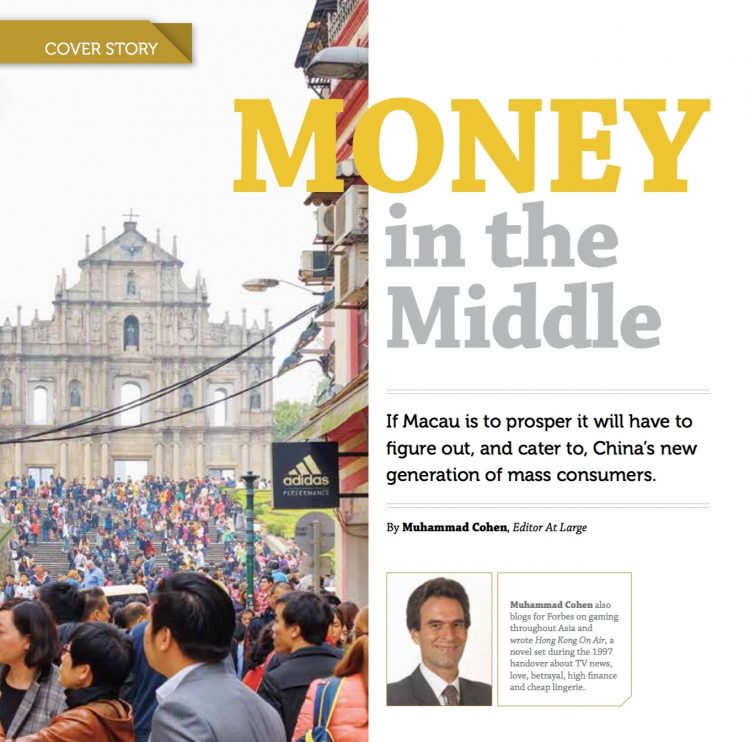

If Macau is to prosper it will have to figure out, and cater to, China’s new generation of mass consumers.

By Muhammad Cohen, Editor At Large,

The opening of Melco Crown’s Studio City in October heralded Macau’s pivot away from focusing overwhelmingly on the high end of the market and turning toward the middle class. The resort opened without VIP gaming and features an array of non- gaming attractions, including theme park style rides, magic shows, international nightclub brand Pacha and a 5,000 seat arena hosting the likes of Mariah Carey and Aaron Kwok on opening night and Madonna this month.

“Ultimately, the rise of the middle class is what drives growth in Macau and Asia,” Melco Crown Co-chairman and CEO Lawrence Ho declared at the Studio City opening. He says Studio City’s location, virtually adjacent to the Lotus Bridge border crossing, destined it to be a mass market property even before Macau’s VIP market collapsed. Last year high roller revenue fell 39.9%, while mass market gaming was off 26.3%. It was just over a year ago, after VIP gaming revenue fell 10.9% in 2014 while mass win rose 13.8%, that Mr Ho wondered “how many more billionaires are going to drop out of trees in the next ten years” in China, underscoring the pivot to middle class customers.

Even with the mainland’s economic growth falling below 7%, its lowest rate in 25 years, China’s middle class will expand to as many as half a billion people within a decade, and that group that will account for the bulk of the projected 200 million Chinese outbound travelers expected annually by 2020. The question that’s most relevant is how many of those middle class travelers, not only from China but the rest of Asia, will drop into Macau and whether they can make up for the shortfall in high end visitors.

Citing various sources, Institute for Tourism Studies (IFT) Assistant Professor IpKin Anthony Wong estimates the Chinese middle class numbers between 109 million people with net worth of US$50,000 to US$500,000 and 340 million individuals with annual earnings from US$6,000 to US$25,000. China Market Research Group Principal Ben Cavender describes China’s middle class as earning US$9,000 to US$35,000 and conservatively estimates that group numbers 10% of China’s 1.3 billion people. Multiple observers, including Global Market Advisors Partner Andrew Klebanow, note that official reports likely understate actual mainland income.

