Morgan Stanley believes Japan is on the verge of passing a bill legalizing casinos

Early last month, a small Japanese political party submitted a bill to legalize casino gaming in the country to Japan’s parliament, the Diet. By most accounts, in doing so, the Japan Restoration Party may only have served to complicate efforts by a cross-party lobby group, which plans to jointly submit such legislation after the country’s upper house elections, scheduled for the 21st of this month.

In April, the cross-party alliance, consisting of 140 lawmakers, selected Prime Minister Shinzo Abe as their Chairman and agreed on a plan to submit a draft casino bill during the Diet’s extraordinary session in the autumn. The JRP is part of the group, known variously as the Alliance for the Promotion of International Tourism and the IR (Integrated Resorts) Alliance. Rather than the JRP’s preemptive separate submission, it will likely be the Alliance’s joint bill, submitted sometime between September and November, that offers the best chance of finally making the decade-long effort to bring casinos to Japan a reality.

Hopes were initially kindled by the return to power in December of the business-friendly Liberal Democratic Party under Prime Minister Abe, who has indicated he is open to the idea of casino resorts as part of his strategy for driving economic growth.

According to a report last month by Morgan Stanley’s Praveen Choudhary and Mia Nagasaka, the process could begin in the fourth quarter of this year. The report stated: “We expect the IR promotion bill to be passed before the end of this year and the implementation bill to be ready within the next 24 months, after which interested parties could submit their bids.”

Japan’s primary speculative pastimeis pachinko, a form of quasi-gamingplayed on pinball-stylemachines which generates about US$36billion in net revenue per year.That suggests enormous untappeddemand for purer forms of gaming.

The report continues: “The process of passing the promotion bill is relatively simple, but drafting the implementation bill will likely require an extensive amount of collaboration among different parties and between State and municipalities. On top of this, there will likely be a widespread effort to pick the best practices from other regions to suit Japan’s particular needs. We believe that there is a significant lack of understanding of other jurisdictions at this point, and thus we think it is too early to predict the nature of regulation in Japan.”

“Japan is potentially one of the largest gaming destinations in the world,” stresses Morgan Stanley. “We expect it to invite bids from foreign operators in the next 2-3 years and open two integrated resorts by 2019-20.”

Japan’s Potential

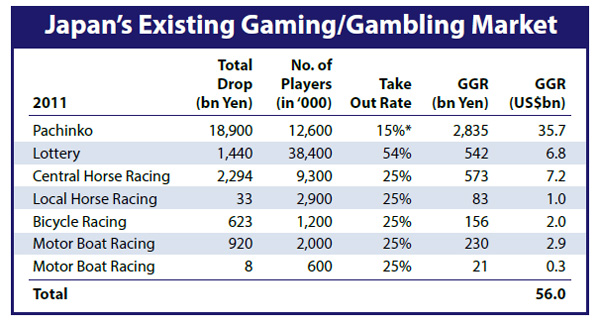

There is no doubt that casino gaming would prove a big earner in what is the world’s second-largest developed economy and third-largest in terms of nominal GDP. Currently, the market for gaming-related activities in Japan is around US$56 billion annually and the primary speculative pastime is pachinko, a form of quasi-gaming played on pinball-style machines that generates about US$36 billion in net revenue. That suggests enormous untapped demand for purer forms of gaming.

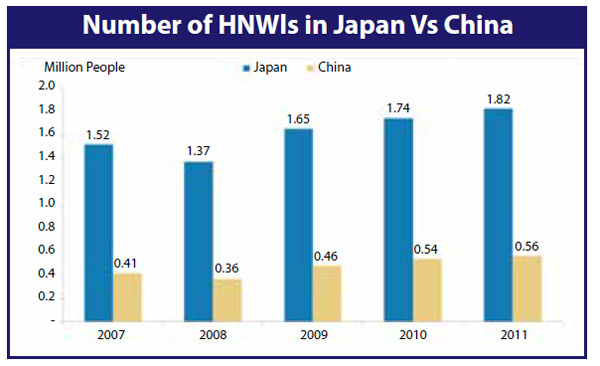

Among the main factors Morgan Stanley identifies as contributing to the success of future casino resorts in Japan are the country’s big concentration of high net-worth individuals—Japan has the largest number of HNWIs in Asia with a cumulative net worth of US$4.2 trillion—and its strong infrastructure and air connections. Japan also benefits from proximity to Beijing and Shanghai, China’s wealthiest cities and a major source of visitors to casinos in South Korea and Singapore. Furthermore, the continued development of gaming across Asia bodes well for Japan’s future casinos, which will offer players across the continent a fresh choice of destination come 2019-20.

Source: Leisure White Paper 2012, Presentation of Director & Visiting Professor,Center for Amusement Industry Studies, Osaka University of Commerce.* Takeout rate for Pachinko is approximately 15%.

Source: Capgemini Lorenz Curve Analysis, 2012

Despite Morgan Stanley’s optimism, the report does point to potential impediments to getting casino gaming off the ground, including the political instability created by frequent changes in leadership and opposition from political and citizens’ groups worried it will give rise to problem gambling and other social ills. Also clouding the outlook is regulatory risk—both over-regulation of the industry and measures to keep locals out of casinos. Then there’s the old chestnut of Japan’s aging/declining population, and the fact that a long history of strained relations between China and Japan could keep away Chinese visitors.

The Fuji Television Building in the waterfront area of Tokyo’s Minato district

Japan’s first casinos will be housed within two Singapore-style IRs featuring leisure and entertainment and MICE facilities as well as gaming, says Morgan Stanley. In their report, Mr Choudhary and Ms Nagasaka offer four approaches to estimating the size of the country’s gaming market, including: revenue to GDP; percentage of pachinko; table efficiency; and population/visitation/HNWIs. The resulting market estimate is US$8-11 billion.

The eventual opening of casinos in Japan is not expected to have much of an impact on Macau, where the bulk of visitors hail from neighbouring Guangdong province in China and Japanese visitors do not feature prominently in the mix. Of Asia’s major gaming destinations, South Korea receives by far the largest number of Japanese visitors and is likely to suffer the largest cannibalization following the opening of Japan’s IRs.

As for which global casino operators might participate in casino development in Japan, analysts point to the usual suspects, including Las Vegas Sands, Genting Group and Caesars Entertainment. Domestically, if the stock market’s wisdom is anything to go by, the front-runners appear to be Sega Sammy Holdings—which is developing an IR in South Korea in partnership with that country’s Paradise Group—and Fuji Media Holdings, a broadcaster located in a section of Tokyo considered prime territory for casino development.

Sega Sammy stated a desire as far back as 2007 to invest in casinos in Japan should the opportunity arise and last February purchased a resort in Miyazaki Prefecture. Two months after that acquisition was announced, company President Hajime Satomi reasserted the company’s intentions, saying, “Of course, [a casino] is what we have in mind.”

Another potential beneficiary of casino legalization in Japan is Konami Corp. and its slot-manufacturing subsidiaries. Given the local population’s affinity for pachinko, Japan’s casinos are expected to contain a high concentration of gaming machines.

-120x86.jpg)