The Macau government’s assault on local slot parlours looks more like gesture politics than substantive policy

Mocha Clubs—a chain of locals-focused Macau slot parlours— were Melco Crown Entertainment’s (MPEL’s) first toehold in its slow climb to the lofty heights of the territory’s huge gaming market. From 2003 until the opening of the Crown Macau (now Altira) casino hotel in May 2007, they were the only generator of Macau gaming revenue initially for Hong Kong-listed Melco, and subsequently for Melco PBL, the Sino- Australian joint venture run by Lawrence Ho and James Packer (now MPEL).

And Mocha was a marginal toehold at that. Until 20th September 2006, the Mocha Clubs business was operated under a revenue-sharing service agreement with SJM. That was a legacy issue relating to the fact that it was only in March 2006 that MPEL acquired its own Macau gaming sub-concession from Wynn Resorts. Prior to that it had been piggybacking on the gaming licence of Dr Stanley Ho in order to operate Mocha. In 2006 it had to close Mocha Kampek, a venue inside the SJM-licensed casino of the same name, as a pre-condition of Macau government approval for the sub-concession deal with Wynn, according to a Melco PBL filing with NASDAQ that year.

But by the end of 2011—with MPEL’s City of Dreams resort firmly established on Cotai and Altira Macau making a steady if not spectacular living from VIP gambling—Mocha’s contribution to the total MPEL business was proportionally much smaller than it had been in the early days. By the fourth quarter of 2011 Mocha’s net revenue accounted for only 3.4% of the net revenue earned by MPEL as a whole during the period (US$34.5 million versus US$1 billion).

Yet if one compares the 4Q 2011 revenue number (US$34.5 million shared among nine clubs) with the 4Q 2007 net revenue number (US$22.4 million spread over seven outlets), that’s an increase of 54% in locals-focused gaming in four years.

That growth rate is tiny compared to the 222% rise in gross gaming revenue from all games of fortune marketwide in the same period, mainly driven by live table VIP baccarat—the domain of high rollers from mainland China. But the fact that Mocha Clubs have been aimed since their foundation at local players means the money they earn is essentially redistributive—taking money from lower-earning consumers and then feeding some of it back to them via the near 40% gaming tax—rather than being a net contribution to Macau GDP by taking money from mainly rich outsiders. This fact is not lost on the Macau government. It is now moving to curtail the activities of local slot parlours— including those run by SJM as well as Mocha.

The result of this government discussion is what has been dubbed in some quarters as the ‘half click’ policy— which purports to push slot parlours out of residential areas by stipulating they must be located within a 500-metre radius of a casino, or within an existing commercial buildings. In reality, in tiny Macau—which covers only 29.5 square kilometres and has one of the highest population densities in the world—very few residential areas are more than 500 metres from either a casino or commercial premises.

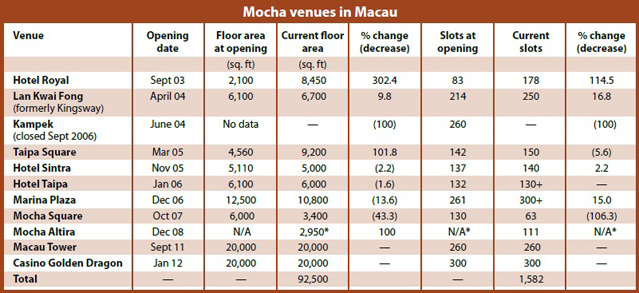

Too close to homes

Two venues have failed the ‘half click’ test. They are Mocha Marina Plaza—a venue with around 260 machines in a residential area of Macau peninsula, the downtown area, and SJM Holdings’ Yat Yuen Canidrome Slot Lounge, at the territory’s dog racing track. No dates have yet been set for the closures. Union Gaming Research said in a note last June—when shutting Mocha Marina Plaza was first mooted—that the property would probably generate only 1% of the parent company MPEL’s EBITDA in 2012 even if kept open. Union Gaming produced that estimate before the opening of two large new Mocha venues in September last year and January this year. Those two new venues, Mocha Macau Tower and Mocha Casino Golden Dragon, between them account for 40,000 square feet of gaming space—nearly half the Mocha total market-wide—and 560 machines; around a third of the Mocha machines currently in the market (see Table 1 below). The new supply injected into the Mocha portfolio may initially have a dilutive effect in terms of win per machine per day, although Lawrence Ho, Co-Chairman of MPEL, said in a commentary to the group’s fourth quarter and annual results that Mocha Casino Golden Dragon was “one of the best performing clubs in our Mocha portfolio”

