American folklore, and the phrase resides in the American lexicon as a synonym for big risk taker. After New Jersey became the second US state to legalize casino gambling in 1976, some Midwest jurisdictions bet on a revival of riverboat gaming with mixed results. In India’s Goa state, table games are only permitted on ships. Grand Korea Leisure floated the idea of gaming cruises and got torpedoed by South Korean authorities. Floating casinos that didn’t leave the pier were fixtures of pre-liberalization Macau and gave NagaWorld in Phnom Penh its start in 1995.

These days, shipboard gaming in Asia overwhelmingly takes place on cruises plying international waters. Once a vessel leaves national jurisdiction, generally three miles offshore, it’s free of restrictions on gaming and any sovereign regulation of it. International cruise lines include casinos among their entertainment options, while smaller operators offer cruises to the high seas specifically for gaming.

Cruise ship gaming remains lucrative in East Asia, with shipboard gross gaming revenue estimated at more than US$500 million last year, roughly double the likely size of the Vietnam gaming market. Gaming cruises stay afloat despite the expansion of the region’s land-based casinos in terms of location, size and attractions. Many in the industry deride shipboard gaming as the redoubt of penny ante players, and contend that it poses no significant competition to land based casinos. But as VIPs shy away from major gaming hubs, and Macau attempts to diversify as a tourism and entertainment destination, cruise ship casinos may prove a bigger factor in regional gaming than the presumed smart money believes.

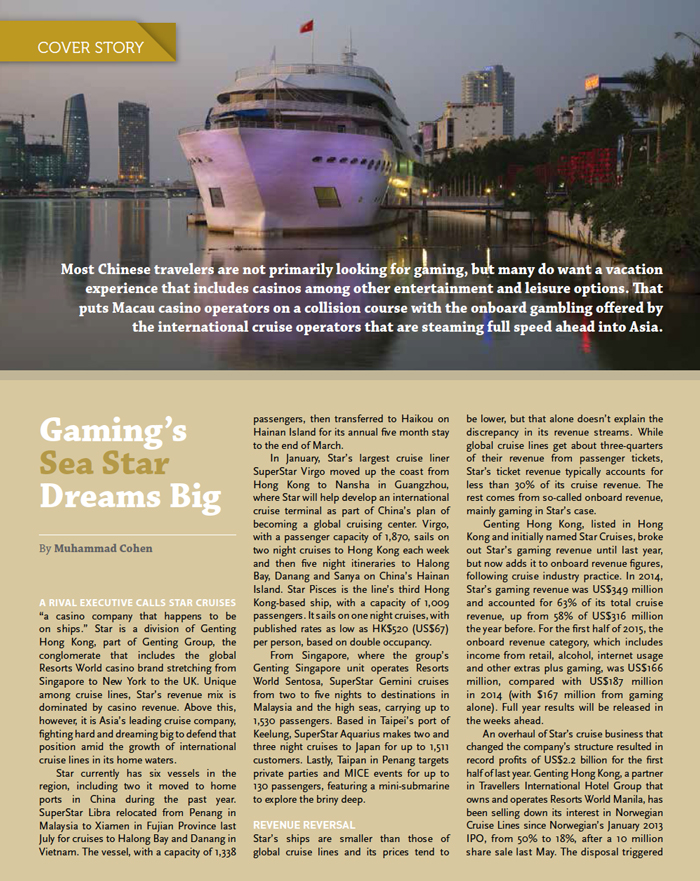

Walk down Hong Kong’s Canton Road and you may be approached with the offer of a free ocean cruise. That’s the blunt end of a surprisingly robust and sophisticated gaming segment. Genting Hong Kong’s Star Cruises runs overnight outings from Hong Kong on Star Pisces with a capacity of 1,000, and two-night high seas cruises from Singapore in addition to longer itineraries. Lower in the market, most cruises-to-nowhere operators sail a single vessel for up to 500 customers, dubbed “pirate ships” in the industry.

While grabbing customers off the street is a crapshoot, gaming cruise operators generally run their businesses much like other casinos in the region. They rate players by average daily theoretical and run loyalty programs. They have VIP rooms and work with junket agents, most doubling as subagents in Macau. Ships include pawn shops, “a mini-Macau,” one cruise executive says.