Depending on which numbers you prefer, Macau is capturing between 6% and 30% of the mainland middle class market, assuming that all mainland travelers to Macau are drawn from that pool. In reality, Macau visitors span the mainland economic spectrum, so there’s substantial room to increase its middle class penetration.

MIDDLE MUSCLE

Some question whether there’s enough spending power in that middle class to replace Macau’s missing high end players. Mr Wong estimates Chinese visitor spending at MOP$5,000 (US$625) per capita. Macau’s Statistical and Census Service’s third quarter Visitor Expenditure Survey puts per capita mainland visitor spending, exclusive of gaming, at MOP$1,776. The most recent IFT Visitor Profile Survey, conducted during last year’s second quarter, finds 50% of mainland visitors spent more than MOP$2,000, excluding gambling. It also found that 75% of the 1,000 people surveyed said they didn’t gamble at all (a statistic IAG has previously raised questions about), and among those that tried their luck, 57% spent MOP$2,000 or less.

Those spending levels indicate Macau would need a substantial increase in visitor numbers to make up for last year’s MOP$120 billion decrease in gaming revenue. At Mr Wong’s estimated MOP$5,000 per visitor, Macau would require some 24 million additional visitors to produce that lost revenue. On the other hand, Mr Cavender estimates that for a major trip, China’s middle class consumers could spend US$10,000 in Macau. At that rate of spending, 1.5 million visitors would make up for last year’s fall in gaming revenue. All of that money would not be spent on gaming, but some would go to segments with higher profit margins, most notably lodging.

“Mass market customers who are willing to spend at a more premium rate than the previous low end mass that Macau was accustomed to will be key moving forward,” Hogo Digital Managing Director Chris Wieners says. “It will become a volume game – and I believe it’s a game Macau can win. Considering China’s middle class and the growth potential over the next five years, any anomalies withstanding, and the fact that the majority of the Chinese middle class have never stepped foot in Macau, the destination has potential to become the destination of choice for Chinese consumers.”

Slower economic growth in China is having an impact on spending, Mr Cavender, whose firm tracks mainland consumer trends, says. “We are in an economic cycle where consumers are still spending, but where they are being much more choosy about how and where they spend.” The challenge is to get those potential middle class visitors to choose Macau.

PRICED RIGHT

Some believe there’s an affordability factor keeping middle class visitors away, but experts disagree. Macau is “totally affordable,” Mr Wong says. “Most of the entertainment and dining options are affordable.” The exception is accommodation during high season periods such as China’s Golden Week holidays at the start of May and October, when Mr Wong calls room rates “insane” at MOP$4,000 to $5,000 a night. “However, during most days of the year, the rooms are quite affordable ranging from a few hundred to a couple thousand [patacas].”

“Macau is relatively affordable,” Mr Wieners concurs. “While accommodation prices are up and down, I don’t currently consider this a crux to mass market success.” He believes, “The bigger issue, more than price, is access to the amenities, infrastructure – for example, adequate transport services – and a generally welcoming experience for a lower spend customer than was previously the key target of operators.”

Some properties and operators are more ready than others for middle class customers. Mr Wieners mentions Sands China’s Venetian Macao and Studio City as middle market friendly properties, and he believes Sands’ Parisian will join that group. “Through a combination of room inventory, available space to build further amenities, and their commitments to promote non-gaming offerings, I feel these resorts will resonate with the new middle class Macau will need to begin attracting,” he says.

