Macau needs Hengqin. Badly. The city doesn’t have enough hotel rooms for its millions of visitors and has no more unclaimed or undeveloped land for building them. Hengqin has plenty of both.

“Visitation to Macau in recent years, quarters, has trailed that of the growth in betting. It’s betting that’s gone up fast over and above visitation. And that’s not a healthy trend.”

Philip Tulk, director of equities research, Standard Chartered Bank

Macau officials expect at least 5 million more tourists will make their way to the SAR from the People’s Republic as commercial and residential development picks up steam on neighboring Hengqin Island. The first wave of them will be appearing in the weeks ahead when a “Chinese Disneyland” replete with theme park, thrill rides and the first of a dozen planned hotels opens there.

More important than the tourists for Macau’s near-term purposes are the hotel rooms, and there are 1,880 of them as part of this project—Chimelong Group’s RMB10 billion (US$1.64 billion) Hengqin Bay Hotel and Ocean Kingdom, which towers over an ancient oyster fishery along Fuxiang Bay at the southeastern tip of the island and whose attractions include the largest roller coaster in China and a 24,000-cubic-ton aquarium billed as the largest in the world. Some of this is supposed to open before the end of the year, possibly this month, as the first phase of a RMB20 billion-plus mega-entertainment and leisure complex— Chimelong International Ocean Resort— that is conceived along the lines of a Chinese Orlando and which in addition to the hotels will feature an array of theme parks with names like Safari Zoo, Global Garden, Bird’s World, International Ocean Theatre and Mountaintop Paradise. The whole thing will cover five square kilometers. Plans include three 18-hole golf courses, shopping malls, convention and meeting facilities, a yacht club or two and scenic rides on elevated cable cars.

Chimelong is the company behind Chimelong Paradise in Guangzhou, the “Disneyland” China already has, and at nine square kilometers the largest amusement park in the country, not to mention one of 66 attractions rated “AAAAA” by the National Tourism Administration, right up there with the Summer Palace, the Temple of Heaven, Shaolin, the Three Gorges, the Terracotta Warriors and the Yellow Emperor’s Tomb. The park drew 13 million visitors last year, helped along by its location on the High Speed Rail running through Guangzhou South Station. The gaming analysts at Citi Research, a division of investment bankers Citigroup Global Markets, expect the company will gradually scale this operation down as development of the Hengqin franchise ramps up. The implications for Macau, for Cotai in particular, which is just across the narrow Shizimen River, are as enormous as the numbers suggest. Once Chimelong International Ocean Resort begins taking up those 13 million visitors—and then some, 20 million or more at full build-out, Chimelong and Citi believe—even if only one in five makes the crossing, the difference will be a 20-25% increase in mainland tourism. This is huge because not only is the mainland the SAR’s largest feeder market and home to its biggest spenders, it’s also the force behind the double-digit boom in high-margin mass gaming that is revolutionizing business in the richest casino market in the world.

“So all of a sudden you go from, call it maybe 7 or 8 million unique Chinese visitors to Macau annually, to double that number right next door,” says Grant Govertsen of investment brokers Union Gaming Research Macau.

With Chimelong’s first phase, together with a 1,200-room resort under development by Guangdong’s Cinese Group, Hengqin is stepping up.

This is all a few years away yet. But then so is most of the new destination gaming development under construction on Cotai. The six casino concessionaires are pouring in aggregate something like US$18 billion into that. So viewed from their spreadsheets this will look quite like the perfect storm when it does break.

“We believe the potential is significantly underappreciated by the market,” Citi’s gaming equities team of Anil Daswani, Minggao Shen and George Choi wrote earlier this year, “especially given the strong correlation between Macau’s gross gaming revenue and mainland China visitation rates.”

“It’s mostly about visitation, driving visitation, and we’re hopeful that [Hengqin] will do that,” says Philip Tulk, director of equities research at Standard Chartered Bank in Hong Kong. “Visitation to Macau in recent years, quarters, has trailed that of the growth in betting. It’s betting that’s gone up fast over and above visitation. And that’s not a healthy trend.”

