With easier comps ahead and the mass market showing no signs of slowing down, concerns about the sustainability of Macau gaming revenue growth in the second half seem overdone

The growth of Macau’s high-margin mass-market gaming revenue continues to comfortably outstrip that of the dominant but much lower-margin VIP sector, and the result is that local casinos— and particularly the more mass market-focused ones—are seeing profitability increase by a greater degree than the headline revenue number.

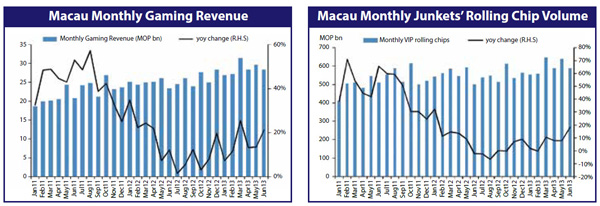

Macau recorded MOP28.3 billion in gross gaming revenue in June, a 21% year on year increase, while profitability, as gauged by the J.P. Morgan Macau Profitability Index, was up 24%.

Mass revenue, which accounted for 29% of total revenue in June, was up 31% year on year. The figure does not include slots, which are classified separately and accounted for 4% of total revenue in June. Slot revenue in recent months has been growing at a decidedly slower rate than revenue from the tables and ETGs served by live dealers that constitute the mass segment. It was up 13% in June, but only 6% in the second quarter.

Source: J.P. Morgan estimates, DICJ Source: J.P. Morgan estimates, DICJ

The VIP sector had contributed 71% of total revenue in 1Q 2012, but by June this year its share had declined to 67%. Both VIP revenue and VIP rolling chip volume were up 18% year on year in June (the industry-wide VIP win rate in 2Q 2012 and 2Q 2013 were identical, at 3.18%), coming off a low base in June 2012, when rolling chip volume had declined 2% year on year. The year-ago July and August VIP volume comps are weaker still, suggesting the VIP sector will continue registering moderate growth in the months ahead against low bases of comparison. The mass market, by contrast, is advancing against a strong growth base, with mass revenue having consistently grown around 30% in the second half of last year, even as VIP growth faltered.

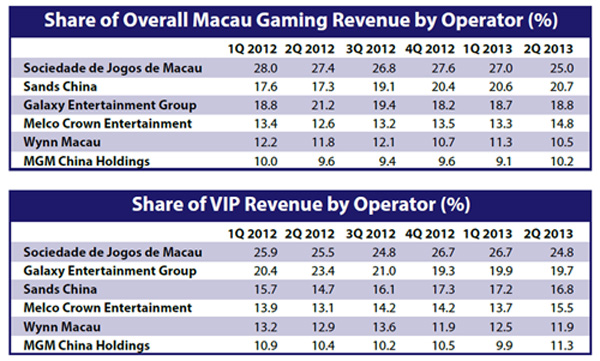

In the latest quarter, SJM experienced a two percentagepoint drop in its share of overall revenue to 25.0%,though that’s largely the result of an unlucky quarter in itsVIP segment—its 2Q VIP win rate of 2.93% was the lowestamong the six operators.

In 2Q 2013, total Macau gaming revenue increased 16% year on year, mass grew 31% and VIP was up 11%. Looking ahead, J.P. Morgan’s Kenneth Fong forecasts Macau revenue to grow “by around a mid-teen rate” in July. Although credit tightening in China and recent turmoil in global financial markets have raised concerns about the sustainability of growth in the second half of the year, it seems likely any fallout would be concentrated in the VIP business, which depends most on the free flow of credit, while Macau’s mass sector will continue its relentless forward march supported by infrastructure improvements, new resort and gaming capacity, China’s burgeoning middle class and, of course, all that pent-up demand for casino gaming on the mainland, only a miniscule fraction of which is currently being served by Macau.

Market Shares

Following the liberalization of Macau’s casino industry in 2002 allowing the entry of five new operators, the market share lead of erstwhile monopoly operator SJM has been steadily eroded.

In the latest quarter, SJM experienced a two percentage point drop in its share of overall revenue to 25.0%, though that’s largely the result of an unlucky quarter in its VIP segment—its 2Q VIP win rate of 2.93% was the lowest among the six operators. The industry-wide average was 3.18%, Sands China achieved 3.47%, Galaxy Entertainment Group, 3.16%, Wynn Macau, 3.13%, MGM China Holdings, 3.14% and Melco Crown got 3.10% at Altira and 3.66% at City of Dreams.

Discounting luck factor by considering VIP rolling chip turnover by operator, the movements were less pronounced, though again it was SJM that lost most ground between the first and second quarters of 2013. The most apparent trends since the beginning of last year are the steady increases in Sands China’s and Melco Crown’s shares of VIP rolling chip turnover, while capacity-constrained Wynn Macau has seen its share decline.

In the mass market, SJM’s share of revenue continued to fall in the face of significant capacity expansion by Sands China at Sands Cotai Central and as Galaxy and Melco Crown continue to ramp up their premium mass businesses. SJM’s loss of mass-market revenue share could also be partly the result of the company’s recent reclassification of some of its premium mass tables as VIP tables, triggered by maximum bets exceeding an apparent HK$300,000 (US$38,460) threshold that Macau’s gaming regulator, the DICJ, views as the cut-off between mass and VIP.

Sands China unseated SJM as the market leader in mass revenue in the first quarter of this year and further extended its lead in the second quarter, commanding a 29.9% share. Wynn Macau lagged the field with a 7.1% share, having been overtaken in the quarter by MGM China.

Sands China unseated SJM as the market leader in mass revenue in the first quarter of this year and further extended its lead in the second quarter,commanding a 29.9% share.