The MPEL group adjusted EBITDA for 2011 was US$809.4 million, according to a company filing with the New York Stock Exchange. Let’s assume a conservative growth rate of 15% for MPEL adjusted EBITDA in 2012 (in line with some market-wide predictions). Let’s also assume for a moment that new Mocha supply coming on stream in 3Q 2011 and 1Q 2012 doesn’t create significant new demand but actually cannibalises earnings to some extent. That would mean MPEL adjusted EBITDA for 2012 of just below US$1 billion (US$930.8 billion to be precise). A one percent slice of that potentially contributed by Mocha Marina Plaza comes to US$9.3 million. That sounds modest. But Mocha Clubs’ total adjusted EBITDA for 2011 was US$40.5 million, so even allowing for a 15% growth rate in 2012, Mocha Marina Plaza would represent about a fifth of all Mocha’s earnings before interest, taxation etc., during 2012.

It’s hardly surprising, therefore, that Mocha has been keen to open new venues in what it hopes will be less politically controversial parts of town to compensate for the expected loss of Marina Plaza. And as our table above shows, the trend of the recent Mocha openings is to go for bigger casino-style venues. This also appears to align with MPEL’s recent group policy of farming out to Mocha the management of the slots in its casino operation. To some observers this makes sense because slots are Mocha’s core business. Others wonder what justification there is for a discrete slots business aimed specifically at local players if that same business is then engaged in managing and tracking slot players across MPEL’s casino slot business. Couldn’t MPEL simply manage its local players as a discrete group within its casinos—in the way that Las Vegas operators do in their casinos?

Between 2003 and 2006, Mocha Clubs were a much-needed earner first for Melco and then for Melco and its joint venture partner. But is there any need for Mocha Clubs and SJM Slots at all at this stage in the Macau gaming market’s development? Locals have plenty of opportunities to gamble in the casino hotels. Do they really need opportunities to do so in parlours specifically targeted at them?

An argument heard against local slot parlours in Macau is that they encourage behaviour among locals—i.e. casino-style gambling—that would not otherwise take place. While it’s hard to prove or disprove the ‘behaviour encouragement’ theory in relation to Macau’s slot clubs, there is one strong argument in favour of the clubs’ retention. This is that the presence of local clubs actually mitigates the redistributive effect of locals gambling. That’s because the rate of return to player (RTP) offered by these clubs—the percentage of stake money returned to the player community, albeit on an uneven basis—is well above the RTP at some of the major casino resorts in the city. The clubs also have a social element to them. Many of the customers appear to be in the 50-plus age group, and from this correspondent’s experience many of those older people use the clubs as a place to meet and socialise as well as to gamble.

But even closing one or two local slots venues won’t necessarily have an impact on levels of local gambling if the parlour operators are allowed to increase the slot numbers in their remaining venues or even add new venues. The machine numbers used in our table are a rough guide. A number of contradictory figures are given in MPEL’s own literature. And a distinction must also be made between the numbers of machines allowed by the government per venue and the numbers actually in use live on the floor. In Mocha Square, for example, discreetly tucked down a side street between Casino Lisboa and Grand Lisboa in downtown Macau, only 63 machines—including several multi-terminal machines—were in operation at the time of going to press, not the 130 listed on some consumer websites (Mocha’s official website doesn’t list machine numbers for Macau Square).

With those caveats, our table does indicate three Mocha venues have each increased their slot numbers since opening— one of them, the first ever Mocha parlour at Royal Hotel, by 114%—though that has been compensated for to some extent by a 106% reduction in machines at Macau Square and a 6% reduction of inventory at Taipa Square.

If Mocha management were to argue that it is trying to take Mocha Clubs upmarket by locating them in places such as Macau Tower—a venue with off-street parking on the edge of a middle class neighbourhood—then a counter argument might be that this is really a back-door way for MPEL to increase its general gaming inventory at a time when the Macau government is apparently committed to slowing the growth of the whole market.

There’s a time honoured tradition in the Macau gaming market of having your cake and eating it too. The most famous example has been the ability of STDM and latterly SJM to use its gaming licence to allow numerous third-party investors to have a Macau casino. The Macau government recently hinted that the days of multiple satellites are over. Its stance on slot clubs in residential areas may be another sign that it is less willing than it was to cosy up to vested business interests in the territory.

But politicians all over the world tend to operate by gesture rather than on the basis of substance. Closing one venue down in the case of Mocha and allowing two new ones with four times as much space to open in its stead—before the closure has actually taken place—looks like gesture politics; and not a very robust gesture at that. It might be better for the gaming industry and the community as a whole to have an honest and open discussion on the role of gaming targeting local players. Let the industry speak and make its case, rather than having to rely on administration by stealth or sleight of hand. Ultimately, that is the best way of safeguarding the sector’s business interests.