CLSA’s latest report on Philippines gaming finds lots for investors to like in the new generation of integrated casino resorts

Philippines casino revenue could rise 130% in the next four years once three new integrated resorts (IRs) open in Manila, says CLSA Asia-Pacific Markets.

The independent bank and brokerage’s report titled “Many happy returns—Integrated resorts draw interest” takes a look at the prognosis for the casino industry in the Philippines in the remainder of the decade and beyond.

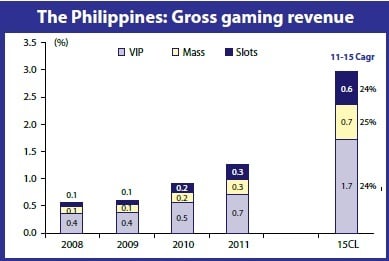

It states: “We expect gaming revenue to grow from US$1.3 billion in 2011 to US$3 billion in 2015 once three new IRs in Pagcor City [Philippine Amusement and Gaming Corporation’s Manila Bay project] are completed, representing a 24% Cagr [compound annual growth rate]. They are: Belle Corp’s Belle Grande Manila Bay; Bloomberry Resorts and Hotel’s Solaire Manila; and Universal Entertainment’s Manila Bay Resorts.

“We estimate the three new integrated resorts to generate US$1.6 billion of gaming revenue in 2015, implying that each integrated resort generates US$0.53 billion gaming revenue per year (versus US$0.63 billion gaming revenue from Resorts World Manila in 2011),” say authors Aaron Fischer, CLSA’s Head of Gaming Research; Richard Huang and Raf Mercado.

Source: CLSA Asia-Pacific Markets

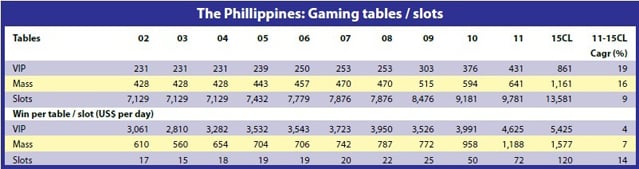

CLSA says the four main drivers for this major jump in gaming revenue are: “….more gaming capacity, foreign and domestic revenue growth and better infrastructure. We expect gaming tables to increase from 1,072 in 2011 to 2,022 in 2015, which is the key driver to our US$3 billion forecast. We are also positive on the local market given improving gaming penetration, the rise in domestic tourism, an emerging middle class and favourable demographics.”

Source: CLSA Asia-Pacific Markets

The report authors acknowledge that there are challenges for investors in the Philippines, including relatively underdeveloped infrastructure compared to some neighbouring jurisdictions and the risk of trade interruptions due to flooding and other extreme weather during typhoon season. But they suggest equity prices for real estate and gaming companies and consortia—and return on investment—are likely to be attractive compared to more developed markets.

Source: CLSA Asia-Pacific Markets

CLSA points out that Resorts World Manila—the country’s first integrated resort, located near Manila International Airport—has produced good returns for modest outlay (under US$1 billion in project costs) and this has helped the developers to maintain a low enterprise multiple. Resorts World Manila opened in August 2009 and was developed as a joint venture between Star Cruises (now Genting Hong Kong, a company listed in Hong Kong but traded in Singapore) and Alliance Global, a Manila-listed conglomerate headed by Andrew Tan.

“Alliance Global was the first among the four [IR] gaming-licence holders to complete its integrated-resort development. Valuations remain inexpensive with the gaming business at just 8x EV/Ebitda,” says CLSA.

Enterprise Value (EV) divided by Ebitda is a formula used to establish the enterprise multiple. It assesses a business as a potential buyer would, because it takes debt into consideration—an item that other multiples such as the P/E (share price to earnings) ratio do not include.

CLSA adds that as well as modest equity pricing, the Philippine gaming market offers other attractions for investors.

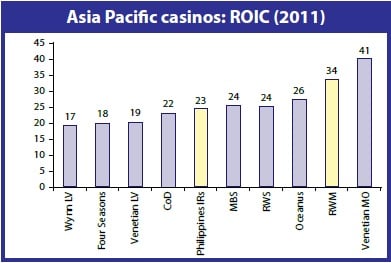

“Low tax rates and cheap construction costs underpin higher returns, with 23% ROIC [return on invested capital] keeping investors happy,” say the authors.

“In 2011, we expect Resorts World Manila (RWM) to have delivered 34% return on invested capital (ROIC), which is higher than the recently opened Singapore and Macau casinos like Resorts World Sentosa (25%), Marina Bay Sands (23%) and City of Dreams (22%). Despite that, the investment return from RWM is still lower than that of the Macau casinos opened before 2008, which are yielding an average investment return of 40% to 133%.”

