A rosy future

Six reasons to be bullish on Singapore gaming

Asians have a high propensity to gamble

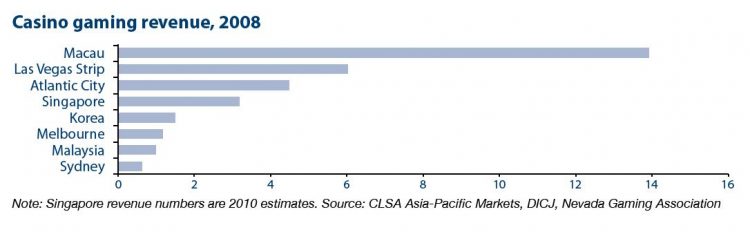

The average bet in Macau is US$100 versus US$20 in Las Vegas. Singapore is well located to tap into the huge Southeast Asian market—there are an estimated 164 million people within a one hour’s flight. Singaporeans also have an avid interest in gambling (54% of locals gambled during 2008; of whom 71% gambled at least once per week), so there is actually a bigger pure-locals market than in Macau. Pent-up demand in this region is huge and we do not believe it is a market-share game in competition with Macau or other Asian-Pacific markets.

Money to burn

Southeast Asia, and indeed Asia, is home to some of the world’s fastest growing economies. The region is expected to maintain GDP growth of 5%-plus over the long-term. Along with GDP growth comes rising incomes. MasterCard estimates that the number of Asians earning more than US$5,000 will reach 639 million by 2014 from almost 400 million now, or 5% Cagr [compound annual growth rate]. Singaporeans, who are expected to make up one-third of casino visitors to the Singapore resorts, have the third-highest GDP per capita in Asia of US$30,000.

Tourist heaven

The Singapore casino-resorts will offer more gaming activities than are available in Macau or elsewhere in Asia-Pacific. Marina Bay Sands is building expansive convention facilities; 1 million sq. ft of mid- to high-end retail; numerous restaurants; 2,600 hotel rooms and the SkyPark, which we believe will be one of the leading tourist attractions in Singapore. Resorts World Sentosa includes Universal Studios, which will be one the largest theme parks in the world. All these attractions will support more than 17 million tourist arrivals by 2015 (+70% from 2008). We expect average length of stay will increase to four days (from 3.2 days currently), which compares with Macau’s 1.3 days.

Government support

Gaming taxes are between 12-22% versus 39% in Macau and 25% in Malaysia. The success of the integrated resorts is in the interests of the government as this initiative represents a tool to attract tourists, create jobs and add to the increasingly dynamic cultural landscape of Singapore. Ebitda margins will be high at around 40%, although ROIC [return on invested capital] will be in the mid-teens given the high capital expenditure.

Efficient infrastructure

Singapore is a well-established travel hub, with an efficient air, land and sea transport network, making it an attractive location for a casino-resort. Both casinos are located just 20 minutes’ drive from the airport. Currently, 4,500 flights arrive weekly into Singapore from 185 countries. There are strong connections to Australia, Europe and the US, which unlikely many other Asian cities. Singapore enjoys a more stable political, economic and social environment than Macau, which should result in more predictable revenue streams.

Less reliance on VIP play and junket operators

We believe VIP play will contribute around 40% of revenue, compared with Macau’s 70%. This is positive as VIP revenues can be more volatile (closer correlation to macroeconomic conditions and loan growth) and significantly lower margin due to the high commissions paid to junket operators. For these reasons, we believe investors will be prepared to assign higher valuation multiples to stocks with more dependence on wider margin, more predictable mass-market business.