With diverse markets that range from the flat to the explosive— some marked by political conflicts, others models of public-private cooperation—and with new resorts appearing on the radar with price tags unlike anything ever seen, 2014 will be nothing if not interesting for gaming across Asia.

While Macau grabs all the headlines, the Asian region has experienced a diverse year when it comes to gaming. Markets have ranged from flat to explosive, government-casino conflict has been prominent in some locales while others have been far more amicable, and new resorts are on the radar with price tags unlike anything seen before. Governments across the region are after tourism dollars, and gaming is seen to be a major part of that, to the point where it is being considered for locals in jurisdictions where it has been off limits. And tourism is what they’re getting: Asia led the world in tourism growth to August 2013, with a 6% increase; the increase in Southeast Asia was a healthy 12%. East Asia continues to lead the world for growth, with the World Bank forecasting a strong 7.1% as of October 2013. “East Asia-Pacific continues to be the engine driving the global economy, contributing 40 percent of the world’s GDP growth—more than any other region,” said Axel van Trotsenburg, World Bank East Asia and Pacific Regional vice president. Foreign direct investment also continues to flow into the region, which has a few countries very thirsty for it, though questions could be asked of its sustainability as the US Federal Reserve tapers its bond-buying efforts. For now, it is generating growth across sectors, and gaming companies with deep pockets are very much amongst it.

CAMBODIA Waiting for Naga2

Cambodia has been one of the stars of the region over the last decade, with growth similar to that of the Chinese mainland. As of October 2013, the International Monetary Fund forecast the country’s growth at 7%, increasing to 7.2% in 2014. World Bank figures from the same month showed the country’s foreign direct investment spiking to US$1.4 billion in 2012 from $785 million the year before, with a further small increase forecast for 2013. While this looks promising on its face, investors are said to be wary due to the political climate.

Tourism figures provide good news: As of November 2013, tourist arrivals had grown 18% to 3.8 million, driven primarily by travelers from Vietnam, South Korea, mainland China and Laos, the latter two recording increases of 40.1% and 67.2%, respectively. Tourism income was expected to grow commensurately from its 2012 total of US$2 billion.

The Ministry of Tourism’s target of 4 million visitors looked well within reach; amongst other factors, government and industry sources thanked direct flights and visa-free access within most of the ASEAN community. The increase in visitors from China is partly due to the increasing number of direct flights available from that country also. As a result, the government plans to double the capacities of both international airports by 2015 and build a new international airport in Phnom Penh by 2020.

In Vietnam the possible legalization of gambling for locals and the subsequent development of The Grand – Ho Tram in southern Vietnam is expected to have some negative effect, however. Currently, approximately 58% of NagaWorld’s gaming revenue to June 2013 came from mass-market players, of whom one-third were Vietnamese (much of the VIP play was from Malaysian visitors). Analysts’ expectation is for some of those Vietnamese to gamble at home if it becomes legal. In addition, Cambodia still suffers from political instability, with the disputed 2013 elections affecting the gaming sector.

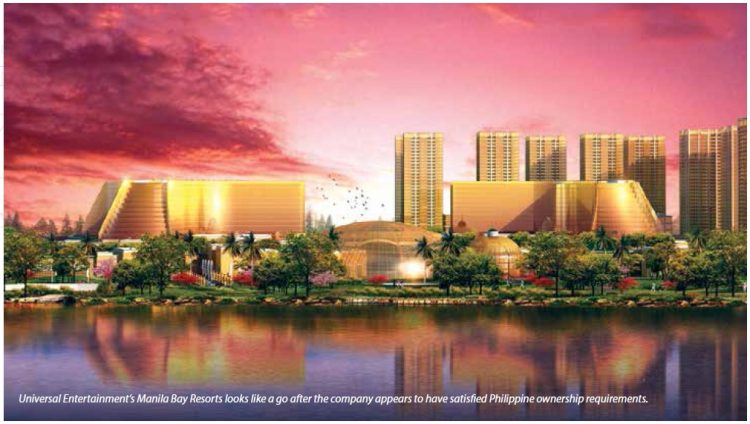

Of course, NagaWorld remains the mainstay, with its monopoly on gaming within a 200-kilometer radius of Phnom Penh. The Hong Kong-listed parent company, Nagacorp, saw its stock price show solid growth over 2013, and the year to June saw a 20% increase in net profit based on a 15% increase in revenue. Non-gaming revenue increased in line with overall visits.

NagaWorld is already substantial by regional standards and includes 660 rooms and suites, 1,700 electronic gaming machines and 170 live table games, 15 food and beverage outlets, a nightclub, a spa, retail shopping and 25,000 square meters of meeting space.

But the bigger story is Naga2, which will add 1,033 rooms, 200-300 table games, 50 VIP gaming rooms, 500 EGMs, more entertainment and MICE facilities, another 18,000 square meters of retail space, a 4,000-seat theater and parking for 533 vehicles. Naga2 is due for completion in late 2015 or early 2016. Positively for the company’s prospects, there are no statutory limits on gaming capacity.

Aside from NagaWorld, there are approximately 70 small casinos and slot parlors, many concentrated around the towns of Poipet and Pailin along the border with Thailand, where gambling is illegal; in Bavet, bordering Vietnam, and in the port city of Sihanoukville. CIMB, an ASEAN-facing investment bank headquartered in Kuala Lumpur, estimates this frontier trade at 20-30% of the total market, although no one knows for sure since it operates with little or no regulation.

One major player in the border market is Entertainment Gaming Asia (EGT), a distributor and lessor of machine games around Cambodia (670 of them in NagaWorld) and the Philippines. EGT is 38% owned by EGT Entertainment Holding, which is a wholly owned subsidiary of Melco Group. The company opened its US$2.5 million Dreamworld-branded casino in Pailin in 2012 with 26 tables, two VIP rooms and 58 EGMs. In May 2013, the company opened a more elaborate $7.5 million slotsonly casino in Poipet with 300 EGMs. Others include large groups such as Crown, with four properties including three in Poipet; Holiday, with three properties including one in Poipet and one in Sihanoukville; and Star Vegas.

EGT’s most recent results were patchy. Gaming and slot revenue in the third quarter of 2013 were relatively unchanged year on year at US$4.5 million and $4.1 million, respectively. Revenue from Dreamworld Poipet offset declines in other slot operations during the quarter. Revenues were on a downward trend in Pailin through 2013, dropping to US$432,000 in the third quarter from $907,000 in the second. The company attributed the difficult time to lower player traffic as it decreased the use of tour promoters. As part of a readjustment, EGM seats were increased to 88, with 30 extra semilive multigame tables. But earlier this year the company announced that it had written off its US$2.5 million investment in Pailin and said it may pull out of the venture completely or sublet the operation.

EGT’s NagaWorld operations showed US$3 million in revenue and $201 in average daily win per machine for the quarter, down from US$3.2 million and $216 year on year, primarily due to lower player traffic attributed to the national elections in the summer.

