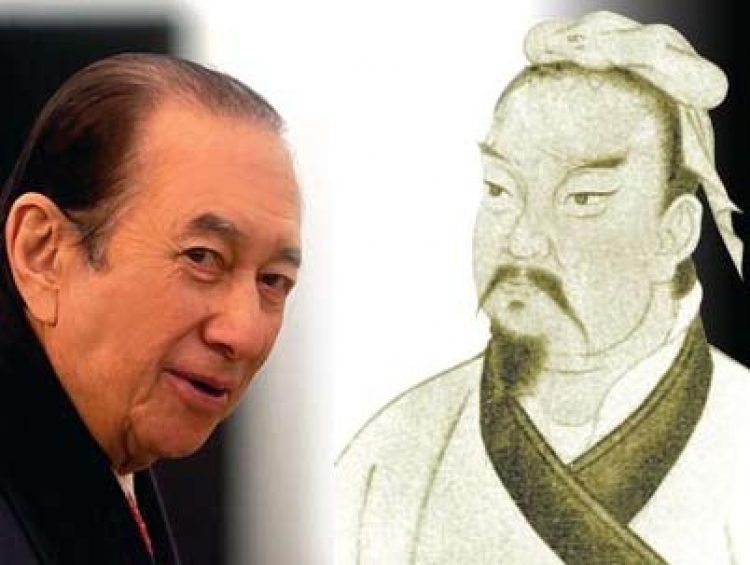

SJM’s market rivals could do worse than read Sun Tzu’s treatise on how to win a battle

“The art of war teaches us to rely not on the likelihood of the enemy’s not coming, but on our own readiness to receive him; not on the chance of his not attacking, but rather on the fact that we have made our position unassailable.”

Sun Tzu ‘The Art of War’

Stanley Ho still controls the largest single share of the Macau gaming market (31.9% of the gross in the first quarter of 2010) even eight years after the formal end of his monopoly and six years after the opening of the first foreign owned casino, Sands Macao.

It’s easy to read too much into SJM’s and Dr Ho’s continuing ascendancy in the Macau gaming market. It could be as much to do with his competitors’ mistakes (such as their initial determination to try to cut out the junkets) as his own good judgement. And SJM has suffered self-inflicted wounds along the way, such as the intra family litigation linked to SJM’s flotation on the Hong Kong Stock Exchange.

Dr Ho is a mortal just like the rest of us, as his recent unfortunately extended stay in hospital illustrated. Like a good general or a good chess player, however, Dr Ho and his management team do seem to have the ability to see several moves ahead in the game. This means that when SJM acts in the Macau market, it may not be doing so in a strictly linear ‘stimulus and response,’ ’cause and effect’ way. It may be positioning itself for an opportunity as yet unseen by the market as a whole or in order to counter a threat several steps down the track. In order to get that overview, you either need a high vantage point, or good intelligence. SJM has both.

Commission war

An example of staying several steps ahead in the market is the way that SJM-linked interests were able to head off the Western operators’ attempts to gang up against SJM on junket commission rates. That commission battle started in late 2006 with the opening of Wynn Macau and heated up after the opening of The Venetian Macao in August 2007 and MGM Grand Macau (now MGM Macau) in December of that year.

Dr Ho went on record in September 2006 complaining that ‘cutthroat’ competition on junket commissions risked tipping a third of his junket operator partners into bankruptcy. He had a point. In 2002, before outside competition arrived, the average commission rate on VIP chips in Macau was 0.7%. By 2008, it had crept up to an average of 1%. But was Dr Ho’s hand wringing merely a feint to buy time while he developed a new method of attack?

“Hold out baits to entice the enemy. Feign disorder, and crush him,” as Sun Tzu puts it.

If it was a feint on Dr Ho’s part, then Sheldon Adelson, the Chairman and Chief Executive of Las Vegas Sands Corp (LVS), certainly took the bait. Soon he was telling Dr Ho via comments to CNN and other media outlets to stay out of the competition kitchen if he found it too hot. Meanwhile, SJM-linked interests were quietly working behind the scenes on a deal that was to have far reaching implications in the commission war.

The Amax deal

Here’s what happened next. In December 2007, AMA International, a junket consolidator, signed a deal to supply VIPs to Melco Crown Entertainment’s Crown Macau property on Taipa in return for an eye watering 1.35% commission on rolling chip volume—nearly one third more than anything seen in the market up until then. In effect, MPEL was trading margin for volume. This had a huge impact on the profit potential of the other operators in the VIP baccarat-focused Macau market. They had a choice—either try and compete on price, or watch junkets up sticks and abandon their tables to join the AMA bandwagon. If they chose to compete on price, they would find their margins—already tight and reliant on play volume for profitability—squeezed still further.

Here are some facts about that AMA-MPEL deal:

- AMA International is a subsidiary of Amax Holdings (formerly Amax Entertainment Holdings), a 49.9% stakeholder in Macau’s Greek Mythology Casino.

- Greek Mythology is an SJM-licensed, VIP-focused casino operation inside the New Century Hotel on Taipa.

- The New Century is across the road from Crown Macau (now Altira Macau), the VIP-focused property built by Melco Crown Entertainment (Nasdaq: MPEL).

- MPEL is co-chaired by Dr Ho’s son Lawrence.

- After opening late and over budget in May 2007, Crown Macau was struggling to make an impact and to grab market share in its target VIP segment.

- Within two months of the AMA deal, Crown Macau had gone from also-ran to grabbing 18% of the gross in the Macau VIP market.

- The commission rate hike hit SJM’s VIP room business and profits as some junkets that had previously done business with SJM casino VIP rooms moved to Crown. But that migration hit the Las Vegas operators just as hard, if not harder, given they were operating on a lower volume of roll than SJM to begin with.

- In early 2009, the Las Vegas operators called for talks on competition issues, including junket commissions, with the talks to be chaired by Dr Stanley Ho. Exactly who talked to whom to make that Crown Macau-AMA International deal happen is speculation, but it shows what the Las Vegas operators are up against in terms of SJM’s market coverage and connections in the local industry.

If it was a victory for SJM, it was a pyrrhic one. But it also arguably saved the prospects of Lawrence Ho and his business partner James Packer in the Macau market, by generating cash to help pay for Crown Macau, and creating some leverage for the funding of MPEL’s Cotai property, City of Dreams.

As Sun Tzu says: “…when using our forces, we must seem inactive”.