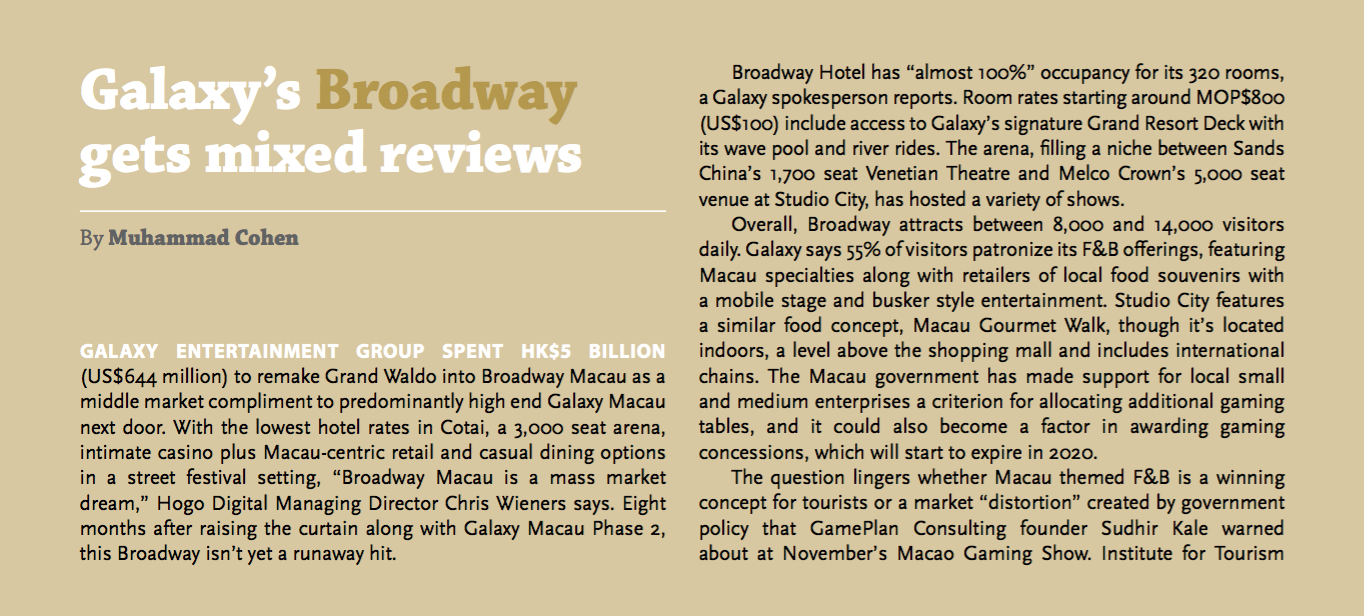

Mr Wong sees all of the operators tilting toward the middle class to some degree, noting that Wynn and MGM, long focused on the high end and lacking Cotai properties, have been increasing their mass market tables and slots. Galaxy Macau’s first phase retail mix included shops that targeted middle class consumers, including drug chain Mannings and watch shop City Chain plus a range of casual dining along with more upmarket offerings. Galaxy’s Broadway Macau, opened in May along with the resort’s second phase, aims squarely at the middle market. Even before Studio City, Melco Crown’s City of Dreams had a Hard Rock Hotel and later introduced SOHO, a dining and entertainment area catering to the middle market. Later this year, SJM Holdings will reopen its redeveloped Jai Alai casino near the Outer Harbor Ferry Terminal with a 130 room hotel and retail, expected to target middle class customers.

MAKING THE TURN

“I think there is an understanding amongst the major players that middle class consumers want something different but it’s difficult to transition quickly,” Mr Cavender says. “So, the resorts are going in the right direction but it may take time for the market to develop and for middle class consumers to come in enough numbers to offset any losses to revenue from VIP gamblers and junkets.”

Simply having facilities to serve the middle market isn’t enough, Mr Wieners suggests. “From a marketing perspective, organizations like Sands are well oiled machines that understand their customers and where they sit,” the marketing executive says. “Regular road shows and familiarization trips to Chinese agents and end-consumers have allowed Venetian Macao to remain a household name for those traveling to Macau. I see this happening with Parisian upon its opening and partly due to its iconic Eiffel Tower structure. Studio City has much to gain from the same exposure in key inbound markets, and a sexy, exciting product that will visually stimulate but must be combined with the right sales pitch.”

