CLSA on Asia’s largest would-be casino market

A Japan casino market based on two resorts similar to Singapore’s could “comfortably exceed” US$10 billion per year in gaming revenue, says a report from CLSA Asia-Pacific Markets in conjunction with Credit Agricole Securities (USA).

Furthermore, CLSA/Credit Agricole Securities (USA) says its own survey of 600 respondents in the country found only 20% actively opposed to casino resorts in Japan, while more than 50% indicated they would be willing to visit one.

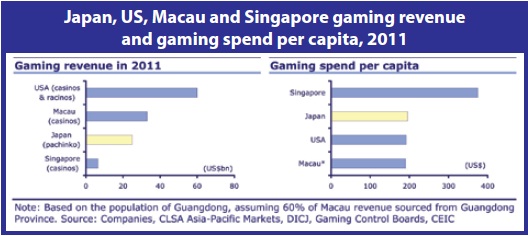

The data come from a 40-page report named ‘Asia’s wonderland—Integrated resorts bring the magic to Japan’. The ‘wonderland’ part of the title is carefully chosen. The authors point out that not only does Japan already have some of the highest gaming spending in the world— with the annual equivalent of US$25 billion revenue from the uniquely Japanese arcade game pachinko, on sales turnover of US$250 billion per year—but it also has some of the highest visitor attendances for theme parks anywhere in the world and some of the highest ancillary spending rates by those visitors. In other words, domestic visitors and overseas tourists don’t skimp when they take time off in Japan. Combine the domestic passions of the Japanese—to be thrilled by arcade games and park rides and shopping—then throw into the mix a surge of interest from overseas visitors if casinos were added to the offer, and Japan could potentially have one of the biggest and most dynamic casino resort industries in the world, suggests CLSA/Credit Agricole Securities (USA).

“In light of Macau and Singapore’s success, we believe the Japanese market offers huge potential to become the biggest IR nation globally,” says the paper jointly written by Jon Oh and Clifford Kurz of Credit Agricole Securities (USA) in New York, and Aaron Fischer, CLSA’s Head of Gaming Research based in Hong Kong.

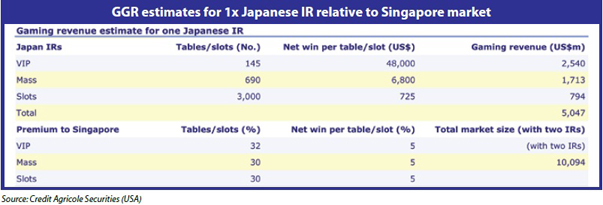

“Assuming two large scale IRs [integrated resorts] are approved in Tokyo and Osaka with a similar industry framework as that of Singapore, gaming revenue could comfortably exceed US$10bn, especially considering that two IRs in Singapore generate about US$6bn in revenue on a population of just 5 million compared to Japan’s 128 million,” suggests the report.

“The Japanese also show high interest in gaming, as evidenced by the current size of the pachinko market. There are 12,652 pachinko/pachislot halls with 4.6 million installed pachinko/pachislot machines, generating an estimated gaming revenue of around US$25 billion (assuming amounts wagered are US$250 billion at a return rate of 10%, of which 5% is the machine take and 5% is on conversion),” add the report authors.

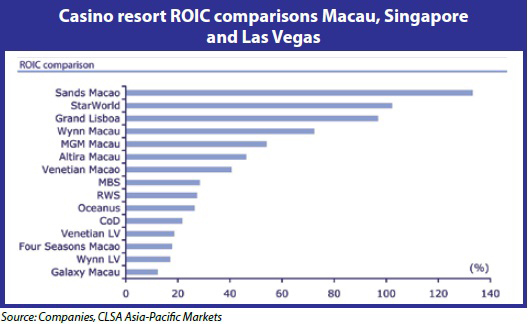

“Given the number of favourable gaming factors in Japan, we believe IR operators could spend as much as US$7-8 billion on each resort compared to US$5-6 billion in Singapore (a potentially smaller market). If we assume 30% margin on a US$10 billion market, the ROIC [return on invested capital] for each IR would be 20%; and if we assume the [Japanese] gaming market size is US$15 billion, the ROIC would be above 30%, in line with the ROIC seen in Singapore and Macau.”

CLSA/Credit Agricole Securities (USA) uses three methods to gauge the potential size of the Japan casino market. What it refers to as ‘bottom up analysis’; comparisons with Singapore visitor patterns and comparisons on average gaming spend by adults in the United States, China and Singapore.