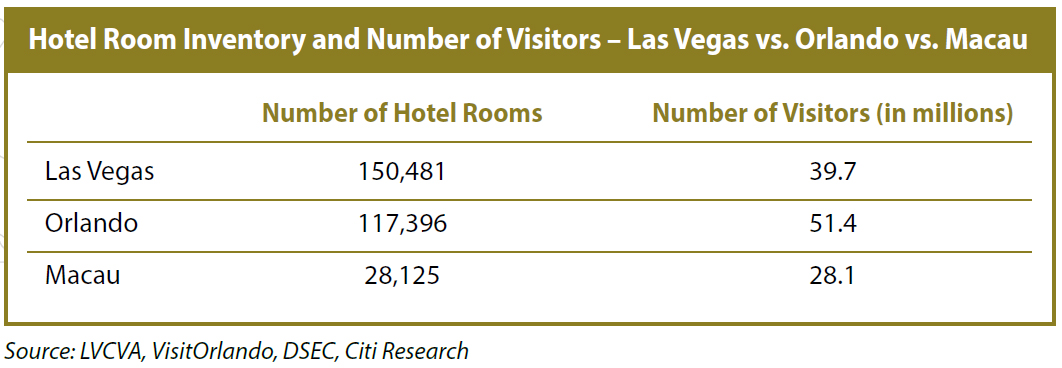

What’s at stake for Macau is the long term, as Citi sees it, and clouding that are three obstacles, all of which Hengqin has the potential to ease out of the way: the first is the “border-crossing bottlenecks” between the mainland and the SAR; the second, a “lack of critical mass in terms of nearby entertainment and MICE venues and business hubs”; and the third, “limited economy-priced hotel rooms”. This last one is what most directly impacts gaming revenue, and it’s been fairly well-documented, the fact that Macau draws visitors on the scale of a Las Vegas and an Orlando—28.1 million last year compared with 39.7 million for Vegas and 51. 4 million for Orlando—but doesn’t keep them around as long because it doesn’t have enough places for them to sleep. Orlando has more than 117,000 hotel rooms, Vegas more than 150,000, Macau 28,000, and most of Macau’s are in casinos and classified as five-star, 68% of the total. Not surprisingly, these run at better than 90% occupancy, which is great for RevPAR come reporting time, not so great for tourists who would like to stay longer and spend more if they could. This is why the average length of stay, at about 1.1 days, hasn’t changed much over the last decade, seemingly in defiance of the billions of dollars of investment in new resort product over that time. (The average was 1.0 days in September, the latest official figures available, 1.9 days for overnight visitors, 0.2 for same-day, roughly five hours.) As the Citi analysts wrote, “The lack of hotel supply is the major reason why most visitors are daytrippers who have to return home before the border closes at midnight.”

Needless to say, this isn’t going to be addressed overnight, and there is a critical element to the problem that is intractable, namely, the fact that Macau is all but maxed out for developable land. But with Chimelong’s first phase, together with a RMB5 billion ($820 million), 1,200-room resort under development by Guangdong’s Cinese Group (plans include retail, MICE and a golf course), Hengqin is stepping up. It’s illustrative to consider how the surge of visitors to the SAR from mainland China—up 20% in 2010, 22% in 2011— so quickly plummeted to +4.6% last year, +4.4% through the first half of this year, and here are two projects that between them equal more than 10% of Macau’s total hotel inventory.

University of Macau’s new Hengqin campus

Mr Tulk says, “We’re hopeful that Chimelong initially, and that a whole range of other economic activity, entertainment, business, educational, whatever it may be, will lead to more visitation ultimately. There’s not enough.”

‘Controllable’ Risk

Yet, it’s a “high-class problem” to have, as Mr Govertsen terms it, given the enormous opportunity this presents not only to mainland companies but to Macau’s concessionaires to get in on some of the development action. But even that is just part of what makes Hengqin not only important but interesting. There’s the tremendous land bank—at 106 square kilometers the largest of the city of Zhuhai’s 146 islands, one-third larger than Hong Kong island, three times the size of Macau—and the fact that nestled there against the most densely populated city on Earth, it is home to all of about 7,000 people. There is also the unique economic and political status accorded the island a little over four years ago as a “New Area,” one of only three in the country (Pudong in Shanghai and Binhai in Tianjin are the others), exclusive zones gifted with tax and import breaks and down the road possibly a freer environment for trading in yuan, the goal being to promote investment across a range of sectors and test the benefits of a deregulated, privatized and more internationalized financial sector. These “New Areas” are laboratories, in essence, out of which it is hoped the tools will be crafted for building a true Chinese consumer economy and liberating the country from its dependence on exportdriven manufacturing.

“The special thing about Hengqin is that it is a naturally isolated island, so the risk is controllable,” as Niu Jing, director of the local government of the New Area, told Reuters. “Hengqin, without exaggeration, is unique.”

Beijing’s comfort level with this is such that the State Council reportedly has approved the island as a “free trade zone” similar to one piloted in Shanghai in September (and which, interestingly enough, will host a Disneyland of its own, slated to open in 2015). Hengqin’s zone will be much larger, however, as plans call for bundling the New Area with Qianhai in Shenzhen and Nansha in Guangzhou and with Hong Kong and Macau at some level to form a kind of super-FTZ, the first of its kind in China.