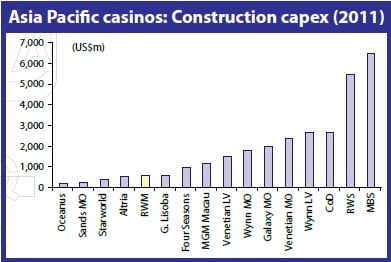

The report adds that low project capex compared to Macau and Singapore strengthens the case for investment in Philippines IRs.

“Taxed at a relatively low rate, we expect Ebitda [earnings before interest, taxation, depreciation and amortisation] margins to be around 38%. With attractive project costs of US$1 billion against an average US$2 billion-US$3 billion in Macau and US$5 billion-US$6 billion in Singapore, we expect return on invested capital of 23%,” adds CLSA.”

Source: CLSA Asia-Pacific Markets

CLSA points out that the Philippines government has identified gaming as an important driver of GDP growth.

“The opening of the gaming market has had a remarkable impact on the Macau economy, with GDP growth averaging 21% over 2004- 10. The unemployment rate has also declined from over 6% in 1999 to 2003 to an average of 3.6% in 2004 to 2010,” says CLSA.

Belle Grande Manila Bay

The report gives a snapshot of the project size and facilities at each of the three new Manila IRs—factors that could help drive GDP growth in the Philippines.

“Belle Corporation owns a six-acre site and is currently constructing the Belle Grande Manila Bay, which is anticipated to house 350 gaming tables, 1,900 slots, three hotel towers (with 1092 hotel rooms), residential tower and other amenities. The integrated resort is scheduled for soft opening in 2Q12 and is estimated to cost US$1 billion,” says the report.

“Belle is a leading developer of high-end second-home gated communities and golf and country clubs. Its flagship Tagaytay Highlands project is an iconic leisure development and well-known real estate brand in the Philippines. In September 2009, the company acquired a gaming licence from SM Investments to own and operate a casino in Pagcor Entertainment City.

“Belle has no experience in operating casinos and has thus outsourced the management of the casino to Asia Pacific Gaming (APG) and Leisure & Resorts World Corp. (LR), with the company committed to paying rentals and royalties for owning the facilities and the gaming licence.”

“LR has a substantial track record in the gaming sector and is currently the largest bingo operator in the Philippines with a client base of over one million patrons. LR has also engaged the services of APG, whose principals each have at least 20 years of experience in setting up and managing casinos. APG’s principals have been involved in the opening and management of five casinos in Macau, including Galaxy’s flagship StarWorld Casino. Both LR and APG have developed strong relationships with junket operators in Asia and plan to leverage these relationships to attract foreign VIP players to Belle Grande.”

Manila Bay Resorts

CLSA also gives details of Japanese gaming entrepreneur Kazuo Okada’s Manila project.

“Universal Entertainment Corporation (formerly known as Aruze Corporation) is a Japanese-based pachinko machine manufacturer, which used to be the largest shareholder of Wynn Resorts (with 19.9% interest). Universal Entertainment’s Manila Bay Resorts is expected to include 500 gaming tables, 3,000 slots and 2,000 hotel rooms. The integrated resort is also expected to have the world’s largest oceanarium, The Manila Eye ferris wheel, a sports arena, a theatre and a museum. The construction capex for the entire project is expected to be US$2 billion.”

Solaire Manila

Last but not least, CLSA fills in some of the detail about the Solaire project.

“Bloomberry Resorts and Hotel investments have commenced construction on its 8.3-acre land site. The Solaire resort and casino is scheduled to complete in 3Q12, which would include 300 gaming tables, 900 slot machines, over 500 hotel rooms, convention facilities and live performance theatre. The complex is expected to cost US$1 billion.

“The hotel complex is developed by Enrique Razon Jr, chairman of port operator International Container Terminal Services (ICTSI) and property developer Sureste Properties Inc. (SPI) and its subsidiary, Bloomberry Resorts and Hotels Inc. (BRHI).”

CLSA then presents some scenarios regarding the likely impact of new resorts and extra gaming inventory on the Philippines market.

“With the significant addition of mass-market tables and strong expected inflows of gamers, we expect mass-market gaming revenue to grow rapidly at 25% Cagr from US$0.3 billion in 2011 to US$0.7bn in 2015. We also expect rapid VIP revenue growth of 24% Cagr from US$0.7 billion in 2011 to US$1.7 billion in 2015, underpinned by inflow of higher-tier VIP players post opening of integrated resorts in [Pagcor’s] Entertainment City.”