It’s not a matter of the sales pitch, but what Macau has to sell. “Macau requires a major reengineering of products and services,” Mr Wieners says. “The majority of properties today have been planned and fitted out with a premium market in mind. In order to see success, the destination as a whole must work to reinvent the perceived service offerings available to visitors.”

Citing a new generation of Chinese consumer that have traveled overseas, or see it as a genuine alternative to Macau, Mr Wieners says, “While we need to remain culturally relevant in our offerings, the lack of diverse offerings across entertainment, food, beverage and amusements are keeping the Macau brand off the travel lists for many in the Chinese middle class who perceive Macau as ‘boring’ or ‘just a gaming destination’ or ‘not a place for quality family entertainment.’ I believe the incoming Cotai resorts are aware of this and are in the process of shifting what they can with regards to service offerings to maintain relevance with what this new Macau tourist will be seeking.”

NOT SO HOT

“Right now Macau as a whole may have a branding issue,” Mr Cavender says. “It really isn’t seen as a hot destination for younger consumers, and those are the consumers who are spending on travel right now.” He says, “The challenge here is still moving beyond the image of hard core gambling as this isn’t necessarily what younger middle class consumers are looking for. Macau has absolutely added more attractions for non-gamblers or casual gamblers to enjoy, but there is still room to go.”

For today’s Macau, it’s still “hard to compete for consumer time and money when they have so many other destinations that they are interested in,” Mr Cavender says. “As consumers look at traveling to new destinations, they are also considering Korea, Singapore, the Philippines, markets that offer a lot more besides gambling.”

“Singapore, Korea, and Taiwan have done excellent jobs in promoting the destinations by having an assortment of leisure and entertainment options catering to Chinese visitors,” Mr Wong says. “Singapore and Korea both have casinos, and they have better shopping options than Macau. Their food variety and authenticity are excellent. These places are also rich in sightseeing options and entertainment activities. Taiwan will pose a genuine threat to Macau’s market once it opens up casinos,” a prospect that may have become more remote with the Democratic Progressive Party winning last month’s presidential election. (Beijing has said it won’t allow mainlanders to travel to Taiwan for casinos, and the DPP is considered less friendly to Beijing than the outgoing Kuomintang party.) new integrated resorts will help make Macau more attractive to travelers, Mr Wong says, but beyond casino facilities, the city remains “reluctant to add new tourism facilities and activities.”

“Like it or not, Macau must go the way of previous gaming destinations like Las Vegas and develop a quality destination brand campaign that reaches out and stimulates not only the Chinese market, but those throughout Asia as well,” Mr Wieners says. “Macau must work to drive the mass markets of other inbound locations, Southeast Asia, Korea, Japan. When the bulk of Asian markets begin coming to Macau en masse, the Chinese consumers will follow.”

Mr Wong also sees Las Vegas providing “the best model” for Macau. “Las Vegas is no longer just Sin City and a hardcore gambling destination,” he says. “The city has so many affordable attractions and leisure activities: shopping, shows and entertainment, exhibitions, golfing, dining, and much more, all at affordable prices.

“The key here is scale,” Mr Wong says, but he doubts pint- sized Macau can match the breadth and depth of attractions in Las Vegas, which began with a vast blank desert canvas. “Macau is too crowded for mass tourism. It is not even pleasant to walk around the city, a major problem that inhibits tourists from staying longer. With the soaring cost associated with service operations, Chinese tourists will soon realize – maybe they have already – that it may not be worth visiting Macau unless the city makes major improvements to its tourism infrastructures and facilities. With such a small piece of land, I don’t think Macau will ever be able to solve this problem.”

But as US$23 billion of new operator investment rolls out, Macau may never have a better opportunity to reinvent itself yet again. It’s not just about attracting the middle class but making Macau the world center for tourism and leisure that government authorities say they want. That would be a new normal worth with a visit.