The company is also looking at expanding on the Vietnamese side in the Bokor Highlands about two hours south of Phnom Penh, where EGT leases machines to Thansur Bokor Resort and Casino. Results at Thansur have been poor. A competing casino in the region, the Hà Tiên Vegas, located across the Mekong Delta from the picturesque beaches of the Vietnamese province of the same name, abruptly closed its doors in January 2013. Operated by Sanum Investments, which is having a torrid time in Laos, the casino is closed for renovations, according to the official account.

JAPAN The Key Player

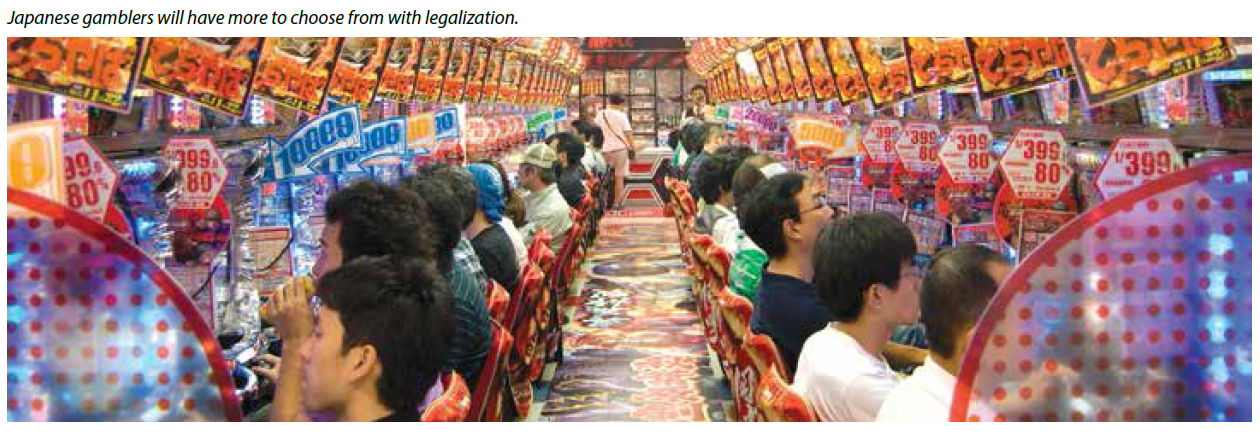

Japan is the story of 2014. The government of Prime Minister Shinzo Abe came to power promising to revitalize the country’s moribund economy with plans that include stimulating consumption through a range of quantitative-easing measures and opening up the world’s third-largest economy to resort casinos.

The initiative to legalize casinos has been led in the Diet by the governing Liberal Democratic Party through a cross-party Alliance for the Promotion of International Tourism. A legalization bill was submitted by the LDP in December and is expected to pass with multi-party support. The talk now is centered on whether it will pass in the legislature’s current session, which runs through June. An implementation bill also is being crafted to define the licensing process and establish a framework for regulating the industry.

Two integrated resorts will be licensed in Tokyo and Osaka and are expected to be similar in size and scope to those in Singapore, and there is talk of two more in regional areas. Officials in Osaka began planning their IR in 2013 in anticipation of the bill’s passage and have spoken to Caesars Entertainment and Genting and are planning to hold talks with MGM Resorts International. The governor of Osaka Prefecture, Ichiro Matsui, who is also secretary-general of the right-wing Japan Restoration Party, has identified a reclaimed island called Yumeshima in Osaka Bay as ideal for a gaming complex and said his government is in discussions to that end with Osaka Mayor Toru Hashimoto. Hashimoto is co-leader of the JRP with Diet member and former Tokyo Governor Shintaro Ishihara.

Once up and running, Japan’s casino industry could become the world’s second-largest, with analysts’ estimates ranging from US$10 billion-$15 billion in annual revenue. Given the country’s heavily urbanized population, level of affluence and propensity to gamble— current avenues include a pachinko industry estimated at more than US$35 billion by analysts, as well as horse racing, lotteries and other forms of gaming—this looks well within reach. Analysts also note the country’s concentration of high net-worth individuals—the largest number in Asia, with a cumulative net worth of US$4.2 trillion— and its strong infrastructure and transport connections. Japan is also close to Beijing and Shanghai, China’s wealthiest cities and major sources of visitors to the casinos in South Korea and Singapore, though recent strained relations with China could affect visitor numbers.

Operators are understandably eager to explore opportunities. In addition to Caesars, Genting and MGM, Las Vegas Sands, Galaxy Entertainment Group, Wynn Resorts, Melco Crown Entertainment and SJM Holdings are all expected to pitch multibillion-dollar resort proposals for Tokyo, Osaka and other major cities. All say they either plan to or are open to joining with Japanese companies. Reports in early 2014 stated that a range of Japanese businesses were lining up to support legalization and to share in the likely spoils. Mitsui & Co., Mitsubishi, Itochu Corp and Fuji Media Holdings have been mentioned as possible partners, together with gaming machine makers Sega Sammy Holdings and Konami.

Supporters are hoping the Tokyo resort will be open in time for the 2020 Summer Olympics there, and Mr Matsui envisions completion of the Osaka resort beforehand. It is also likely, according to analysts, that the major locations could open before the regional ones.

LAOS Stunted Progress

Laos is another Southeast Asian nation that can point to some positive news on the tourism and economic front. Visitors total more than half of the population, with tourism projected to grow by 7.5% for 2013, building on a successful 2012 to become the second-largest industry behind mining. The country is modernizing its economy and has drawn praise from the World Bank for its sustainable development model. Last year saw GDP growth of 8%, moderating to 7.6% in 2014, according to the World Bank. Foreign direct investment has more than doubled since 2011 to US$2.6 billion and is expected to remain around that level. Laos also became a member of the World Trade Organization in 2013.

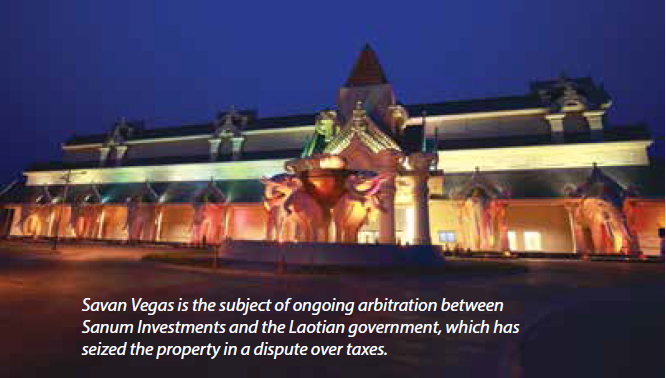

However, in the gaming industry, the country is drawing attention for political issues that have seen major setbacks.

Undoubtedly, the biggest story is still the government’s ongoing dispute with Macau-based Sanum Investments Ltd., which ran the lucrative Thanaleng Slot Machine Club in the capital of Vientiane before the company’s local partner seized control of it in connection with a purported business dispute. This was followed by government allegations that Sanum had falsified gaming earnings for tax purposes at its flagship Savan Vegas casino in Savannakhet, which also has been seized. The government had Savan’s books audited and issued Sanum a tax bill for US$23 million. The company disputes both seizures, and the case is set for arbitration at the World Bank’s International Centre for Settlement of Investment Disputes. Sanum is suing for damages of more than US$500 million over the seizures, which include land for another project in Champassak that has been granted to a company called the Solar Entertainment Corporation in violation, or so Sanum claims, of a 50-year monopoly it says it was granted at the site.