Currently, there are 56 projects under development on the island representing investments of more than RMB226 billion. These include commercial development, transportation infrastructure and water and power generation. On the commercial end, the government is actively promoting seven sectors: travel and leisure, logistics, commodities and business services, financial services, “culture and creativity” (130,000 square meters was recently offered to Hong Kong bidders for a film studio), health care, technology and education. The media has mostly focused on the latter, embodied by the new campus of the University of Macau, which has moved from Macau’s Taipa island to 94,500 square meters just south of the immigration checkpoint at the Lotus Bridge, a showplace 20 times the size of the old campus and funded by the Macau government to the tune of US$1.28 billion. It will include a major hotel school and plans are to build it into one of the pre-eminent institutions for commercial gambling research in the world. It also will provide an intriguing test of China’s “One Country-Two Systems” policy. The campus is considered Macau territory under a land lease agreement with Zhuhai and is sealed off for immigration purposes from the rest of Hengqin and therefore houses its own fire and police stations. When it opens early next year, students from Macau will travel to it via a tunnel under the Shizimen. A little over one kilometer long it will be the only legal way to enter and leave the campus, which will operate under the jurisdiction of the SAR, not the PRC, with all that implies in terms of freedom of expression and freedom from Internet censorship.

The powers that be in Zhuhai have set an ambitious goal for Hengqin of RMB56 billion in gross domestic product by 2020. At that point, Chimelong will be complete in all its family-style glory. Cotai, too, will be all but built out. Only by then Macau’s development will no longer be the isolated phenomenon it largely is today. It will be knit into an integrated social and economic enterprise spanning the 11 cities of the Pearl River Delta and encompassing more than 55 million souls.

What that means, too, is that Hengqin will be home to a lot more than 7,000 people. The goal is 280,000 by 2020. Home prices have already started to climb in anticipation. The sole units currently available commercially, 1,800 of them in a residential tower set to open near the Lotus Bridge checkpoint, have drawn huge demand from Macau residents and are considered a bellwether for what the market will bear. They’re expected to fetch RMB25,000-30,000 per square meter (HK$31,800-$38,150) in the early going, a 60% premium to the going rate in Zhuhai’s central business district of Xiangzhou.

This also is likely to affect Macau’s dominant industry in a profound way.

“You’ve got a dynamic where over some period of time you’ll have many hundreds of thousands of people living there,” notes Mr Govertsen. “So it’s almost a bedroom community for Macau, but most likely mainland Chinese residents, and I liken that almost to the locals casino dynamic in Las Vegas where you’ve got 2 million people living there who collectively have a much lower propensity to gamble but still generate in the neighborhood of $3 billion US a year in gaming revenue at locals casinos. Clearly, that could be meaningful as a mass-market revenue source.”

A ‘Bigger and Bigger Experience’

Viewed from the Macau side of the Lotus Bridge, Hengqin looks like something from a science fiction movie: a sea of craters, construction cranes, power lines, high, sharp cliffs of upturned earth, the steel hulks of office towers and banks yet to be built, all of it seeming from a distance to float in a perpetual fog of yellow dust.

The parts of the island that are developable span an area roughly the size of Macau, and 90% of it is undeveloped. To entice Macau banks to set up branch offices their investment threshold has been lowered from US$6 billion to $4 billion. In all, about six square kilometers are set aside for Macau enterprises. One of those is already taken by UMAC. Another 0.5 square kilometers is allocated to a Science and Technology Industrial Park of Chinese Medicine that will be jointly operated by Macau and Guangdong provincial authorities at an initial capital investment of RMB600 million. The remaining 4.5 square kilometers is to be sold via auction. The opportunities for Macau’s casino concessionaires, which appear sizable on the face of it given their resources and experience in resort development, are still being assessed.

“Definitely there’s an opportunity. We just don’t know about the restrictions,” says one industry analyst. “And if the Chinese government wants you to invest, whether they will allow companies that are local, like Galaxy, and won’t allow companies that are not local, like Sands, it’s not clear. These guys are flush with cash, so they will invest as much as they can. While it will only be non-gaming amenities you can always accentuate whatever you want to provide your customers with non-gaming amenities. It’s possible to do that on Hengqin.”

