The Northern Marianas, a US Pacific territory, is moving to tap its destination gaming potential, but legalization on the main island of Saipan is a mess.

The Commonwealth of Northern Marianas Islands (CNMI) faces a severe financial crisis and needs more casino revenue in the worst possible way. That’s how the government is trying to get it: in the worst possible way. Legislation to authorize a single US$2 billion casino resort in Saipan, CNMI’s main island where voters have twice rejected casino legalization, was approved at lightning speed amid corruption allegations. The gaming law gives the cash-strapped government just a fixed $15 million annual gaming license fee over the 40-year license term, with no additional tax on casino revenue. A judge has halted awarding the Saipan license, and opponents are petitioning for another referendum.

Tinian Dynasty Hotel and Casino, the struggling casino on the neighboring island of Tinian and CNMI’s lone operating casino, has new ownership, Hong Kong-based Mega Stars Overseas, with grand plans that are mired in a public feud between Mega Stars and Tinian regulators. After threatening to cancel further investment in protest over the authorization of a competing casino on Saipan, Mega Stars bid for the Saipan license, but is now suing to stop it. Both Saipan license applicants, though linked to gaming, have no track record in resort development and no obvious means to finance the mandated $2 billion investment.

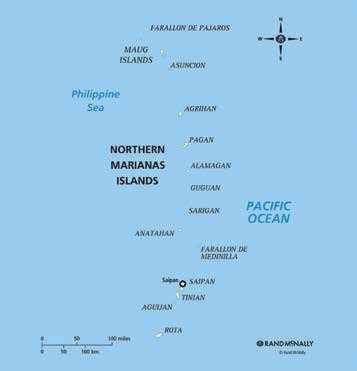

But these issues shouldn’t obscure CNMI’S potential as a gaming destination. The self-governing US territory, which lies about 1,200 miles east of Manila and 1,000 or so miles south of Japan, offers white sand beaches and turquoise waters, and with special visa-free access for Chinese visitors is well-positioned to cash in on China’s explosive demand for overseas travel. Saipan has 90% of the commonwealth’s 54,000 inhabitants and 100% of its tourist arrivals, which numbered 433,736 for the fiscal year ended September 2013. The economy has relied almost entirely on tourism since its garment industry collapsed after 2007 when the US extended federal labor laws and most immigration rules there following revelations of sweatshops turning out clothing labeled “Made in USA” that were the work of migrant laborers paid a fraction of US minimum wages.

‘Only US City in Asia’

“The Northern Mariana Islands have great potential for tapping the greater Asia growth story in tourism,” says Global Market Advisors partner Jonathan Galaviz, a travel and gaming industry consultant who has visited the commonwealth to research the market. “The beaches, overall environment and US oversight bode well for the future of CNMI in many respects.”

“We’re the only US city in Asia, four or five hours from Asia’s biggest population centers. That brings a lot of value to the table,” says Phillip Mendiola-Long, president of CNMI-based consultants Sherman Pacific. Mr Mendiola-Long, whose clients include investors proposing a Titanic-themed casino resort in Tinian, thinks the US connection could leverage broader interest from investors drawn by the opportunity to gain US residency or have US dollar revenue as a hedge. “The [CNMI government], in its haste, left a lot of money on the table,” he says.

He says there was no research to determine the proper scale of a Saipan casino. The new casino law mandates Saipan’s licensee to spend $2 billion and construct 2,000 hotel rooms in a market that currently has 2,300 rooms. For comparison, Manila’s Entertainment City requires a $1 billion investment and 800 rooms for its integrated resorts. Macau, when it sought licensees in 2001, required a $500 million investment.

“The legal and regulatory framework in CNMI needs to be updated in order to encourage significant capital investment in tourism,” Mr Galaviz agrees.

The law calls for a Commonwealth Gaming Commission to oversee the industry but offers few regulatory details. Sparsely inhabited Rota has its own gaming law and commission, though its one casino operated for only a few months before closing in March 2011 and has postponed two scheduled reopenings this year. Tinian’s gaming rules were “Xeroxed from the New Jersey law,” Mr Mendiola- Long says.

Spectrum Gaming Group Managing Director Fred Gushin, who served as an advisor to the Tinian Casino Gaming Control Commission in the early ’90s, says US law enforcement suggested Tinian adopt New Jersey’s regulations as its model. “[We] all knew that it was a big mistake and tried to interpret Tinian law in a way that would not be so difficult,” he says. “The New Jersey gaming law was designed for an urban gaming environment and for a high-traffic casino. Tinian never was able to secure that kind of base.”

Mr Gushin also disputes one Saipan applicant’s assertion that gaming in the CNMI is not subject to US jurisdiction. As in US states, federal law has supremacy. Noting that US Internal Revenue Service agents raided and temporarily shut down Tinian Dynasty last April for failing to record large cash transactions, he says, “The US Bank Secrecy Act applies to CNMI. However, as it relates to licensing and other regulatory matters, the states or commonwealths have primary oversight for gaming control.”

The IRS raid also raised questions about the competence of the Tinian Gaming Control Commission, which has since been reorganized. The commission is currently trading barbs with Mega Stars, which took over ownership of the property last July. The commission says Mega Stars delayed applying for its license, which has yet to be granted even though the casino is open, while Mega Stars accuses the commission of dragging its feet, even though the company has spent $40 million to rescue the property and begin renovating it. Neither party would comment on their differences.

