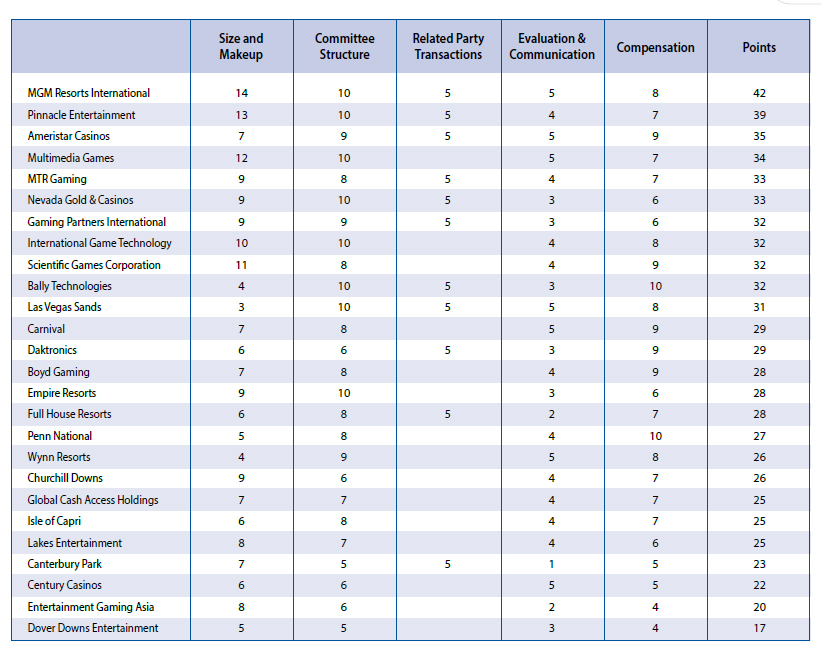

This year’s ranking of gaming’s best boards emphasized diversity, clearing the way for MGM Resorts to capture the top spot

By Keith Kefgen & Juliette Boone, AETHOS Consulting Group

What value do you place on diversity in the workplace? Well, when it comes to company boards and corporate governance within the gaming industry, it can mean the difference between a business with good PR that is operating on all cylinders and one with a bad public image that is just sputtering along.

AETHOS Consulting Group evaluates corporate governance practices and, in partnership with Casino Journal magazine, has determined and reported on the gaming industry’s top boards for more than a decade. This annual study closely examines board makeup, independence, committee structure and executive pay-forperformance in determining a governance score for each company. As in past years, this gaming board ranking explored the following five areas of corporate governance

• Size, makeup, independence and diversity of the board;

• Committee structure, number of meetings and effectiveness;

• Extent of related party transactions;

• Board self-evaluation and communication; and

• Pay-for-performance models for board and executive pay.

There is one difference from previous studies, however: this year’s report emphasizes the importance of diversity at the board level, and we have given it added importance in our scoring system. For longtime readers of this study, that means the top point total a company can reach is now 45 points.

Another item to keep in mind with this year’s report: corporate consolidation narrowed the playing field in this year’s study. In total, 26 companies were evaluated, a decrease from 32 in last year’s February 2014 | INSIDE ASIAN GAMING 39 In Focus analysis. Scientific Games bought WMS Gaming, Bally Technologies gobbled up SHFL entertainment, GameTech reorganized, and so on.

MGM Rises to the Top

Fewer participants does not detract from the noteworthy performances of some gaming boards this year. Indeed, MGM Resorts International took the top spot in this year’s study, moving up from third place in the prior year and eighth place the year before that. We were impressed that MGM had a section of their proxy statement related to board diversity and their rationale for board composition. In fact, MGM was the only company to do so. MGM Resorts has set a new standard for excellence in corporate governance practices, and we applaud James Murren and the entire MGM board of directors for their diligence in corporate governance.

Pinnacle Entertainment also had a strong move in governance standards, rising to second place from ninth in the prior year. Other companies appearing in the study’s top five rankings include Ameristar Casinos (third), and MTR Gaming and Nevada Gold & Casinos (tied for fifth).

On the gaming vendor front, Multimedia Gaming was the top finisher, placing fourth. Table games supplier Gaming Partners International was tied for sixth place with machine giants International Game Technology (IGT), Scientific Games and Bally Technologies, all scoring 32 points.

Size and Makeup

The examination of chairmanship in gaming demonstrates that two-thirds of companies continue to have a chairman who is not considered “independent.” In one-third of these companies, the role of lead director has been assigned to a completely independent board member.

A step in the right direction; but we would like to see a complete separation of chairman and CEO responsibilities. Half of the companies had boards comprised of an odd number of directors; between five and 11, a range that experts consider to be optimal. This percentage was unchanged over last year, although we anticipate an improvement in this area in 2014 based on several companies, such as Carnival, decreasing their board size.

Other aspects of board make-up include the number of truly independent vs. insider members (half the companies had boards comprised of 25% or fewer insiders) and length of term (just over half of the companies put the entire board up for reelection annually vs. staggering elections).

As previously stated, we added a section on board diversity. Companies received points for having a formal policy around gender and racial diversity, policy implementation and diversity representation on the board. We believe that board diversity is socially responsible as well as good for business.

Committee Structure

The Securities and Exchange Commission requires public company boards to have the following four committees: audit, compensation, governance and nominating. Like the prior year, six companies achieved a perfect score in this category. The number of committee meetings remained virtually unchanged, with an average of one fewer audit committee meeting and one more nominating and governance committee meeting. These committees play an important role in making sure management acts appropriately and in the best interests of shareholders. Much can be gleaned from the committee reports that are required in proxy statements.

Insider participation on subcommittees of the board has virtually disappeared, with only two of 26 companies having an insider sitting on a committee compared with six out of 32 companies last year. This trend shows a commitment to maintaining objectivity and keeping shareholder interests at the center of decision making.

Transactions with Related Parties

The category “transactions with related parties” examines where conflicts of interest may arise due to a company insider or board member conducting business with the company in some other way. If any related party transaction is present, the company receives zero points for the category. Only eleven out of the 26 companies had a perfect score in this area. Although most of these “related transactions” were done at “market prices,” shareholders are a skeptical bunch. It appears that most companies are communicating these transactions to shareholders and that is a good thing.

Evaluation and Communication

Issues concerning the effectiveness of internal board operations, director evaluation and accessibility to shareholders were measured in the evaluation and communication area. Seven of the 26 companies received a perfect score in the overall category, equating to the same percentage as last year. We reiterate that boards that measure their own performance as well as strive for and welcome two-way communication with shareholders will see an increase in their stock multiple and shareholder loyalty.

Pay-for-Performance

Average scores in the area of director and named executive officer compensation remained unchanged from last year. Evaluation of payfor- performance models includes consideration for clear articulation of compensation philosophy and incentives, stock ownership guidelines, incorporation of a claw back policy, and absence of excise tax gross-ups and excessive perquisites.

While we hoped to see upward trends in improvement in this area, we are optimistic that as shareholders continue to more publicly voice opinion on the matter of compensation and watchdog agencies continue to apply pressure in this area, scores will tick upward. In this year’s study, two companies of the 26 achieved perfect scores in pay-for-performance.