Warning signs

It can’t be all good news

Teething problems

The challenge for Marina Bay is erecting the SkyPark, which will connect the three 55-storey hotels. Rides at Universal Studios will have to satisfy strict testing requirements by Universal’s parent company, General Electric. As at the City of Dreams recently, casinos tend to suffer from a low hold rate when they first open. Service levels will also probably disappoint on day one as staff are trained up over time. There will be around 20,000 new employees for both resorts.

Bad press

We can almost guarantee there will be bad press around the opening. We expect numerous articles discussing how the casinos are destroying the social fabric of society. We saw it before in Melbourne and to some extent the press will be right. But there is growing recognition that the positive benefits of legalised casinos (essentially increased economic activity and job creation) outweigh the side effects, which the Singapore government will work hard to manage. Their track record speaks for itself.

Low ROIC

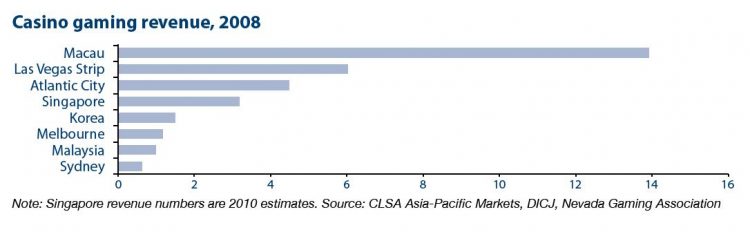

Although well flagged, it is true that the ROIC for the Singapore casinos will be in the mid-teens in the first two years. The reason is the high capital expenditure required for the non-gaming components. Mid-teens ROIC is significantly lower than in Macau, which is typically in the range of 20-30%.

Early casinos such as Sands Macau were in excess of 100%. However, we believe mid-teens is reasonable for Singapore, which is a lower-risk market due to a clearly defined supply outlook (only two casinos), clear government support and significant growth potential.