LOW COST CONVENIENCE

So why don’t cruise players go to the real Macau or another casino in the region’s burgeoning land-based gaming industry? For customers, the main factor is convenience. Passengers board, perhaps have a quick meal or nap in their cabin and within minutes of casting off, they can start playing. No hassles with ferries, Macau immigration or shuttle buses. Singapore residents avoid the SG$100 (US$70) entry tax at the city’s integrated resort casinos. For rated players, cruises are generally free. Minimum bets are lower than those at Macau or Singapore tables. On the VIP side, commissions can reach 1.60% of rolling, compared with 1.25% in Macau. Credit to junket promoters can run up to HK$50 million per cruise.

On the business side, all cruise ships have significant cost advantages over land-based casinos. Because they operate on the high seas, they pay neither gaming taxes nor compliance costs connected with regulation. Workers recruited from low wage countries such as the Philippines and Indonesia get low salaries, though they don’t pay taxes and have room and board provided. A gaming cruise’s breakeven point for a customer can be as low as HK$100 (US$13), an industry insider says. International operators, with dozens of ships, buy in huge bulk, feeding and otherwise accommodating thousands of people a day, and can negotiate big discounts from suppliers. The falling price of oil has cut one major operating cost; Star Cruises reported fuel costs decreased 41% though it also recorded a loss on fuel hedges for the first half of 2015. Low costs help fuel gaming cruise marketing efforts that resemble those of US regional casinos, including free berths and other incentives for customers who’ve stayed away.

Gaming cruises are a decidedly niche product. “It’s a particular market segment that will get on board, sail out, punt all night and into the early morning hours, and then get off around noon and head straight into the office. It’s not for the faint hearted!” Global Market Advisors Asia Regional Office Head Shaun McCamley says. Moreover, there’s no opportunity to try your luck at a different casino, and other amenities are limited. “Bottom line, the cruise business has never been felt to be a threat to land based casinos, and even with the turmoil today, I don’t see that ever changing,” Mr McCamley, who once worked with gaming cruises, says. For VIPs and other serious players, cruise ships aren’t on the radar.

But Asia’s high roller market has rolled into rough seas. Macau’s VIP gaming revenue tumbled from US$29.8 billion in 2013 to $16.2 billion last year, a 46% decline over 24 months. Some changes impacting the mainland premium segment may prove permanent. South Korea and Singapore also experienced significant drops in VIP revenue last year. The combination of falling revenue and government policy directives have led Macau to refocus on becoming a leisure and tourism destination, with resorts offering a wide range of non-gaming activities. The goal is to cater to China’s burgeoning middle class. Most Chinese travelers are not primarily looking for gaming, but many do want a vacation experience that includes casinos among other entertainment and leisure options. That puts Macau casino operators on a collision course with the onboard gambling offered by the international cruise operators that are steaming full speed ahead into Asia.

FULL AHEAD

Asia has become the world’s fastest growing cruise market, with China leading the way. Ocean Liner trade group Cruise Line International Association says volumes in the continent surged from 774,000 passengers in 2012 to 1.4 million in 2014, the last year for which figures are available. And analysts say growth certainly continued last year. For China the expansion has been more spectacular, from 217,000 cruise passengers in 2012 to 697,000 in 2014, making it that year’s seventh largest global source market for cruising, CLSA’s Chinese Tourists 2016 report states. Shanghai, Sanya on Hainan, and Tianjin outside Beijing are the top three domestic departure ports, with South Korea, Japan and Hong Kong the top three destinations, the brokerage says.

“[T]he Chinese population is getting richer and aspirations are rising for more adventurous and exotic locations, driven by growing social media pressures,” CLSA Regional Head of Consumer and Gaming Research Aaron Fischer and Marcus Liu write. “[W]e have largely seen a continuation of the 2014 trend, with Hong Kong and Macau lagging and a surge in ‘cooler’ holiday destinations to brag home about on social media.” The overall direction of Chinese tourism works in favor of cruises, which offer the independence and choices of an individual excursion with the comforts of a group tour, particularly for shore excursions to “cooler” destinations such as South Korea and Japan where Chinese is not widely spoken.