As of this writing, none of the cases had been settled. Savan Vegas continues to operate, presumably under government and/or local partner control.

Sanum is not the only operator to have incurred the government’s ire. A casino called Royal Jinlun in Boten, an area near the Sino- Laotian border, has been closed and the area downgraded from a “special economic zone” to a “specific economic zone” amid stories of kidnappings of Chinese gamblers who had accumulated debts. Reports are that Laotian officials had been pressured to act by China.

Deputy Prime Minister Somsavat Lengsavad has since said the government aims to redevelop the zone to compensate for the lack of employment opportunities in the area and floated its potential as a convention or eco-tourism destination.

But in a further blow to foreign gaming interests, Mr Lengsavad said that no more casino concessions would be granted in special economic zones, despite the fact that the country planned to expand the number of zones from 10 to 29 by 2020. However, this did not seem to affect another license granted before the proclamation to the Lao-Thai group AAC Green City. Their operation, the Naka Palace Entertainment Hotel & Resort on the border with Thailand, an hour from Chiang Rai International Airport, opened with 534 EGMs in 2013.

Another existing property has remained unmolested: the Dansavanh Nam Ngum Casino Resort, with a 6,500-square-foot casino floor featuring 150 EGMs and 60 table games.

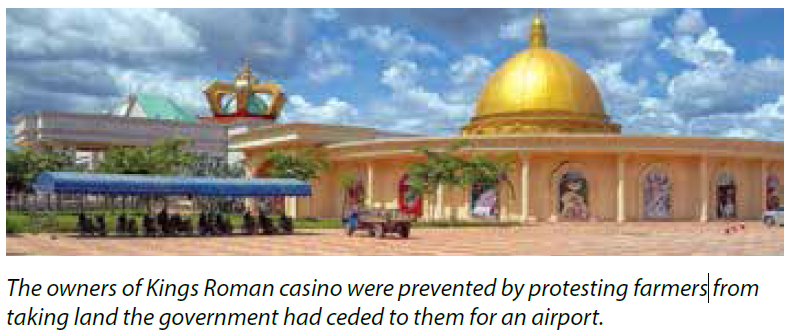

A further major story was related to the Kings Roman casino, developed by a company called Dokngiewkham and part of a 10,000-hectare special economic zone near the Thai border. There has been unrest there, with rice farmers refusing to give up 3,000 hectares of land the government ceded to Dokngiewkham for an airport.

Further developments will be particularly interesting to foreign investors in the context of the country’s WTO membership and the establishment of the ASEAN Economic Community in 2015.

MALAYSIA Steady as She Goes

Rumors of the Malaysian government allowing a second gaming resort in addition to Resorts World Genting have been circulating but have recently been scotched by both officials and the company most thought to be involved, property giant Berjaya Assets. Berjaya is going ahead with a resort development, which it said in December could possibly include slot machines before saying in January that no gaming is planned.

The chief minister of Johor, the state where Berjaya wants to build, said he had not received an application for a casino and would not approve it if he did; further, he said, Johor would oppose any such approval by the federal government.

Berjaya is controlled by Forbes-listed billionaire and Cardiff FC boss Vincent Tan, who is no stranger to gaming. Mr Tan bought Sports Toto, the government lottery agency, when it was privatized in 1985 and claimed in 2010 that another of his companies had been granted a football betting license, which implied that this had been legalized. A furor resulted, and the government withdrew the approval.

In another recent controversy, one of the country’s slot machine clubs faced government censure for doing a deal with a slotlicensed company to lease and relocate its machines outside the club. The incident shone light on what one report called a billion ringgit industry, one in which a handful of government-connected tycoons control hundreds of licenses and have been offering to lease machines from private clubs around the country and relocate them to other venues. In Malaysia, only private clubs are allowed to operate slot machines, and only for members, another condition that had reportedly been habitually broken. Of course, in all venues, the ban on Muslims partaking in gaming remains.

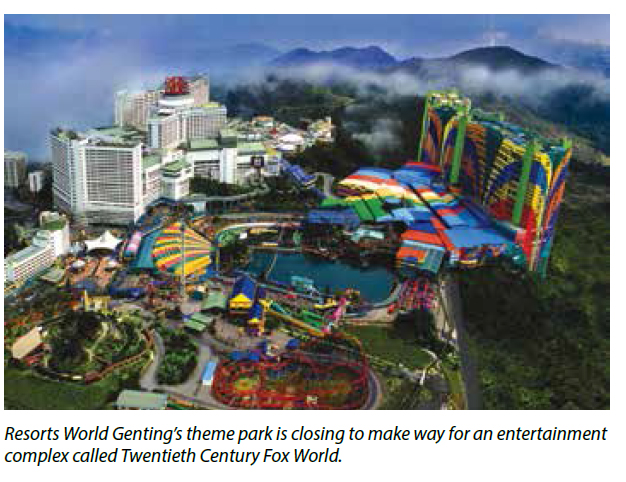

Malaysia’s best-known gaming destination, and only legal casino, remains strong and free from imbroglio. Resorts World Genting continued its strong performance to the end of the third quarter of 2013. The resort, together with a pair of non-gaming tourist hotels in Langkawi and Kijal, account for 67% of the company’s global revenues and 87% of EBITDA. It is one of Asia’s largest, and includes six hotels totaling 10,000 rooms, family attractions, 170 dining and shopping outlets, an 18-hole golf course and MICE facilities. The company has also agreed on a deal for the world’s first Twentieth Century Fox World, to be undertaken with government assistance. Visitation is expected to fall off, though, when the existing theme park is closed to make way for the new attraction.

Malaysia’s tourism statistics are also impressive. To September 2013, the country had attracted close to 19 million visitors, an increase of 3.3% on 2012, which was in turn an increase on 2011.

MYANMAR Tourism’s New Star

The opening up of resource-rich Myanmar since 2011 has drawn much attention. Since the lifting of sanctions, foreign investment has risen from US$1.05 billion in 2011 to $1.4 billion in FY 2012-13 and $1.8 billion in the first five months of FY 2013-14, which has proven excellent news for the government, except for the spike it has caused in the price of already-short office space. In tourism, the country has seen arrivals rise similarly, with a more than 20% increase between 2011 and 2012 showing the desirability of the country as a tourist destination despite ongoing unrest. The government’s current target is for the country to host 7.5 million visitors annually by 2020.

Optimism about consumption growth in Myanmar, however, must be tempered by the caveat that while there are 60 million consumers most are rural and do not even have electricity. On the opposite end of the spectrum, the resource boom has created a wealthy minority. In addition, the country’s infrastructure needs a lot of work, though money is coming in, including from the Asian Development Bank and other multilaterals. Flights now connect directly to Bangkok.

