CLSA predicts 30% annual growth in Macau during 2010, as the industry ponders a possible table cap

Predicting the growth of Macau’s gaming market appears at times to be as much about art as it is about science, though in truth the issue is not ‘whether’ Macau will grow, but how much growth it will experience.

Predictions matter, however, because investors need an understanding of what kind of return on investment they can expect and over what period of time in order to feel comfortable about committing capital in the form of debt or equity at a particular price point. Investors also tend to seek to understand the regulatory and political demands of a market in which they are investing, and don’t much like situations where such an understanding is difficult to arrive at.

The good news in this search for predictability is that the current Macau licence concessionaires and sub-concessionaires are effectively a ‘protected species’ as participants in a state monopoly divided between only six players, in a market growing year-on-year by 9.4% even in 2009, when the aftershock of the global credit crisis was being felt.

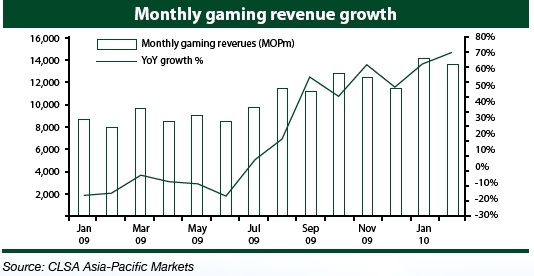

Macau’s gross gaming revenues grew by an average of 66% year-on-year across the first two months of 2010. But so far, few analysts appear to have revised earlier, relatively conservative, estimates for 2010 performance of around 15% annual growth. That could partly be a function of the fact analysts are still crunching their numbers. It could also be a function of their caution based on the experience of previous stop-go factors in Macau’s gaming market. These include China’s exercising of its right—as the supplier of around 60% of all Macau visitors—to control the ‘on-off’ tap by rationing individual visas to the territory. Another issue that could have an impact on 2010 gaming revenues in Macau is a potential downturn in China’s export orders if the weak economic rally seen in Europe and North America relapses into full blown recession in some major importing countries.

Some commentators also fret over possible credit rationing measures by Beijing designed to cool the growth of Chinese assets, including real estate and equities. That, in turn, is likely to have an impact on the issuance of credit to high roller gamblers in Macau. In 2009, VIP play accounted for 66.8% of all gross gaming revenues from games of fortune in the territory.

Some commentators also fret over possible credit rationing measures by Beijing designed to cool the growth of Chinese assets, including real estate and equities. That, in turn, is likely to have an impact on the issuance of credit to high roller gamblers in Macau. In 2009, VIP play accounted for 66.8% of all gross gaming revenues from games of fortune in the territory.

The rapid pace of gaming revenue growth seen in the first two months certainly gives a passing impression of a cash and credit-fuelled bubble—mirroring what’s happening in China’s wider economy.

Many analysts may have been put off extrapolating annual growth estimates for Macau based on first quarter GGR performance by the recent excitement, and to some extent confusion, caused by an announcement by Francis Tam, Macau’s Secretary for Economy and Finance. According to media stories in late March, Mr Tam was reported as saying a maximum of 500 new tables would be allowed in the Macau market between now and 2013.

Such regulatory hiccups notwithstanding, CLSA Asia-Pacific Markets, an independent brokerage and investment group, has been prepared to put some bullish cards on the Macau gaming table regarding 2010 growth.

Admittedly, CLSA’s latest report on the Macau gaming market by Aaron Fischer and Huei Suen Ng, titled ‘Charging ahead’, was published on 23rd March, shortly before Mr Tam’s announcement. Nonetheless, CLSA’s forecast of 30% growth year-on-year for 2010 hardly seems radical, given the current growth trajectory of Macau in the first quarter.