Global giants have joined local leader Star Cruises (see sidebar) in the regional market. Royal Caribbean claims to have the most ships with home ports in China, three in the mainland with a fourth coming and one in Hong Kong under its Royal Caribbean International brand that also sails from Singapore. Additionally, its Celebrity and upscale Azamara Club brand ships call into Asia. The first of the line’s most advanced vessels, Quantum of the Seas, with a capacity of 4,150 passengers, transferred its homeport from the New York area to Shanghai last year. A second giant Quantum category ship will homeport in Tianjin after its inaugural cruise next month. Royal Caribbean carried 400,000 passengers from the China market, including Hong Kong, last year, registering 64% growth annually since 2009, a company spokesperson tells Inside Asian Gaming.

Then there is the world’s largest leisure travel company Carnival Cruises, which sails from China, Hong Kong, Singapore and Japan under its Princess and Costa brands. Princess will take delivery of a new ship for Asia next year. In a US stock market filing accompanying 2015 results, Carnival estimates 4 million annual Chinese cruisers by 2020, noting, “The Chinese government has expressed a strong desire to transform China into a leading global cruise region and is making substantial investments in cruise-related infrastructure.”

SPENDER CONTENDER

Union Gaming Securities Asia Managing Director Grant Govertsen sees cruises as a strong contender for Chinese travel spending. “It represents a new experience for mainlanders and therefore is likely to be something they will want to try,” he says. “The fact that these cruise ships happen to have a casino is icing on the cake.” The CLSA report finds nearly 15% of its survey group had taken a cruise. Among the cruisers, 80% say they will consider taking another. (By contrast, among visitors to Macau, only 8% say they want to visit again in the next three years.) About 70% of the survey group that haven’t tried a cruise would consider taking one.

Cruise prices in the mainland start around RMB3,000 (US$460) in low season for a basic package, high by global standards, CLSA says, with better rooms, alcoholic drinks, premium dining and shore excursions available at extra cost.

On board, however, the vessels offer an extraordinary range of activities, from 6am dancercise to last dance with a live band pushing 2am. Depending on the ship, passengers can select from a menu that usually includes yoga classes, Sudoku tournaments, Zumba classes, arts and crafts geared to destinations, mahjong, child and youth programs, lucky draws, indoor and outdoor pools, duty free shopping plus live music throughout the day and evening shows in different locations.

And, yes, there’s gaming. International cruise ship casinos may have 50 tables and 30 machines on the main floor, plus a VIP club with up to a couple dozen tables and private rooms. That may not be up to Macau or Las Vegas standards, but the customers are leisure travelers who want gaming as part of a broad entertainment menu, the same group Macau is courting as it adds non-gaming attractions.

SUBMERGED REVENUE

Cruise operators list their casino revenue under onboard revenues, along with payments for alcohol, internet, spa, retail and other passenger spending. Last year, Royal Caribbean’s onboard revenue was typical; 27% of its total cruise revenue (the rest is passenger ticket sales) or US$2.2 billion out of US$8.3 billion. An industry source says perhaps 10% of international carriers’ onboard revenue now comes from gaming, although the proportion is higher in Asia and rising. For Carnival, meanwhile, onboard revenue made up 25% of its US$15.5 billion total cruise revenue.

“I think that quietly the big international cruise operators are very happy these days with the revenues from the onboard casinos of cruises originating in mainland China,” Union Gaming’s Mr Govertsen says. “I suspect it is still a very small proportion of revenue, but seems to be growing nicely.”

Asia has helped open the eyes of international cruise executives to the revenue potential of their casinos. Carnival, which has cross marketing deals with casinos for some of its brands, says it is instituting a program aimed at expanding casino revenue. Royal Caribbean names expanding Asian casino revenue as a growth driver in last year’s fourth quarter and is working to develop that side of the business.

Cruise line executives aren’t the only ones innovating to grow revenue through shipboard gaming. Central Vietnam’s port of Danang announced in January that it would allow visiting cruise ships to keep their casinos open while docked. Only passengers can play, so there’s no loosening of Vietnam’s domestic gaming restrictions.

“The goal is simply to get cruise ships to anchor at Danang,” Global Marketing Advisors Partner Andrew Klebanow says. “Every time a ship makes port, it disgorges 2,000 passengers, which has a significant economic impact on the communities surrounding the port. In this situation, some passengers will take a day trip to Hue, others will play a round of golf while others will just go to a beach resort.”

Imagine using a casino, even someone else’s casino, to attract visitors for non-gaming activities. Maybe it’ll catch on.