CLSA says it bases its estimates on what it calls “back-tested growth assumptions”

“We derive our 2015 industry gaming revenue forecast of US$3.0 billion by using a bottom-up calculation. We combined the number of gaming tables expected in the market with our estimated win-pertable to calculate our industry gaming-revenue forecast. To ensure validity of our forecast, we have also cross checked some of our key forecast variables with those of other countries.

Source: CLSA Asia-Pacific Markets

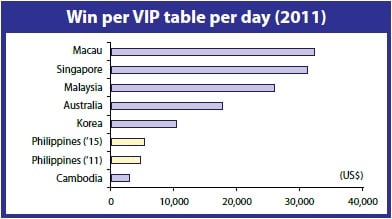

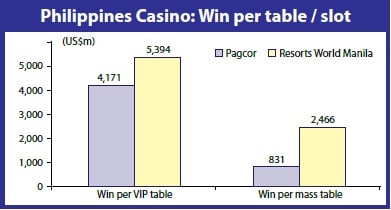

“We estimate win-per-VIP table to be US$4,625 in 2011 and expect it to grow to US$5,425 in 2015. Despite the significant growth, the win-per-VIP table in the Philippines is still far lower than the current win-per-VIP table in most of other Asian countries, which yielded an average of US$10,000-US$33,000 per table per day.

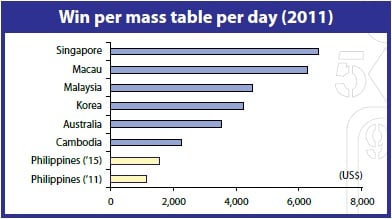

“In the mass-gaming segment, we forecast win-per-table per day to increase from US$1,188 in 2011 to US$1,577 in 2015, which compares to US$2,291-US$6,717 in other Asian countries.

“We expect the size of domestic gaming revenue to also grow rapidly from US$1.1 billion to US$1.7 billion, but it will still be smaller than Singapore’s US$2.0 billion and Australia’s US$2.5 billion. Despite the rapid growth, domestic gaming revenue per adult population in 2015 will still be low at US$31 (versus US$20 in 2011), compared to China at US$33, Malaysia at US$102, Australia at US$149 and the USA at US$268.

Source: CLSA Asia-Pacific Markets

CLSA also presents a best-case position it refers to as the “bluesky scenario”.

“In a blue-sky scenario, the size of the Philippines gaming market could grow to US$6 billion [annually], which is in line with the government target. In the ‘terms of reference’ document regarding the Entertainment City published by Pagcor, it indicates that Pagcor targets to increase annual income generation by US$1 billion when the Entertainment City is completed. With a blended tax rate of 21%, it implies the government expects the Entertainment City to generate incremental gaming revenue of US$4.9 billion, bringing the size of the Philippines gaming market to US$6.0 billion, on par with that of Singapore.

Source: CLSA Asia-Pacific Markets

Source: CLSA Asia-Pacific Markets

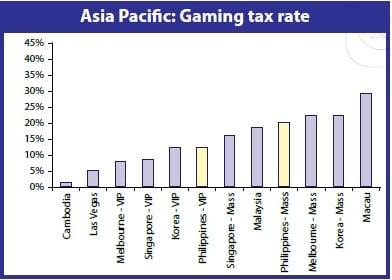

“Similar to other Asian countries, a segregated gaming tax regime is applied to Philippines casinos with 17% gaming tax applied to VIP gaming activities and 27% gaming tax applied to mass-gaming activities. Blended gaming tax in Philippines would come in at about 21%, which is higher than Singapore’s [blended] 16% [22% for the mass and 12% for VIP], but significantly lower than 25% in Malaysia and 39% in Macau.”

Underpinning the favourable business fundamentals is the government’s political support for casino gaming as a motor for general economic development in the country, states the report.

“The success of integrated resorts in Asia has captured the imagination of the Philippines government. Eager to boost GDP and employment, the Pagcor Entertainment City development in Manila Bay is at the forefront of its ‘more fun in the Philippines’ campaign aimed at attracting repeat local and overseas tourists.

“Economic development in the Philippines has lagged other developing Asian countries, with a relatively slower 5% GDP Cagr over 2005-11 and higher unemployment rate (8% in 2011),” adds CLSA.

“Marina Bay Sands in Singapore is a prime example of the potential benefits of an integrated resort injecting vitality into a country’s economy. Success stories in Macau and Singapore have boosted the Aquino government’s confidence to undertake its Pagcor Entertainment City development in Manila Bay,” concludes CLSA’s executive summary.