David Chow is the only gaming operator to date to buy in and he’s done so through an investment vehicle that is separate from the Hong Kong-listed company he controls that owns Macau’s outdoor Fisherman’s Wharf theme park and The Landmark Macau hotel, both of which contain casinos that operate as “satellites” under the SJM concession, the two families, Mr Chow’s and Stanley Ho’s, having maintained close business ties over the years. Last December, Mr Chow picked up 30,000 choice square meters on Hengqin next to the immigration checkpoint, where it’s expected there will be a station on the Guangzhou-Zhuhai Intercity Rail line. He spent RMB250 million for the land and plans to spend RMB1.6 billion to develop it into a “Portuguese”-themed commercial center with retail and restaurants.

Mr Ho’s daughter Pansy Ho, who owns a sizable minority interest in casino operator MGM China Holdings, has chosen in an even bigger way to “ride along with the long-term growth story of Hengqin,” as Citi’s Anil Daswani has put it. Ms Ho controls Hong Kong-listed conglomerate Shun Tak Holdings, which her father founded in the early 1970s, a powerhouse in the Pearl River region with far-flung interests in residential and commercial real estate, hospitality, transportation and financial services. Shun Tak owns TurboJET, the largest ferry service in the PRD and holds an 11.5% interest in STDM, the company that used to operate Mr Ho’s former casino monopoly in Macau and holds the controlling interest in its successor, Hong Kong-listed SJM Holdings. Shun Tak won a bid in July for 23,834 square meters on Hengqin just behind the immigration checkpoint for RMB721 million. Plans for the site, which totals more than 131,000 square meters of gross floor area, include office and commercial space, a hotel and serviced apartments. Morgan Stanley, which covers Shun Tak, prices the development at HK$1 billion-$2 billion and says construction will begin this year and finish by 2018.

Sheldon Adelson had big eyes for Hengqin at one time and was reported in early 2006 to have secured permission from the Zhuhai government to submit a master plan for developing the island. This was a full 18 months before the company’s flagship Venetian Macao opened on the Cotai Strip. Nothing came of it, but it wasn’t for lack of ambition. The company had mapped 1,300 acres of leisure, tourism and convention facilities with golf courses, a marina and an outdoor arena with a total price tag of US$1 billion.

Earlier this year, casino giant Galaxy Entertainment Group weighed in with an expression of interest, possibly as an investor in sports arenas, golf courses and a marina. “Hengqin is going to be very important for us,” Deputy Chairman Francis Lui told Reuters. “The customer is wanting a bigger and bigger experience, and in Macau we just don’t have the land, and it would be too expensive.”

Certainly there are enough Chinese tourists to support development on this scale. What remains finally is the ability for them to get to it. Most visitors to Cotai from the mainland still come through the Gongbei border crossing on the Macau peninsula because it’s easier to get to and is open till midnight. The Lotus Bridge remains woefully underused, handling only about 10-20% of the traffic, and that will have to change. Operating hours at the checkpoint there have been extended to 10 p.m., and that’s helped. It’s reported that 24-hour clearance is on the way. There are plans also to move the checkpoint to Hengqin Bridge opposite Zhuhai at the north end of the island. This would open up a single entry with only one border checkpoint, Macau’s, and will make day trips to Cotai more convenient and promote regular movement between different locations on Hengqin.

A highway to Hengqin from the Zhuhai North rail station is under construction and its scheduled opening in 2015 will go a long way to making the checkpoint more attractive as a point of entry. The eastern section of a four-lane ring road linking Chimelong and UMAC with the checkpoint is complete, and a western section is nearing completion. These will allow local authorities to proceed with plans to run something like 10 bus routes into Chimelong, including special routes connecting to and from Zhuhai’s Jinwan Airport and various stops along the popular Guangzhou-Zhuhai Intercity Rail. An Intercity Rail extension from Gongbei to Hengqin also is planned and could be operational in a couple of years. This will be key as it will tie Hengqin into China’s national High Speed Rail network. Seven stations have been mapped for the 17-kilometer run, five of them underground. Its completion will allow travelers to get from Gongbei to the fun at Chimelong in about 10 minutes. Plans call for connecting the Hengqin station to Macau’s Light Rail Transit line in Cotai. An Intercity connection with Jinwan also is contemplated, the effect of which will be to connect Cotai directly to the airport. It’s expected also that at some point free access to Hengqin will be granted to vehicles bearing Macau license plates, which would make it a lot easier for the casinos to run shuttle buses to the island.

“The good news, clearly, is that many if not all the Macau casino operators are contemplating non-gaming developments on Hengqin,” says Mr Govertsen, “and that makes sense because they, too, realize the problem, the high-class problem, of having too many guests than can be dealt with the existing and expected stock of hotel rooms. You can make the argument that it is a gaming investment. And I’m not saying they’re going to have gaming there, they won’t, but it’s to drive their existing investments in gaming and non-gaming in Macau.”