There is already a gaming industry in the country, small as it is. Illegal online gambling exists, but is being tackled through cooperation among regional police forces. Regulating the sector is being discussed as is the legalization of lottery-style scratch cards.

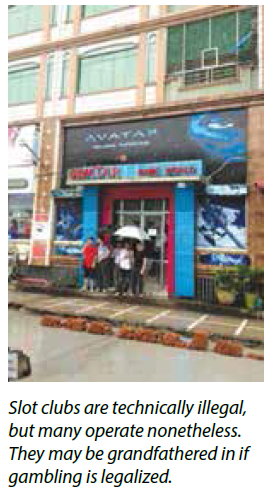

The casino sector is not officially accepted but in practicality is tolerated. Legal loopholes, ownership by influential individuals, operations in semi-autonomous areas such as Shan State bordering Thailand and China, and a short arm of the law combine to mean that about 60 or so gambling venues and a handful of larger casinos go unmolested.

Most of the locations around Yangon are slot clubs, though there are a few high-stakes tables for VIPs. The EGMs tend to be older models, and the scene borrows from the pachinko model, in which prizes are given that can then be sold back to independent vendors located nearby. Gaming establishments in Yangon issue tokens that customers exchange for vouchers that can be converted by independent agents for cash at a discount.

In addition, there are gaming facilities in areas that are known due to insurgency and unrest as the “black zones” as well as around the Andaman Sea. Thahtay Kyun Island in the Andaman Sea near Thailand’s city of Ranong hosts two casinos. The Andaman Club is a Thai-owned golf and casino resort set on 730 hectares with EGMs as well as roulette, blackjack, baccarat and poker. Treasure Island Casino, the largest gaming establishment in the country, is located nearby and also offers EGMs and tables.

The other major center is Tachilek on the Thai border with several openly run casinos. They include the Regina Hotel Casino with 12 tables and 30 machines; the Maekhong River with two floors of gaming; the Allure Hotel with an estimated 200 machines; the Golden Triangle Hotel with 80 EGMs and 15 tables; and Las Vegas and the Aka, with only EGMs. An estimated 10 underground casinos are also active in the area. Other border areas also host casinos and deal in currency depending on where they are.

The industry in its current form is highly profitable, demonstrating strong underlying demand both from locals and those in neighboring countries. Not surprisingly, the government is pursuing the establishment of a more formal and regulated gaming sector. While there is no set plan yet, the government is undertaking preliminary research by examining different options and looking closely at experiences with gaming elsewhere in the region, specifically in Cambodia, Laos and Vietnam, as well as Singapore and Macau. And according to a source with knowledge of the process, while tax revenue is one of the major factors, the primary motivation is to boost tourism. The catchment area is expected to be similar to others and might cannibalize Cambodia’s own industry.

The country looks likely to follow Cambodia and Vietnam in restricting access to foreign passport holders. It is also believed that the government will institute a two-tier licensing system: one for small and medium-sized establishments, essentially allowing the existing operations to be grandfathered in, and one for large-scale casinos, enabling the development of integrated resorts restricted to certain designated areas in the country.

The formalization of legal gaming is not expected to be without hurdles, however. Like Thailand and Sri Lanka, Myanmar is a predominantly Buddhist country, and Buddhism tends to frown on gaming, as Sri Lanka’s government is finding out. In addition, the country’s parliament will likely need to make gambling debts enforceable, as collecting would appear to contravene a law dating back to the 19th century; perhaps less a very high hurdle in itself than a symbol of how much remains to be done.

THE PHILIPPINES Continuing Promise

Last year was a big one for the Philippines gaming industry. Not necessarily in its overall results, as encouraging as they were, but in the sector’s developmental politics as it becomes what is hoped will be a destination to rival Singapore. Investigations continue into the dealings of Kazuo Okada’s Universal Entertainment, a controversial tax ruling has injected uncertainty into the country’s emerging resort casino industry, and the old year was seen out with a high-profile spat between Bloomberry Resorts Corp., owner of Manila’s new Solaire Resort & Casino, and the property’s former operator, Global Gaming Asset Management.

Universal appears to have resolved its difficulties with finding one or more local partners to meet local ownership requirements for its Manila Bay Resorts development, which is slated at some point to join Solaire as one of four large-scale gaming complexes licensed for the government’s new Entertainment City complex in the capital city. After discussions with several groups, Universal finally inked deals with local developers Century Property Group and First Paramount Holdings 888 to join it on the project. Universal’s Philippines subsidiary, Eagle I Landholdings, has been accused of selling stakes to dummy companies in order to circumvent the government’s 40% local ownership requirement. The case was still being investigated, as of this writing. Bribery allegations have also stalked the company but have not resulted in any legal action to date.

Further drama was created by the September rift between Bloomberry and GGAM. Reports suggest that the former accused the latter of not doing enough to lure the Chinese VIP segment to Solaire, which opened last March as the first of the Entertainment City resorts. Bloomberry cancelled its 8% equity partner’s operating contract and replaced Solaire COO Michael French with ex-Marina Bay Sands chief Thomas Arasi. GGAM has taken the case to arbitration in Singapore, where it remains pending. GGAM also attempted to sell its entire stake in Bloomberry, worth about US$165 million at recent prices. Bloomberry requested a temporary injunction against the sale, which was granted late last month.

Taxation continued to command a place in the spotlight. Following a 2012 decision affirming the liability of PAGCOR, the government’s casino operator, to pay the country’s 30% corporate tax, the Bureau of Internal Revenue last April said the tax also applies to the rest of the industry. Philippine casinos currently pay a 15% levy on VIP gaming revenue, 25% on mass-market and a 5% “franchise fee”. Share prices predictably fell in the wake of the announcement. PAGCOR later indicated its willingness to help shoulder the burden of the extra tax; however, no resolution has been forthcoming on this or on the question of whether the tax will apply prospectively or retroactively.

PAGCOR’s results for 2013 were flat, totaling PHP40.52 billion in revenues (US$834 million), marginally down from 2012’s PHP40.88 billion but still enough to make it the government’s third-largest source of revenue. PAGCOR predicts 2014 revenue will rise to PHP45.47 billion partly due to increased regulatory fees as Entertainment City continues to come online. The company did, however, close one of its 13 Casino Filipino venues and plans to close another this year.

Fitch Ratings is bullish on the Philippines’ prospects, forecasting that the island nation’s share of the global gaming market could grow from an estimated 3.3% currently to 5% in the next three to five years, fueled by “robust domestic demand,” the country’s positioning as a “low-cost tourist destination,” and the development of Entertainment City.

Fitch pegs gaming revenues at around US$1.4 billion currently and projects a 12% annual rate of growth through 2020 to more than $3.3 billion, despite potential obstacles such as the taxation issue. The firm says that even in the event of tax increases the country is still a low-cost operating environment.

