City of Dreams Manila’s grand opening marks milestones for Entertainment City and Melco Crown. The question now is: Will the resort’s Macau connection boost Philippine gaming?

For its opening night concert, City of Dreams Manila brought in international stars Ne-Yo and Kelly Rowland. Industry observers are anxious to see how many more international players the US$1.3 billion CoD Manila will bring to the Philippine capital’s Entertainment City district. They’ll probably need to be patient.

During the 2nd February grand opening, more than 30,000 people visited CoD Manila, jointly owned by Melco Crown Entertainment and Belle Corporation, part of the SM Group controlled by the Philippines’ richest man, Henry Sy, and family. That crowd represented double the average footfall during the resort’s six week sneak preview that kicked off 14th December with the 170 gaming tables and 1,700 machines on a two-level main gaming floor plus a handful of food and beverage options including Nobu, the star-studded modern Japanese restaurant. The Signature Club, a spacious and richly appointed private premium-mass area with 34 tables and 108 machines plus a comfortable lounge, also opened during the preview period.

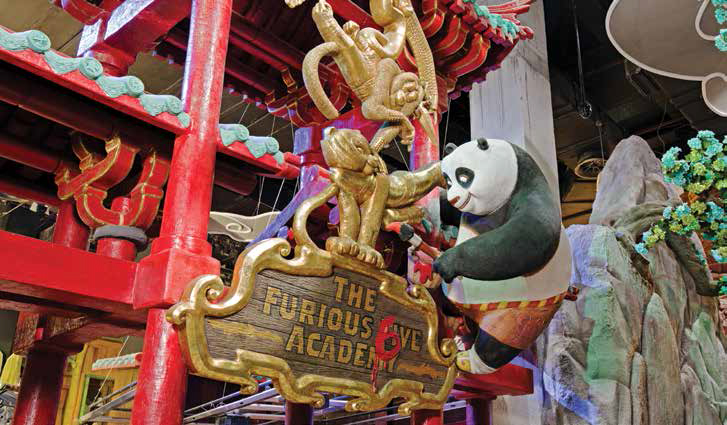

For the grand opening, Retail Avenue, which adjoins the upper level of the gaming floor, had about half of its 15 boutiques open along with seven F&B outlets. The rest of the retail offering is expected to be completed by the end of this month, along with the world’s first DreamPlay interactive theme park, inspired by DreamWorks Animation movies and employing RFID technology to rate and track participants (so parents can leave the kids there).

City of Dreams Manila, sheathed in gold with six towers on a 6.2 hectare site, is Melco Crown’s first venture outside Macau, where it operates the original City of Dreams, Altira hotel-casino and chain of Mocha Clubs slot parlors. Melco Crown became the Manila project’s operating partner in 2013 and that October rebranded the property as City of Dreams Manila after Philippine regulator Pagcor significantly raised its allocation of gaming tables and machines. “The success of City of Dreams Manila is a major milestone for Melco Crown Entertainment as we continue to expand our City of Dreams brand in Asian markets to meet the large and ever-growing number of leisure destination seekers across the region and internationally,” Melco Crown Co-Chairman and CEO Lawrence Ho said.

CoD Manila is the second property to open at the master-planned cluster of casino resorts at Manila Bay called Entertainment City. The first, Solaire Resort & Casino, controlled by Philippine ports magnate Enrique Razon, opened in March 2013. The other two, the upcoming Manila Bay Resorts and Resorts World Bayshore, are being developed by, respectively, Japanese pachinko mogul Kazuo Okada’s Universal Entertainment and Travellers International Hotel Group, the partnership between Genting Hong Kong and Philippine billionaire Andrew Tan’s Allied Global Group that owns Resorts World Manila. It was the financial success of the game-changing Resorts World Manila following its 2009 opening that paved the way for the new crop of integrated resorts now opening in the country.

ENTERTAINMENT OPPORTUNITY

“We’re as much an entertainment company as we are a gaming company,” Mr Ho said at the grand opening, and CoD Manila aims to prove it. The CenterPlay bar in the middle of the ground floor gaming area features local and international singers and dancers on its elevated, spectacularly lit stage that animates the casino experience. “You could not have this in Macau,” where players are less interested in entertainment than Manila, Melco Crown (Philippines) Resorts Chairman and President Clarence Chung said.

The resort’s architecturally prominent Fortune Egg Dome houses two global nightclub brands, ultra-lounge Pangaea, also found at Singapore’s Marina Bay Sands, and nightclub Chaos. “Manila might not have been our first choice for our next club. But because City of Dreams was such an extraordinary project, it brought us here,” international nightclub developer Michael Van Cleef Ault said as champagne was served amid sparklers.

“We are contemplating to bring in Dragone Group to do some kind of a cabaret show,” Mr Chung said. Dragone produced Taboo, a racy stage show playing at City of Dreams Macau’s Club Cubic. “That’s been well received in Macau, and we would like to do something [similar] here.”

