Macau’s getting richer—but not always thanks to heavy marketing

With China’s exports growing at a 10-month low in December and an apparent slowdown in the expansion of the Macau VIP gambling market, then it’s devoutly to be wished from an investors’ viewpoint that the higher margin mass market can take up some of the slack.

Certainly some analysts are now paying more attention to the mass sector; with a number praising Sands China Ltd (SCL) for its strength in this segment. In the fourth quarter of 2011, SCL had 23.1% of the Macau mass market, where gross margins are 35% to 40% compared to 10% in the VIP segment, according to some analysts. SCL’s mass share that quarter was second only to the historical incumbent SJM, which recorded 35.3%.

SCL’s overseas-owned rivals in the Macau market—experiencing not an actual reverse in VIP turnover, but a slowing of growth (see Table 1 overleaf ), might be tempted to start getting more Sands-like in their approach to the mass. And by more Sands-like we mean things like SCL reportedly giving away a return ferry ticket for a mere two player points earned under one of the company’s Macau mass-market loyalty schemes. The trick is to get the player to redeem the return voucher bringing him back to Macau, but no one could accuse Sands China of being half-hearted in its commitment to player reinvestment on the main floor.

There are a couple of points to make there. One is to ask how ‘sticky’ that subsidised mass player’s loyalty will prove to be over the course of six months or a year. Even Chinese VIPs—who have far more care and attention (and money) lavished on them than mass customers—have a reputation for following the money in terms of commission on rolling chip volume; changing venue and even swapping junket for the right offer. At least one junket room investor in Macau is said currently to be rebating so much of its net margin to its players that industry insiders are wondering if the directors are living on fresh air.

Another question to ask is how worthwhile SCL’s apparent levels of reinvestment are, if the mass player is from mainland China and may only visit three or four times per year at most? It used to be said around town that the return to player percentage on SCL’s slots was generally at or near the de facto jurisdictional minimum of 85%. The argument from market watchers was that SCL’s approach—at least as far as electronic games was concerned—was to relieve mass players of their money on their first trip, as it wasn’t expecting to see them again. Such anecdotes certainly don’t chime with the effort SCL seems to be making currently with its mass players, as we report elsewhere in this edition.

Another point to make is that marketing involves not only reinvesting in your current players, but in growing your own market by recruiting new ones. And that often means reaching first-time visitors before they get on the boat, train or plane to Macau.

Everybody knows that marketing casino gambling directly to Chinese citizens—when they’re at home in the People’s Republic—is forbidden. But the marketing in China of casino excursions is almost as much of a political hot potato. Everybody does it. The crime is to overstep the mark. And that mark isn’t as clearly drawn as in Singapore, where for example the casinos are not allowed to provide free shuttle buses from and to the so-called ‘Heartlands’—a euphemism for public housing zones with lower income families. It’s broadly true to say the mainland China authorities seem relaxed about their rich citizens losing a lot of money at the Macau tables, but much more anxious about their poorer countrymen following suit, for fear of creating politically dangerous social unrest. But China’s administrative system is all about drawing up deliberately vague guidelines that can then be interpreted a certain way or another later, depending on the political necessities of the moment. Las Vegas Sands Corp—Sands China’s parent company—has already fallen foul of this system once before. According to the LVS earnings report for the third quarter of 2010, a company affiliate involved in nongaming marketing activities in the People’s Republic was given notice of an RMB10.8 million fine in relation to “certain payments made by the company’s wholly foreign-owned enterprises to counterparties and other vendors in China”.

So Macau operators may generally find it politically safer to focus their competitive effort on marketing to those players who are already in Macau. If, however, a mass-market rewards war were to break out among the operators during Chinese New Year and beyond, then as the likely holiday ‘bounce’ decays, such competition might succeed only in cannibalising the existing market and driving down gross margins on mass play.

There’s some historical evidence from the VIP market to support this cannibalization thesis. When Crown Macau (now Altira) increased the commission paid to junkets for VIP rolling chip turnover by a third almost overnight in December 2007, what it did was to expand rapidly the property’s share of the high roller market—from HK$16 billion rolling chip turnover per month in November 2007 to HK$70 billion in December—a growth rate of 337.5%. What the strategy didn’t do was to expand the whole VIP market at the same rate.

The most obvious reason for Macau casinos to offer junket agents greater incentives or to offer mass-market players greater rewards is to build market share. But unless the whole market grows at the same time, the side effect of major hikes in commissions and incentives is indeed likely to be an erosion of margins and/or a cannibalisation of the market’s existing business.

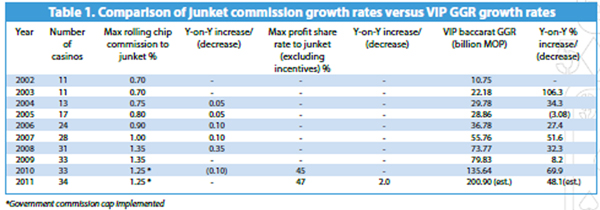

As Table 1 below shows, while maximum rolling chip commission rates paid to Macau junkets rose incrementally and relatively smoothly up to the point of Crown Macau’s 1.35% market-busting offer in December 2007, the year-on-year growth rate in VIP baccarat gross gaming revenue has been relatively lumpy over the last decade. That growth has been affected by a range of external factors including not only fluctuations in the casinos’ baccarat hold rates, but also microeconomic policy out of China (the inward visa restrictions imposed on Chinese citizens in early 2008) and macroeconomic issues such as the credit crisis that began in the West in the autumn of 2008 and extended into 2009, also impacting China’s export market and therefore Macau’s VIP gambling growth rate.

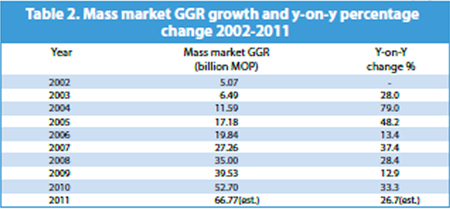

Table 2 (below) shows a mostly positive correlation between the growth of the mass market between 2002 and 2011 and the growth of the VIP market in the same period. The one exception was in 2005, when the VIP market actually contracted by 3.08% year on year, while the mass market—spurred by the opening of Sands Macao in May 2004—grew by 48.2%.

But the variation in the rate of upward movement in the mass market as compared to the VIP during the period suggests that the pressures acting on the two segments are different and not influenced only by the positive beta of China’s economic growth. Without further insight into exactly what other pressures are acting on the mass market (and here we are discounting visa restrictions as there have recently been rumours of fresh and selective quotas on permits for mass players but no hard evidence), then it would be difficult to foresee the outcome if casino operators started competing harder on mass market player rewards.

In Las Vegas or Atlantic City, casino operators can target potential players or market to existing players before they even leave the house. In China, that’s harder to do—especially in the mass segment. It’s understandable, therefore, that the marketing focus in Macau has tended to be in battling for customers among visitors already on the streets and in the casinos. But the supply of Chinese gamblers to Macau can be subject to subtle political pressures as well as the positive effects of China’s economic growth. So until such time as the vast hinterland supplying Macau is operating as a pure market rather than as a giant social experiment ultimately overseen by the Chinese authorities, it’s likely that the application of traditional Western techniques for building business will produce yet more lumpy gravy and not the jam that the operators undoubtedly desire.