Risky Business?

Investment in the Philippines gaming industry may require some appetite for adventure

In the Philippines the risk factors for investors in the local gaming industry include not just the standard market question of ‘Will they (the customers) come?’ but also political and regulatory issues.

The Philippines is by no means universally regarded around the world as either a stable or as an exemplary jurisdiction when it comes to financial matters. This may account for why the investors in the two Manila projects are all East Asian or Southeast Asian institutions, namely: Malaysia’s Star Cruises; ARUZE Corp., a gaming equipment maker and operator with roots in Japan; Alliance Global Group and SM Investments Corporation, both based in the Philippines. They all presumably have a greater insight into local market and regulatory conditions than would Western companies.

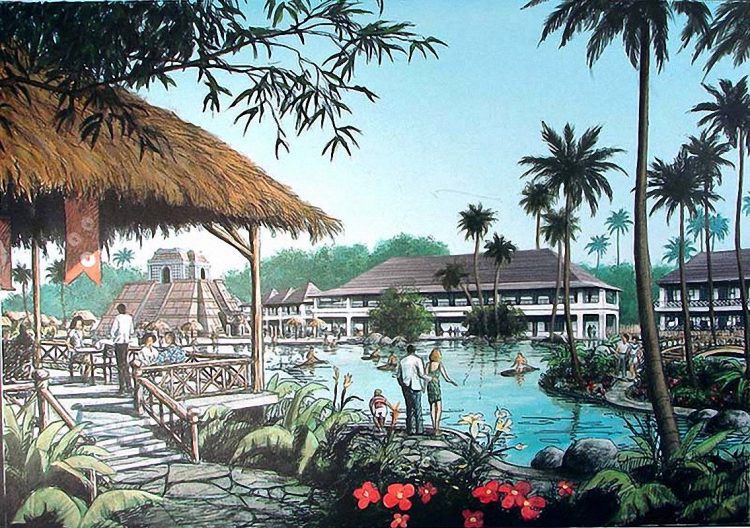

At Asia’s GEM, the gaming industry congress and expo held annually in early April by Pagcor, guest speakers were generally full of praise for Newport City and for Bagong Nayong Pilipino.

But even before Asia’s GEM had closed its doors on 3rd April, the Organisation for Economic Co-operation and Development (OECD) in Paris named the Philippines as one of 84 ‘non-cooperating jurisdictions’ in relation to the transparency standards of its taxation laws. Within days, though, the Philippines had been taken off the list after the organisation said the country had committed to meeting the OECD’s policy guidelines.

Risk factors

Political and regulatory risks remain for investors in the Philippines market. On 1st April the country’s lower national legislature, the house of Representatives, passed to the nation’s Senate a bill requiring, quote: “that all the funds and transactions of Pagcor including revenues, income and expenditures, be examined by the country’s Commission on Audit (CoA).”

The CoA has been involved in some auditing of Pagcor for years. What was significant about this bill is that it seeks to amend Presidential Decree No. 1869 issued by former president Ferdinand Marcos. That decree currently limits CoA audits to ensuring that the government’s cut—i.e., 5% in franchise tax and 50% of gross earnings—is fully accounted for. If the new bill becomes law then in future (possibly as a result of pressure from international bodies such as the OECD), the auditors will be able to shine a light over every corner of the Pagcor books. Given what the CoA has found in the Pagcor figures previously even under its existing limited mandate, fresh scrutiny could raise fresh concerns for the investment community.

Audit evidence

CoA documents seen by Inside Asian Gaming and issued after the Commission’s audit of Pagcor’s accounts for 2007 claimed at that time examples of lax regulation, non-payment of tax, overspending and unauthorised enhancement of employment benefit packages by Pagcor. These issues and the legislators’ external pressure to implement a full audit on Pagcor must call into question just how committed Pagcor really is to reform from within.

Take this example from a CoA document titled: “Status of Implementation by Auditee of Prior Year’s Audit Recommendations”. The document, relating to the 2007 audit of Pagcor by the Commission (the most recent currently publicly available), is divided vertically into three columns reading from left to right: “Audit Observations”; “Recommendations” and “Actions Taken/Comments”

One audit topic reads: “Cash dividends from Pagcor’s net earnings for calendar years 2005 and 2006 not remitted to national government.” Next to this is the auditor’s advice: “We have recommended that Pagcor comply with RA 7656 (the relevant Republic Act) and its implementing rules and regulations to remit annually the 50 percent cash dividends of Pagcor net earnings to the national government to avoid penalty charges and criminal liabilities.” Under the “Actions Taken/Comments” column is the bald statement in bold type: “Not Implemented”, followed by an explanation: “Pagcor reiterated its position that it is not covered by the memorandum on the maximization of dividend payments to the national government by GOCCs [Government Owned and Controlled Corporations] and GFIs [Government Financial Institutions] citing the same grounds invoked in Pagcor’s exemption from RA 7656. Pagcor sent a letter to the Office of the President concerning the proper interpretation of RA 7656. The Office of the President referred the letter to the Department of Finance.”

The fact that Pagcor appears in these documents to be conducting negotiations over its tax liabilities direct with the President of the Republic must raise questions about its potential exposure to hostile regulatory action by politicians in the country’s Senate.

Give and take

Experts on tax law and tax compliance would no doubt point out there’s generally more room for negotiation between governments and big corporations over tax payment than there is between governments and average individuals. In other words, governments always push corporations to pay more, and companies return the favour by seeking loopholes and favoured status. In that respect, Pagcor may only be doing what businesses across the world try every day. The difficulty for investors in Philippines gaming projects is the current relative lack of transparency in relation to Pagcor’s tax liabilities. It makes it difficult to anticipate what Pagcor’s tax liability will be in a year or 18 months’ time and whether any new liabilities as established by the courts or the legislature will be passed on to the investors.

Perhaps the most damning revelation of all made by the Commission on Audit team when looking at Pagcor’s books for 2007 was an admission by Pagcor that if accounting standards recommended by the Commission were adopted, it would mean a halving of Pagcor’s previously stated net income for the year.

“Recasting Pagcor’s 2007 Statement of Income and Expenses based on CoA’s position on what constitutes gross earnings will result in a 52.39% decline in Pagcor’s net income and a cash loss of PHP776,703,081.91 [US$16.3 million]. In any case, pending final resolution of the cases before the Supreme Court there can be no definitive finding on the matter, with Pagcor, CoA and the Department of Finance/Bureau of Internal Revenue (BIR) having different positions on the issue.”

Worries

This kind of regulatory uncertainty would probably get the due diligence teams of most foreign investors reaching for a bottle of strong liquor. Time will tell whether sufficient safeguards and rigour can be injected into the system to turn investment in the Philippines’ new generation of casino resorts from a wild card play to a blue chip investment.

Mikio Tanji of ARUZE is upbeat though about the prospects of the Manila projects.

“Our aim in Manila is to try to reach the best and the most sophisticated customer all over the world here in Manila Bay,” he says.

“Although we are a shareholder in Wynn Resorts we would like to surpass Wynn Resorts. We would like to combine the hospitality people here in the Philippines with Japanese sense of service and design. I think we can achieve this.”