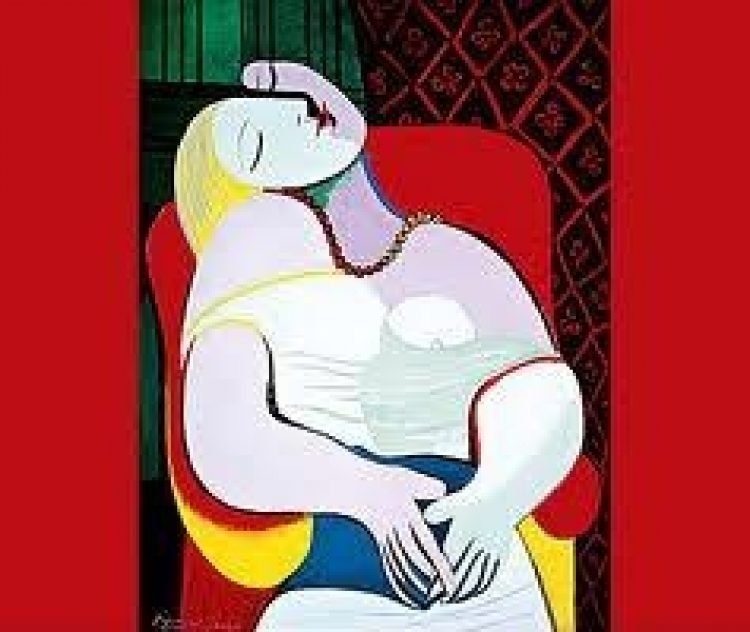

Art restoration has come a long way, as have art prices, judging from the US$155 million a hedge fund tycoon has paid Steve Wynn for the Picasso titled “Le Rêve”.

That’s the 1932 masterpiece Mr Wynn poked a six-inch hole in with his elbow while showing it to friends and a few select members of the press back in 2006. At the time, he had just sold it—for $139 million—to the same guy who has bought it now.

That’s Steven A. Cohen, who runs $15 billion hedge fund SAC Capital Advisors.

The hole nixed the sale, but apparently not Mr Cohen’s ardor, given the $16 million premium for the repaired painting, not to mention the fact that $155 million is the most ever paid for a Picasso and the most money a US collector has ever shelled out for a work of art, according to reports on the sale in the New York Post and New York Times. Mr Wynn paid $48.4 million for “Le Rêve” at auction in 1997.

It’s not the first nine-figure work of art to join Mr Cohen’s collection. He paid $120 million for four Matisse bronzes a few years back.

Nor is it the only record Mr Cohen has laid claim to recently.

That would be the $616 million SAC Capital agreed to pay the US government earlier this year to settle an insider-trading case against two of its affiliates. It’s the largest penalty of its kind ever leveled in the US. The settlement, which is scheduled for review in US District Court in Manhattan this week, came out of a federal investigation into dealings connected to SAC that is ongoing, according to news reports.

As for the other bit of artistry, neither Mr Cohen nor Mr Wynn had anything to say, according to the Post.