Entertainment City is, of course, the major positive. Solaire, despite its operational issues, posted a profit of PHP165 million (US$3.6 million) in the third quarter, a sharp increase from the previous quarter’s 22.7 million. Gaming revenue was up from PHP3.89 billion to 4.87 billion. Bloomberry is spending US$480 million on the property’s second phase, which is slated to include a second hotel with 308 rooms and suites, more restaurants, an array of high-end retail outlets and entertainment facilities. Its completion will bring the total cost of the resort to US$1.2 billion.

City of Dreams Manila remains on track to open this summer as the second Entertainment City IR. Melco Crown Entertainment’s Philippines subsidiary has partnered with the country’s richest man, retail and property tycoon Henry Sy, on the US$1.3 billion resort, which will feature 1,680 rooms and suites, 1,900 EGMs, 365 table games and a range of non-gaming attractions.

In January, Melco announced that it will have a Nobu hotel at the site, the luxury US hospitality chain’s first in Asia. In addition, it said it was raising its investment in the project to US$680 million, with a chance of increasing it further as other brands come on board. Co- Chairman Lawrence Ho was quoted as saying that the country’s gross revenue could easily double to US$4 billion in two years, closing on Singapore’s $6 billion.

Universal’s Manila Bay Resorts and Travellers International Hotel Group’s (a Genting Hong Kong-Alliance Global joint venture) Resorts World Bayshore will fill out Entertainment City over the next several years. Travellers’ will-they-won’t-they IPO on the Philippines Stock Exchange was also the subject of some attention in 2013. In December, it said it was still looking for cornerstone investors.

The partnership’s existing casino, Resorts World Manila, is still going strong. In the first half of 2013, revenue was up 31% to US$468.9 million and EBITDA was up 40% to $109 million year on year, while daily visits were up 12% to 18,600. Travellers plans to spend $600 million over the next three years to expand the number of hotels as well as to add gaming facilities.

SINGAPORE Still Healthy

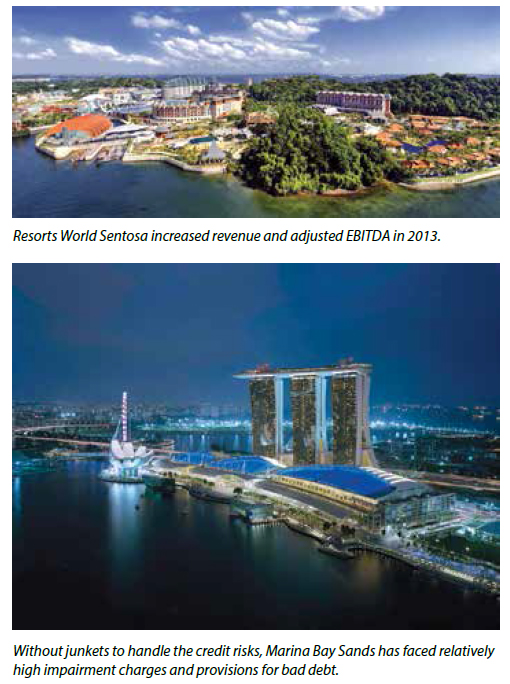

While much of the talk about Singapore has focused on slowing growth, both Resorts World Sentosa and Marina Bay Sands saw healthy year-on-year increases in the third quarter. Revenue and EBITDA at Sentosa increased by 17% and 15%, respectively, to S$776.4 million and $348.3 million, while MBS generated adjusted property EBITDA of US$373.6 million and gaming revenue of $628.1 million, increases of 43.3% and 33.4%, respectively.

The trend did not continue for MBS, however, which closed out the year with gaming revenue down 8.2% and adjusted EBITDA down 14.4%.

While luck has played a role in the results, the figures continued an overall downward year-on-year growth trend market-wide that began in the second quarter of 2011, leading one analyst to categorize the market as “flattish and boring”.

On the plus side, the range of attractions on offer in each resort has led to sound growth in non-gaming revenues, ensuring that both will remain highly profitable enterprises despite the apparent plateau in gaming revenue.

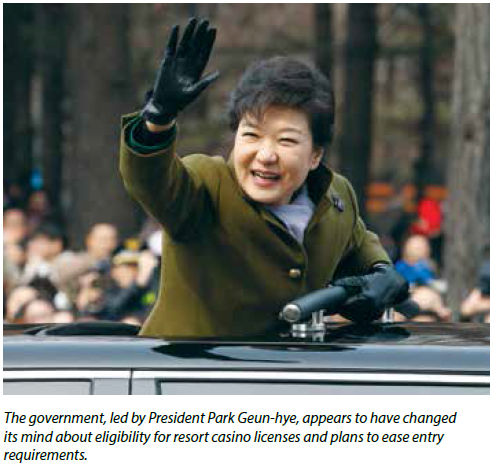

The main concern on the gaming side is with the VIP segment. The government remains antipathetic to junkets, and this has kept VIP volumes low relative to other jurisdictions and volatility correspondingly high and forces the casinos to shoulder the credit risks. Given that many of the high rollers come from China, where gambling debts are not legally enforceable, it’s a sizable problem.

The government currently has licensed only three junkets, none of them Macau-based, and restricts their services. Junkets active in Macau would certainly work with Singapore’s casinos in order to offer their clientele a greater choice of venue and also potentially to partake in the greater incentives enabled by the city-state’s much lower tax rate on VIP play—12%, which includes 5% on the gross and a 7% goods and services tax—versus 40% on the gross in Macau.

Even without junkets, however, mainland Chinese players account for about half the rolling chip volume at both MBS and RWS. Not surprisingly, this has led to the IRs being saddled with relatively high impairment charges and provisions for bad debts. The Singapore government has not given any indication that it will loosen restrictions on junket operators and may impose stricter regulations covering VIP gaming this year, such as requiring players to draw down their entire qualifying deposit of S$100,000 before credit can be extended to them and imposing higher fines on junkets for regulatory violations.

Despite these challenges the outlook for the VIP sector appears decidedly more robust than that of the mass market. According to analyst Grant Govertsen at Union Gaming Research Macau, the mass market will remain soft for the foreseeable future. While there is scope for mass margin improvement, he believes the casinos’ current efforts to acquire more premium-mass customers will have little near-term impact, with market penetration already high.

Indeed, daily visits by locals have dropped, according to the government’s Casino Regulatory Authority, and initiatives to curb problem gambling and local visits in general are working as intended. Only 7.7% of the local adult population made more than one visit to the casinos in the past three years, the CRA said in its 2012/13 report.

Tourism figures, however, are up. According to the Singapore Tourism Board, more than 12.9 million international visitors arrived to October 2013, an 8.4% year-on-year increase similar to the growth in non-gaming revenue at both resorts. Given that revitalizing the flagging tourism industry was the government’s primary stated objective in legalizing casinos, the two resorts appear to be doing their job.

And with annual hold-adjusted EBITDA at Resorts World Sentosa looking close to the billion-dollar mark, and Marina Bay Sands well above, there isn’t much cause for too much dissatisfaction. And the duopoly will remain in place for some years, with no license revisions due until at least 2017. Thus, if return on investment is a key consideration in assessing a property’s success, Singapore’s plateau is still quite positive.