Bottom up analysis

“If we were to assume for now that there will be two IRs in Japan, which cost on average 30% more than those in Singapore (US$7-8 billion each given the larger relative size of Japan), then we would also expect each IR to have 30% more tables and slots. Given the assumed capacity and using a slight premium to our estimates for Singapore in 2013 (considering Japan’s greater wealth), we estimate that two IRs could generate roughly US$10 billion in IR revenue.”

Comparisons to Singapore visitation

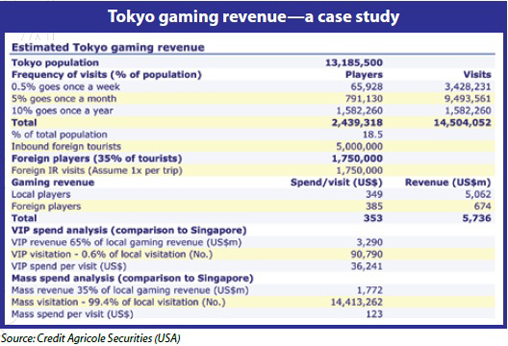

“Our second method estimates the Japan market by making comparisons to IR visitations in Singapore, which average roughly 25,000 visits per IR and where local guests represent 30% of total visits. Using a similar proportion of IR visits from Tokyo’s 13 million local population and spend per visit, the domestic contribution to gaming is roughly US$5 billion. For foreign players, we assume that visitation picks up from the current 3 million visitations a year to 5 million a year, which seems reasonable considering that Singapore picked up nearly 2 million visitors after the opening of its IRs in 2010. Thus, given a similar spend per visit as Singapore for foreigners, foreign contribution to gaming [in Tokyo] would equate to roughly US$670 million, for total gaming revenue in Tokyo of US$6 billion. If we run a similar comparison for Osaka, which has a larger population but potentially lower income and propensity to gamble, the estimated gaming revenue is roughly US$4 billion. Thus, we estimate total gaming revenue in Japan is US$10 billion.”

Comparisons to gaming spend by adults

“Looking at gaming revenue per population age 18 or older (potentially a better measure than gaming spend per capita), we find that, unsurprisingly, Singapore has the highest gaming spend per adult population given two IRs located in the heart of a densely populated citystate,” says the report, adding: “Yet Tokyo is not far behind, with a population density higher than New York City and a much larger population of 13 million.”

“Japan spends as much on pachinkos as others spend on full-scale IRs with both slots and tables, implying that Japan’s gaming potential could be much larger than our comparisons suggest,” says CLSA/Credit Agricole Securities (USA).

“A similar comparison for Tokyo and Osaka estimates that gaming revenue could be at least US$11 billion,” add the authors.

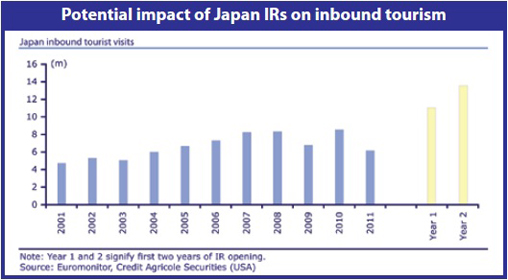

Inbound tourism

CLSA points out that although Japan is a highly-developed country with a unique culture and world-class tourist attractions, its relative share of inbound international tourists has traditionally been low compared to neighbouring countries— even before last year’s earthquake, tsunami and nuclear disaster.

Under the heading ‘Tourism—Waking a sleeping dragon’, CLSA/Credit Agricole Securities (USA) says: “The Japanese government has a goal to bring in 25 million tourists in 2020, up from 6.8 million in 2009. And IRs can provide a needed boost in inbound tourism in Japan. Despite the global popularity of the Japanese culture, the nation has historically had issues attracting foreign tourists. Japan welcomed 8.3m tourists in 2010, ranking it 30th in the world.

“Japan’s tourism industry benefits from its proximity to China. Up until the Fukushima tragedy, Japan was the fastestgrowing destination for the Chinese, aside from Taiwan (which recently allowed direct flights to China) and the USA. Should IRs be introduced in Japan, the growth potential for the nation’s tourism industry is significant, especially as it relates to Chinese tourists.”

“Singapore is the best example of strong growth potential,” says the report.

“Shortly after the opening of Resorts World Sentosa (RWS) and Marina Bay Sands (MBS) in 2010, Chinese tourists flooded into Singapore at a 30% Cagr [compound annual growth rate] from 2009-11. This compares to just 1% Cagr over the five years prior to the IR openings. Singapore added a total of nearly 3.5m total tourists in 2010 and 2011, representing an average annual growth of 17%. Given our expectations for larger-scale IR developments in two large cities in Japan, we believe that Japan could add significantly more than the nearly 4m tourists that Singapore added in one year. This could result in more than a doubling of total visitation to Japan, which saw just 6m visitors in 2011,” add the authors.