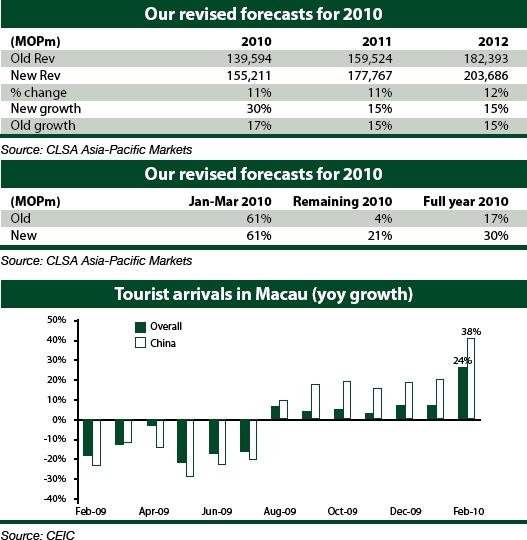

“With such a strong start to the year, our implied growth for the rest of the year appears too light. As a result, we have lifted our top line gaming revenue forecast from 17% to 30% for full year 2010,” states the CLSA report.

“We have revised our gaming revenue forecasts for Macau to MOP155 million (US$19 billion) for the full year 2010, implying 30% yoy [year-on-year] growth,” the report continues.

“We have revised our gaming revenue forecasts for Macau to MOP155 million (US$19 billion) for the full year 2010, implying 30% yoy [year-on-year] growth,” the report continues.

“The first three months is expected to register above expectations growth at 61% yoy. As a result, our earnings and target prices for Sands China, Wynn, SJM and Melco Crown have been revised upwards,” adds the research paper.

“Unless there is some shocking contraction in the second half caused by a severe credit tightening in China or unforeseen events that greatly restricts travel, we expect our forecasts to be met,” states the CLSA report.

CLSA also points out that in January and February, visitor arrivals increased by 15% year-on-year, “a sharp rebound” from a decline of 5% in the equivalent period last year. It adds that the number of tourists from mainland China grew by 28% in the first two months of 2010. In February, the month of this year’s Chinese New Year holiday, the number of mainland tourists grew 38% year on year.

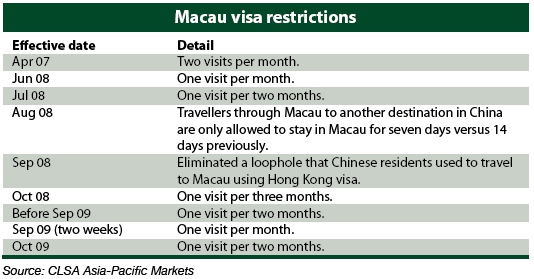

“There had been concerns on tightening of visas with recent explosive growth in gaming revenues. As a reminder, the Chinese and Macau governments intervened when gaming-revenue growth hit 60% in 2008,” says CLSA in its report.

“While it was not the first time China restricted mainlanders’ entry into Macau when it sensed an overheated market, the measures were more stringent than before.”

Entry was limited from once per fortnight to once per month effective 1st June 2008, and elevated to once every two months starting 1st July. Perhaps the most influential measure was the separation of Hong Kong and Macau visas effective 1st September.

CLSA acknowledges that a potential dampener on the growth of Macau’s gaming sector growth could be the limited access to high quality labour. “In terms of human capital, we understand from the operators that hires have to be mainly local Macanese and that expats who need to renew their work permits were facing difficulties unless they are of managerial positions. During the recent policy address, the Chief Executive mentioned that this policy is now being reviewed. With two large projects coming on next year, we expect labour demand to pick up,” states CLSA.

CLSA also has words of caution regarding any attempts by the Macau government to introduce a formalised policy to cap the number of tables in the market.

CLSA also has words of caution regarding any attempts by the Macau government to introduce a formalised policy to cap the number of tables in the market.

“Macau cannot transform itself into a manufacturing hub because it does not have the land size or a sizeable, cheap labour force. Nor does it have a highly educated workforce that would allow it to compete in financial or professional services or other highly valued areas such as biotech.

“We believe that the obvious area is tourism and the Chinese government has mentioned on many occasions that they support Macau’s drive to become a tourism and leisure hub. With the implementation of a table cap, gaming operators are less incentivised to build properties without the cash flow from gaming to support it.”