SOUTH KOREA Change of Heart

South Korea’s government, led by President Park Geun-hye, has not been in office long, but has already had time to do what appears to be an abrupt about-face on the requirements for new casinos. And with a market geared towards Chinese tourists, proximity to areas with little penetration by Macau, and talk of liberalization, the possibility of eased restrictions is generating plenty of interest.

The gaming sector is geared towards tourists, and the fastestgrowing segment of the tourist market is Chinese, which has quickly drawn level with the number of Japanese visitors and is poised to overtake it. Of Asia’s major gaming destinations, South Korea receives by far the largest number of Japanese visitors and is second-most popular for Chinese, behind Macau.

With the government looking to encourage both tourism and foreign investment, it announced a plan in July 2013 to invest a total of US$72 billion in the development of eight “Free Economic Zones” by 2022, with a long-term goal of attracting as much as $20 billion in FDI. Destination-scale casinos are viewed as an important plank, and to attract both foreign and domestic developers, the government is prepared to provide a friendly tax and regulatory environment sweetened with other incentives.

One of those eight zones—Yeongjongdo, near Incheon—has been set aside for casino development. It is considered a key to this effort because of its proximity to China. Official plans call for the licensing of up to five resort-scale casinos over the next decade or so, though to date the government has approved only one: a joint venture between Paradise Group, one of the two operators that dominate the country’s foreigners-only market, and Japanese pachinko giant Sega Sammy Holdings. (The country’s other major operator is Grand Korea Leisure, a semi-private entity with several properties under the Seven Luck name.)

Paradise and Sega Sammy plan to open a US$730 million integrated resort at Incheon that will dwarf all of the country’s current casinos in terms of size and attractions. It is slated to open in phases beginning in 2016 with two hotels, a theme park, a convention center and a casino featuring 450 table games at full build-out.

Elsewhere, progress has been mixed. A highly ambitious development—all of US$290 billion worth—in Yeongjongdo, called EIGHTCITY, was scrapped last year due to lack of funds by one of the principal developers, although there is talk of reviving it on a more realistic scale, and the government rejected a joint-venture resort proposal by Caesars Entertainment and Indonesia’s Lippo Group and a proposal by Kazuo Okada’s Universal Entertainment. Caesars’ debt problems were widely seen as the reason for their rejection, while Universal’s legal problems in the Philippines and elsewhere may have contributed to its lack of success.

However, as the new year unfolded, the government seems to have realized that its requirements were too onerous. January whispers of easing standards looked to have been confirmed in a statement by President Park in early February affirming her belief in tourism as a key to economic growth, and reports now say the government will ease requirements on foreign investors interested in developing resorts.

The news appeared to have been anticipated. In December, it was reported that Caesars and Lippo had made a fresh pitch for a US$2 billion resort covering 330,000 square meters in Yeongjongdo. In January, it was learned that Universal had bought property in Yeongjongdo. A third potential player, PNC Financial Services, a US bank, reportedly has proposed an integrated resort with a casino pegged at $6.5 billion.

Currently, the country’s foreigners-only market generates around US$930 million annually from 16 relatively small casino hotels serving mostly Japanese and Chinese players. There is also one large and lucrative casino, Kangwon Land, in the remote northeast of the country that is open to Koreans—it generates in excess of $1 billion annually, more than the others combined, despite its location and various statutory limits on bet sizes. Its exclusive right to serve domestic gamblers expires in 2025, and it’s speculated the government will license at least one new casino for Korean nationals by then.

Offshore, there is Jeju Island, which has emerged as a major hotspot for Chinese visitors, offering plenty of scenery, visa-free entry and casino gambling. According to a 2013 Goldman Sachs report, “The pace of growth in number of visitors and gaming revenues of casinos in Jeju is three to four times higher than what we see for overall foreigner-only casinos in Korea. While the total number of visitors to casinos in Korea increased to 2.4 million persons in 2012, up by 13% year on year, visitors to casinos in Jeju increased to 227,000, up 45% year on year. Gaming revenues are also rising at a fast pace in Jeju with aggregate sales of eight Jeju casinos increasing by 55% vs. 11% year on year for total gaming revenues of foreigneronly casinos in Korea for 2012.”

Malaysian conglomerate Berjaya is currently undertaking a large development on the island that includes a casino. Priced at US$2.5 billion, it is the most expensive foreign-developed project in Korea to date. One downside for the foreigners-only market is the imposition of a 4% “consumption tax” which kicks in this year. The government is also proposing an additional 10% leisure tax on Kangwon Land to raise funds for infrastructure development in its host Gangwon province, which will be the site of the 2018 Winter Olympics. If that measure proceeds it’s possible a similar tax will be imposed on the foreigners-only casinos.

SRI LANKA A Tricky Mix

Plans to introduce resort gaming to Sri Lanka have been mired in the country’s fractious domestic politics, with legislation to allow two large developments appearing inevitable, then delayed, then watered down.

Since the defeat in 2009 of a bloody insurrection by the island’s Tamil minority that raged for 25 years, the government of President Mahinda Rajapaksa has worked assiduously to present the country as a viable destination for tourists and foreign investment. The government in 2011 released a five-year tourism development strategy that envisions the sector as the nation’s primary foreign exchange earner. The targets are for 2.5 million tourists per year by 2016, at which point the government hopes to have attracted US$3 billion in tourism-related FDI and foreign exchange earnings of US$2.75 billion. Overseas visitors numbered 1.27 million in 2013, in line with the target, with India providing the most with more than 200,000. Chinese visitors numbered only 54,000 despite a China road show by the government promoting the country as a destination. The target for Chinese visitors is 275,000 by 2016.

Just where all the future tourists will stay, however, is an issue—which in large part is why casinos figure prominently in the government’s plans. Currently, only about half of the government’s target of 45,000 hotel rooms exist, and while there are several major hotels on the drawing board it’s not known how many will actually get built.

The country’s existing casino market consists of a handful of small tourist-only clubs in hotels, most located in and around the capital of Colombo. At the government’s urging the parliament in 2010 passed legislation—the Casinos Business (Regulation) Act—that recognized the clubs; however, it did not license them; and no regulatory framework exists. Police actually shut down two clubs last year.

There certainly exists an appetite for gambling, though just how large is difficult to quantify. KPMG in a recent study estimated that US$60 billion was wagered in the Indian subcontinent in 2010, most of it through various black markets, and it’s with an eye on India that James Packer’s Crown Resorts is seeking approval for a casino as part of a US$350 million, 400-room resort the company wants to build in Colombo in concert with local partner Ravi Wijeratne, owner of Rank Entertainment Holdings, the biggest operator in the existing casino market. John Keells Holdings, the country’s largest public company, is planning an 800-room resort in the capital priced at $650 million. Both projects will feature an array of dining, shopping, entertainment and leisure attractions and significant conference and meeting space.