The 365-room Hyatt and 321-room Nobu hotels opened progressively from December were nearly complete by the grand opening. A third 254-key hotel tower, Crown Towers, catering to high rollers officially opened for guests on 1st February, with just some of its 173 rooms, 73 suites and seven villas available. VIP gaming began on grand opening day, with about 69 tables—25 in the main VIP area on the second floor, the rest in private rooms and the Sky Suite area atop Crown Towers. Melco Crown says it will have 90 VIP tables in operation by the end of March.

MACAU LINKS

Melco Crown executives at the grand opening spoke about bringing in high rollers through their corporate web extending from Macau to Australia, home to Co-Chairman James Packer’s Crown Resorts. “With our connections in Macau—of the four licensees, we’re the only one with a direct connection in Macau—we have a strong foothold to bring in additional customers from overseas,” Mr Chung said.

A desire to stimulate visitor arrivals was a key factor behind the government’s support of the Entertainment City initiative, allowing Pagcor (Philippine Amusement and Gaming Corporation), the government-owned regulator cum operator, to license four integrated resorts. “One of the reasons for building premium resorts has been to bring in players from China. That’s part of the premise,” Pagcor Vice President for Regulation and Business Development Francis Hernando said.

A Macau operator running an Entertainment City resort gives Manila a pipeline to Macau junkets. And having the Ho family name prominently associated with the project may help overcome Chinese resistance to visiting the Philippines stemming from ongoing territorial disputes between the Philippines and China and lingering concerns over safety.

But City of Dreams Manila hasn’t launched its VIP program as aggressively as many expected. In its analysis of Melco Crown earnings last month, Union Gaming Research Macau forecast a “long-tailed” ramp up for the property with 2015 EBITDA of $128 million on revenue of $414 million, a 31% margin. Some observers were surprised that VIP wasn’t part of the mix during the preview period. The projected 90 VIP tables are half as many as Solaire has in its expanded VIP area, and fewer than Resorts World Manila. CoD Manila has authorization from Pagcor for about 380 gaming tables, so can add some 70 tables as well as hundreds of additional electronic-gaming-terminal positions.

“Solaire’s VIP area is like a football field; the City of Dreams Manila VIP room layout is not as expansive as you would expect,” Mr Hernando observed. “I would like to think in three-to-six months, we’ll have a better picture of how it will play out.”

A gaming executive with extensive experience in Southeast Asian markets expressed surprise about CoD Manila’s lack of aggressiveness on VIPs, then said, “The Signature Club is beautiful. Maybe that’s what they’re going after, the premium mass segment. That’s what they’ve done in Macau.” If capacity is constrained in Macau, CoD Manila has room, and gaming areas don’t ban smoking.

DOMESTIC AGENDA

“From they beginning, they’ve not been bashful about saying the domestic market is a large one,” Mr Hernando said. He noted that, unlike Solaire, CoD Manila was advertising on local television during prime time, using spots featuring film giants Leonardo DiCaprio, Robert DiNiro and director Martin Scorsese.

At CoD Manila’s grand opening, top Melco Crown executives repeatedly praised the Philippine market of 100 million people, including some 20 million in Metro Manila. In a January report, Morgan Stanley Research Asia/Pacific forecast 6.3% GDP expansion this year to drive mass-gaming revenue growth. The report notes Philippine consumers spend just 2% of their income on leisure, less than half the comparable level of Indonesians, Thais and Malaysians, and speculates rising disposable incomes in the Philippines could trigger greater gaming spend amid increased leisure expenditure.

Mr Cheung was most explicit about the domestic opportunity: “The Philippine gaming market and Philippine economy keep growing,” he said. “With this nice property, we’d like to take a piece of that market.”

With its location at the edge of Entertainment City bounded by two major boulevards connecting to the heart of Manila—the sites of the other three resorts are along the Manila Bay waterfront— CoD Manila may have a slight edge when it comes to accessibility for locals. During the sneak preview, CoD Manila’s reported average daily visitation of 15,000 roughly equaled Solaire’s, though both trail the 20,000 daily footfall at Resorts World Manila, which is adjacent to the airport and connected to Manila’s highway system.

A toll road linking Entertainment City directly to the airport, Makati business district and highway system is scheduled for completion late this year. (The exit ramp will feed into the bayfront side of Entertainment City, possibly negating CoD Manila’s locational advantage.) Along with new resorts, that’s likely to push Manila’s center of gaming gravity toward Entertainment City.

“Is the market big enough to support two IRs? Yes,” Global Market Advisors Partner Andrew Klebanow believes. He’s not sure, though, that the airport and related infrastructure “can bring in enough customers” to support Entertainment City with four resorts, plus Resorts World Manila, much less Caesars Entertainment’s proposed IR adjacent to the airport. Still, what he is certain of is that international players are vital to Manila’s long-term success.

Editor at large Muhammad Cohen also blogs for Forbes on gaming throughout Asia and wrote Hong Kong On Air, a novel set during the 1997 handover about TV news, love, betrayal, high finance and cheap lingerie.