When Tinian first tried to grant gaming licenses, Mr Gushin and his colleagues found several applicants had ties to Japan’s underworld. “In the 1980s and early ’90s, [CNMI] was a playground for middle-class Japanese,” he says. “It could have been a credible beachhead in Asia for a US operator before Macau opened up.” CNMI tourism peaked at 700,000 arrivals in the early 1990s. But no gaming license was granted until Tinian Dynasty opened in 1998.

Now Mr Gushin thinks a $2 billion Saipan resort may be arriving late to the Asian gaming party. He compares CNMI to the Bahamas, an island chain in the Caribbean near the US southeastern coast. “When Florida and the northeastern US didn’t have casinos, the Bahamas boomed,” he says. But now those areas have numerous convenient casinos. In Asia new or expanded gaming jurisdictions such as Macau, Singapore and the Philippines reduce the appeal of CNMI casinos, he says. However, the Bahamas and other Caribbean destinations are currently seeing investment from Chinese companies aimed at Chinese travelers, and CNMI hopes to get in on that action.

“Outbound tourism among mainland Chinese is soaring, they are looking for options beyond Hong Kong and Macau, and Saipan could be one of them,” Nicholas Niglio, CEO of Macau junket promoter Neptune Group, says. “Whether this particular project is successful remains to be seen—so much depends on the quality of the product and transportation issues.”

According to the Marianas Visitor Authority, visitors from mainland China to CNMI grew 43% to 112,570 in the fiscal year ended September 2013, making them the commonwealth’s third-biggest source market. Overall visitor arrivals rose 11% to 433,736 over the same period. This year, in February and again in May, China supplanted Japan and South Korea as CNMI’s top source of visitor arrivals. In a presentation to potential investors, Mega Stars estimates Chinese tourist arrivals will reach 176,000 this year and 251,000 next year.

Macau money magnet?

With growing Chinese tourism, low taxes and an uncertain regulatory environment, Macau junket promoters seem like prime candidates to invest in CNMI. “Junkets have so much money, and you see them moving into casino management across Asia,” Mr Gushin notes. Other sources add that Macau junket promoters want to diversity away from Macau. The other Saipan applicant, Best Sunshine International, reportedly has ties to Macau junket promoter Hengsheng Group through its Hong Kong-listed parent, Imperial Pacific International Holdings. Hengsheng declined to comment on CNMI, saying any announcement would come from Imperial Pacific.

Marianas Stars Entertainment, a partnership between Mega Stars and a subsidiary of Hong Kong-listed Chinese Strategic Holdings, says it has no other ties to gaming. However, Mega Stars Chief Financial Officer Henry Leung says the Saipan casino it wants to build, as well as its Tinian Dynasty renovation and expansion, will be financed by a combination of institutional investors and “gaming industry practitioners”.

Best Sunshine wants to make Saipan “the Monaco of the Pacific,” says COO Terence Tay, who was general counsel and head of corporate affairs for Genting Singapore when it developed Resorts World Sentosa, Singapore’s first gaming resort. It proposes an “iconic” resort with four hotels, shopping and entertainment to be developed in four phases, the first completed by 2018. Best Sunshine has asked the government for assistance locating suitable public or private land for the development. Mr Tay says that because of the delays inherent in planning and construction, Best Sunshine would like to find an existing facility that it can convert into a gaming hotel while building its resort. Critics say that statement telegraphed the group’s plan to open a casino and then delay other development plans indefinitely.

Marianas Stars proposes a “Legend of the Ocean” theme park as the centerpiece of its development. In 2017, the park would open with 16 attractions alongside a 500-room five-star hotel, a casino with 100 table games and 200 machine games, a shopping mall and multipurpose venue for shows, conventions and exhibitions. Subsequent phases would add three more hotels, including one catering to “family and budget travelers,” according to Marianas Stars’ Web site, plus 10 additional Legend of the Ocean attractions and an expanded casino featuring 300 tables and 700 machines.

A Saipan resort under its ownership will complement Tinian Dynasty, Mr Leung says, citing the synergies between Macau’s peninsula casinos and the casinos on Cotai.

“The casino in Saipan will be positioned as part of the integrated resort, targeting a broader mid- to high-end market,” he says. “Whereas for Tinian, it will pursue a more up-market and exclusive gaming experience for the high-net-worth tourists and gamblers.

”To facilitate travel between Saipan and Tinian, a 10-minute flight apart, Marianas Stars plans to form a joint venture with charter operator Star Marianas Air to provide low-cost service connecting the CNMI and the island of Guam about 136 miles to the south, also a US overseas territory. The deal calls for purchasing up to six 30-seat aircraft. Direct international flights to Tinian are scheduled to begin in December this year.

In an “open letter” posted last month on its Web site, Marianas Stars suggests that the government award two licenses, one to each applicant, require each to build a 1,000-room resort and collect two $15 million annual license fees. “Each applicant will get half a loaf, but the CNMI will get twice the revenue for retirees, for health care, for schools, for infrastructure, for everyone,” the company wrote.

Multiple casinos can be good for CNMI gaming overall, Mr Mendiola-Long agrees. “You could see two or three charter flights weekly split between two or three properties.”

Some legislators also have expressed support for the idea, but Best Sunshine and Gov. Eloy Inos oppose it.

In any event, either project could prove tempting for high rollers looking for an exotic holiday. “Junket players like to go on vacation too,” a source knowledgeable about gaming in Macau and beyond says. “A $250,000 player in Macau may play $50,000 when they go on to a tropical island.”

Editor at large Muhammad Cohen also blogs for Forbes on gaming throughout Asia and wrote Hong Kong On Air, a novel set during the 1997 handover about TV news, love, betrayal, high finance and cheap lingerie.