Gaining Intelligence

As vital for business as it is for war

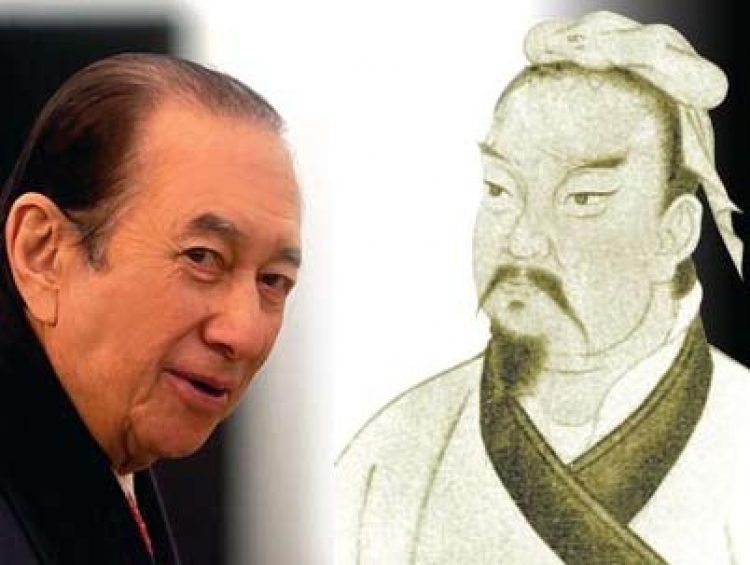

Another Asian warrior-philosopher still read today by business executives is Oda Nobunaga. He was a 16th century Japanese warlord and a student of Sun Tzu’s teachings. He used to reward his spies as handsomely as warriors who fought bravely for him in battle. His logic was simple. Knowing what the enemy is doing before, during and after battle is as vital to military success as prowess on the field itself.

SJM doesn’t have spies, it has ‘guanxi’ or ‘connections’—a far more valuable commodity. Both Dr Ho and Dr Lui Che-woo, the mainland-born founder and chairman of the other Chinese-run Macau gaming operator, Galaxy Entertainment Group, are committee members of the Chinese People’s Political Consultative Conference, the advisory body to the leadership of the People’s Republic of China.

SJM and Galaxy have at least three major advantages over their foreign operator rivals in the Macau market when it comes to gathering political intelligence that can affect the market, such as China’s thinking on how to implement the Individual Visit Scheme of independent travel visas for mainland residents wishing to visit Macau:

- access to the ongoing conversation within China’s political leadership regarding policy on Macau (if not direct access to some of the politicians themselves);

- the advantage of insight, via shared language and culture, into understanding what shapes the thinking of the leadership in making those decisions;

- knowing the political and business culture and knowing how and when to conduct negotiations in private and how and when to make pronouncements in public.

Forewarned is forearmed

An example of the political problems that can arise suddenly and seemingly without warning for foreign operators in the Macau market is the Macau government’s announcement in late April that it would only authorise work permits for migrant workers on Macau construction sites on a ‘one for one’ basis, i.e., one migrant for every one local employed. Sands China says it needs 10,500 workers for its US$4.2 billion Cotai extension, but only 2,500 local construction workers were registered as unemployed and seeking construction jobs in 2009. Leaving aside the conspiracy theory that the government was somehow ‘punishing’ Sands China for the past ‘sins’ of LVS, such as pressing ahead with its Singapore resort while suspending work on Cotai, it’s not hard to see how having advance warning of such a policy change could carry commercial advantages for a casino operator or at least protect it from commercial risk.

The benefits of such political channels and political intelligence to the incumbent SJM and to Galaxy should not be underestimated. Rumours had been circulating since last December that the government was going to cap the number of gaming tables in the Macau market. The cap was eventually announced in April at 5,500 tables between then and the end of 2012. And yet Louis Ng, an executive director of SJM, confirmed on the day that SJM’s latest property Casino Oceanus opened in December 2009 that SJM had an allocation of 1,700 tables in the market. Mr Ng may have been revealing more than he realised. At the end of the fourth quarter of 2009, the Macau market had 4,470 tables, according to the Gaming Inspection and Coordination Bureau (DICJ). That means if Mr Ng is right, SJM was guaranteed 35.6% of the tables in Macau at that time, despite in 2009 as a whole having only 26.5% of the market by share of gross gaming revenue.

That might explain why SJM’s market share rose to 31.9% in the first quarter of 2010—a reversal of a three-year trend that had seen SJM’s market share fall from 70% in 2006, to 27% in 2008. SJM may have in effect been re-programmed for success in the last few months by being given an overweight allocation of tables compared to its rivals. How could that have happened? Most likely by harvesting goodwill SJM had previously sown among government leaders.

As Sun Tzu also says: “The victorious strategist only seeks battle after the victory has been won, whereas he who is destined to defeat first fights and afterwards looks for victory.”