Under the heading ‘Japan theme parks: The more the merrier’, the report states that the country has some of the highest levels of theme park occupancy in Asia.

“Of the top-25 most visited theme parks in the world, five are in Japan and two (Disneyland and Disney Sea in Tokyo) are the top-five most visited parks in the world. Furthermore, Japan charges the highest admission fees in Asia and [they] are almost comparable to daily tickets charged in Western locations.

“Furthermore, Japan has a very high ratio of [theme park] ticket-to-ancillary spending, with nearly 50:50 ticket-toancillary spending, which compares to roughly 70:30 in the USA and Singapore. The higher ancillary spending is attributed to the Japanese’s higher tendency to purchase gifts and souvenirs.”

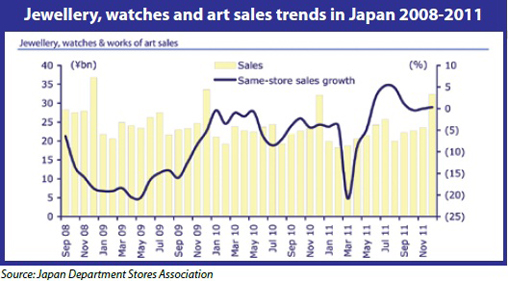

The authors say that despite a 1.5% year-on-year fall in retail spending in the country during 2011, there are now signs of recovery—especially in jewellery, watches and art sold in Japan’s department stores.

“We expect the retail malls at the [Japanese] integrated resorts to do very well, given the precedent from Macau and Singapore. This is especially true if the resorts are able to attract the number of visitors, particularly ones from China, like those of the IRs in Macau or MBS and RWS in Singapore.”

MICE trap

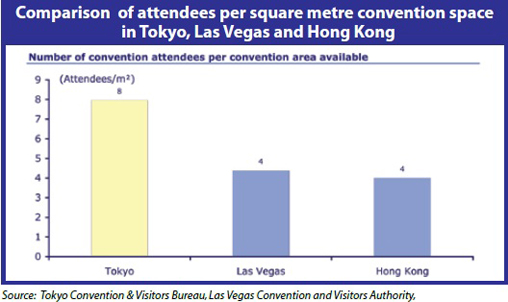

Tokyo currently is the largest market—on a city for city basis—for conventions in Asia, says CLSA/Credit Agricole Securities (USA). Furthermore, it is undersupplied with venue space compared to Hong Kong and Macau, adds the report.

“According to the Tokyo Convention & Visitors Bureau, Tokyo should see 1.6 million convention attendees in 2012. This is larger than other large cities in Asia, such as Hong Kong, which has seen roughly 1.3m attendees,” says the report.

“Tokyo will have several big conventions this year including the New Environment Exposition (N-EXPO), which is expected to have 200,000 attendees (the convention attracted 180,700 in 2008, its record so far). This would make it larger than the Consumer Electronics Show (CES) in Las Vegas, which recently broke its record attendance in 2012 with 153,000 attendees.

“Despite the number of attendees, we believe Tokyo could use more convention centres.”

“With an estimated 1.6m convention attendees [annually in Tokyo], there are roughly eight attendees per square metre of convention space compared to four per square metre in Las Vegas and Hong Kong (which is likely to be more space constrained than Tokyo),” say the authors.

“As Japan looks to reignite its economy, the administration is likely warming up to the idea of introducing a gaming bill.

Further, based on our proprietary survey gauging the public’s opinion of IRs, 43% of 600 respondents stated they are open to a large IR in Japan and only 20% are opposed, while over 50% would visit the establishment despite the majority (72%) having never engaged in pachinkos or pachislots.”

Summary

CLSA/Credit Agricole Securities (USA) say in the executive summary to the report: “The real appeal of IRs, we argue, lies in their diverse offerings that emphasise non-gaming amenities, such as luxury accommodations, convention and meeting facilities, retail space, fine dining and theme parks. Apart from the huge domestic potential for the gaming market, Japan can also seize the opportunity to transform the social landscape and reinvigorate the service industry to better capitalise on pentup demand from Chinese tourists.

“It’s still too early to determine which operator would receive the licence to develop an IR in Japan. Nevertheless, we run various scenario analyses that suggest Japan’s IR opportunity could be significant for operators such as Las Vegas Sands, MGM, Wynn and Genting Singapore, potentially adding 20-115% to Ebitda and offering 15-100% upside to current share prices.”