Things have not proceeded smoothly, however. Both the opposition United National Party and the country’s powerful Buddhist clergy have problems with Mr Rajapaksa’s pro-casino stance. As a result, generous tax breaks for the Crown and John Keells projects have gone by the boards, and the government has emphasized that casinos will open only to foreign passport holders and will be restricted to special tourism zones. Legislation passed in December approving Crown’s plan made no mention of a casino and implied no permission to operate one. The company says it is hopeful of getting that approval, possibly by transferring one of two casino licenses held by Rank.

International problems have added to the government’s political problems at home. There have been threats of sanctions over possible war crimes in the conflict against the Tamils, and India and Canada boycotted a Commonwealth heads of government summit held in Colombo late last year over the issue. India is a country whose gaming demand Sri Lanka is hoping to draw on.

The summit was not all bad news for Sri Lanka. At a concurrent Commonwealth Business Forum, the country was able to ink agreements with China worth billions of dollars in investment to improve the island’s infrastructure, including a port city near Colombo and hotel developments to add to the transport and energy infrastructure projects already undertaken by Chinese companies. The deals underscored both Sri Lanka’s dependence on foreign expertise and investment and its importance to China as a counterbalance to India’s influence in South Asia and the Indian Ocean.

TAIWAN Ambition and Uncertainty

Taiwan is seeing more than its share of political wrangling related to the proposed development of a gaming industry. Millions of mainland Chinese are only a short trip away, and the potential windfall this could bring is the main driver of the island nation’s strategy. However, exactly where casinos could be located has been the subject of both domestic politicking and potentially ominous words from the mainland government.

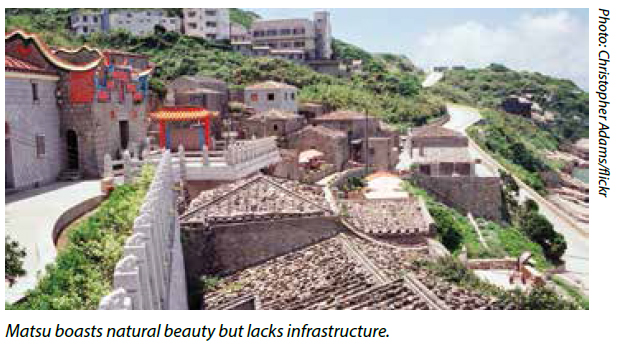

Gaming was authorized by the Offshore Islands Development Act, which was passed in 2009 to allow residents of the Matsu, Kinmen and Penghu archipelagos in the Taiwan Strait to vote on legalizing casinos with a view to attracting tourism and generating growth. Matsu voted in favor of them in 2012, the only archipelago to date to do so. Last May, Taiwan’s cabinet approved a draft bill for regulating the industry on the islands that approve them.

So far, only one developer has stepped forward with a specific plan: Weidner Resorts, a company founded by former Las Vegas Sands President William Weidner. Weidner envisions a veritable resort city for Matsu to open in phases with gaming as the anchor for a cluster of hotels, residences and leisure attractions designed to bring 5 million to 7 million visitors to Matsu a year. The current price tag is $2.5 billion, a good portion of which is earmarked to bring the islands’ primitive electrical, water treatment and transport infrastructure into the 21st century. There would also be a university to train staff, and locals would be paid a monthly stipend. The first phase calls for 2,000 hotel rooms and an array of entertainment and leisure attractions. Mr Weidner predicts 1 million visitors in his first year of operation and 4.5 million after five years, 70% of them from mainland China. Currently, Matsu hosts about 100,000 visitors a year, only about 7,500 of them from China. Given the transportation and infrastructure needs, it’s estimated that 2019 would be the earliest the resort could open.

The company has reached across the Taiwan Strait to sell officials of China’s neighboring province of Fujian with its 37 million inhabitants on the wisdom of joining forces, and a preliminary agreement has been reached with Hong Kong ferry operator Chu Kong Passenger Transport for a service between Fujian’s capital of Fuzhou and Matsu. Mr Weidner has reportedly also gained Fuzhou officials’ support for the development of a supporting tourist hotel near the city, whose 4.4 million residents, together with the 5 million or so living around Xiamen to the south, are considered key to Matsu gaming’s success.

However, late in 2013, the mainland government invoked a clause in the 2008 Cross-Strait Agreement between the two governments that forbids travel agents and tour groups from organizing gambling trips from the mainland or involving its citizens in gambling activities. The National Tourism Administration holds to a similar position, and this was affirmed last year when the question of Matsu was broached with a spokeswoman for the State Council’s Taiwan Affairs Office.

This threw developments into confusion. Taiwan’s pro-casino Minister of Transportation Yeh Kuang Shih has since suggested that it would make more sense to allow gaming on the main island to take advantage of the large population in and around the capital of Taipei, and some legislators have proposed foreigners only casinos for a number of special economic zones, the main one being the Taoyuan Aerotropolis complex at Taoyuan International Airport. Terry Gou, head of Foxconn Technology Group and one of Taiwan’s wealthiest citizens, suggested earlier in 2013 that a special casino enclave be developed near the capital, but Premier Jiang Yi Huah described the proposal at the time as “problematic”. Officials on Matsu are concerned they’ll lose out and strongly oppose casinos on the main island, an idea that also has encountered significant public and political opposition. At the end of last year, a committee of the Legislative Yuan struck out 83 of the 114 articles contained in the draft regulatory bill and reaffirmed their support for restricting casino development to the outlying islands.

A final bill is expected to be approved this year. What it will end up containing isn’t known. It’s believed the casino tax regime will not be unfriendly: an effective 14% initially, composed of a 7% “franchise fee” that gradually increases after 15 years and a local government tax capped at 7%. There had been talk of a 20% tax on winnings, which wisely was scrapped. Some Singapore-style restrictions are expected to be imposed on gambling by Taiwanese. The rules are expected to come in somewhere between Macau and Singapore in their receptivity to junkets.

Pro-casino forces, meanwhile, are marshaling their resources for another try at Penghu, where an Isle of Man-based company called Claremont Partners owns 27 acres on which it wants to develop a gaming resort. Some better-known industry names, SJM Holdings, Caesars Entertainment and Jimei Group among them, have scouted sites on Penghu and Kinmen and have met with local officials.

VIETNAM Looking to a Larger Market

Vietnam is continuing its solid record of economic growth from the past decade. Though the pace has moderated somewhat, growth over the past 10 years has varied from 5.2-7.5% and is expected to remain above 5% through 2018, according to the International Monetary Fund. Government stimulus measures have supported growth in recent years. Macroeconomic indicators alsoshow stabilization in recent years, according to the World Bank, though not without challenges brought on by both internal and external structural issues.

The country is also growing as a tourist destination. The number of international visitors increased 11% last year, according to official statistics, totaling more than 45 million and good for an estimated US$10 billion in revenues.

The country’s seven casinos are growing revenues at a robust annual average of 10-15% a year, according to the Finance Ministry. They paid VND1.5 trillion in total taxes (US$72 million) in 2011.

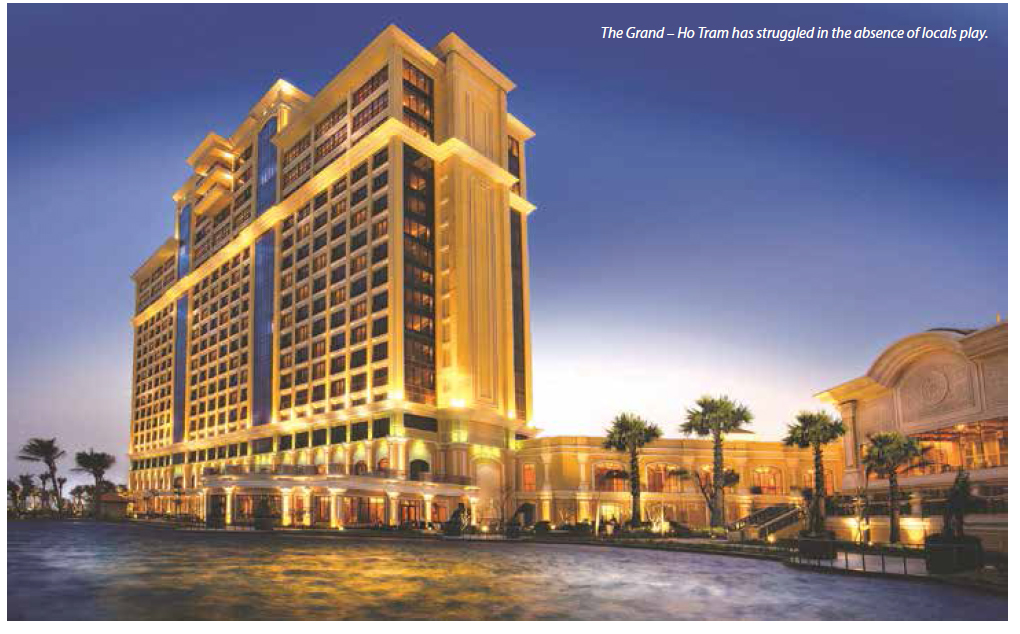

The attention now is on whether the government will end its prohibition on play by its citizens, an issue that has come to loom large in the wake of the opening of The Grand – Ho Tram, which has struggled on the casino side since debuting in July on the South China Sea coast about 90 kilometers from Ho Chi Minh City.

The country’s largest and most luxurious resort, Ho Tram features 541 rooms and suites, 90 gaming tables and more than 600 slots and EGMs. The Vancouver-based investment group behind it, Asian Coast Development Ltd, has plans for much more. Construction has already begun on a second phase, with 559 hotel rooms and 14 villas to open in 2017, along with a second casino that will bring the development to Vietnam’s legal limit of 180 live tables and 2,000 slots and EGMs. US casino operator Pinnacle Entertainment, a major investor, will manage it. The 164-hectare site is configured for three more hotels or some variation, with high-end residential and/or luxury time-share mentioned as possible parts of the mix.

The resort’s challenges are sizable, though, in the absence of locals play, principally because its location, while scenic, is difficult to access from Ho Chi Minh and the city’s international airport.

But even with the ban, Vietnam’s potential as a tourist destination continues to attract interest. Rose Rock Group, an investment vehicle backed by the Rockefeller family, is partnering with Vietnam’s Vung Ro Petroleum Co. to develop a 200,000-square-meter site on Vung Ro Bay on the south-central coast with 760 hotel rooms, 4,400 residences, retail shopping and 350 marina berths. There was no initial word on

whether the resort would include gaming, but the timing suggests a distinct possibility. VinaCapital Group, the country’s largest fund manager, is planning to build a $4 billion casino resort in Quang Nam province, also on the south-central coast, and says it has secured a partner for the project to replace Genting, which pulled out a while back. Vina also owns a beach resort in Da Nang.

Aside from Ho Tram, the existing market consists of about 500 slots and EGMs and upwards of 75 table games, all located in tourist hotels, some of which, like the Crowne International at Da Nang Beach and the Do Son and the Royal Hotel and Villas on picturesque Halong Bay, are marketed to an international clientele.

The Chinese borderlands have also proven lucrative. Mong Cái in Quang Ninh province in the northeast boasts a recently opened casino. Three hundred kilometers from Hanoi in the northwestern mountains adjoining China’s Yunnan province is one of the largest slot floors in the country, in the Lao Cai International Hotel, controlled by relatives of Genting Group Chairman Lim Kok Thay. Another resort, the Ratana Casino Resort which is said to be under Korean management, is reported to be opening in Ratanakkiri on the Cambodian border in March. The resort will feature 60 table games, 60 EGMs and 80 hotel rooms.

Nationwide, another 740 or so EGMs exist in more than 20 clubs.

The key to the industry’s future is whether locals will be able to access the market. The latest news on this front concerns the development at Halong Bay, in which the government plans to allow locals to gamble as part of a pilot project, though the timing and investment parameters are unclear. Certainly the appetite for gaming exists, given the huge numbers of Vietnamese patronizing NagaWorld and the Cambodian border casinos. Legal pari-mutuel betting takes place at a horse track in Ho Chi Minh City and more recently at a greyhound track in the coastal province of Ba Ria-Vung Tau, where Ho Tram is located. There is also a popular public lottery whose sales account for about 2.5% of gross domestic product. The Internet is illegally taking tens of millions of dollars in wagers annually, according to official estimates; this constitutes a vast black market the government says it wants to shut down.

THE OTHER PLAYERS Mixed Developments

While their developments may not be as newsworthy as some, other countries around the region have provided some news that bears noting. In Thailand, a report by the prestigious Chulaongkorn University says the country should make its play for a share of Asia’s gambling boom by legalizing casinos. The report argues that Thailand’s antiquated gambling laws are leaving it behind while several Asian markets, notably Japan, Taiwan and South Korea, are preparing to legalize or expand.

In Nepal, the government continues to try to regularize licensing and tax collections in the small casinos catering mostly to Indian players. The casinos have mostly ignored an order to renew their licenses. The Nepal Recreation Center had its permit revoked in 2011 but continued to operate into 2013. The government has also passed new regulations that include the doubling of entry fees for locals, and at least one casino, the Pokhara Grande, has closed, blaming the elevated fees. At last report, others were expected to follow.

This might prove a further fillip for India, whose small market in Goa continues to flourish in the face of official ambivalence and some significant community opposition. The size of the market is difficult to determine precisely. Official numbers place it at the equivalent of US$145 million-$165 million a year. But those close to it say the real numbers are much higher. If taxes and fees are any indication—the casinos in total paid the equivalent of $43.6 million to the state in the 2012-2013 financial year—they would be correct.

The bigger news is the scheduled opening this year of a major resort in the nearby state of Daman. Hospitality and property development giant Delta Corp., Goa’s largest operator, is behind it. The 60,000-square-foot resort will include a 187-room hotel. Delta also has its sights on Sri Lanka and is seeking partners for land it controls in Colombo.

In the Pacific, gaming is still discussed around the Marianas. Saipan’s economy has been hit hard by falls in tourism and the closure of its textile industry, and its sovereign wealth fund is almost depleted. It has discussed opening up to gaming, but the consensusis that its location makes it impractical as a major destination, and the government is