Wanted: Customers

Not enough foreigners are currently saying ‘Wow’ to the Philippines holiday offer

If the Newport City project is relying on foreign tourists alone it could struggle, despite its proximity to Ninoy Aquino International Airport.

A modest 3.14 million foreigners visited the Philippines in 2008 according to the country’s Department of Tourism. That’s a little more than one-tenth the number of visitors that Macau recorded in the same period. The good news is that of the top four national markets delivering tourists to the Philippines (judged by volume) three are countries with a lot of dedicated gamblers, namely: South Korea (611,629 visitors and a market share of 19.48%); Japan (359,306 and a share of 11.44%); and China (163,689 and a 5.21% share). Of more concern to investors will be the sluggish growth rate of Philippines tourism. Despite the regional boom time that lasted up to the third quarter of 2008, the country managed only 1.53% year-on-year growth in tourist numbers, as compared to 2007, according to DoT data. By contrast, Macau’s visitor numbers soared by 13.4% year-on-year in the first 11 months of 2008.

The success or otherwise of both schemes is also likely to depend on controlling capital costs; on how highly leveraged the partners are on the projects and what the covenants are from the lenders regarding repayment of the interest and the principal. Last, but by no means least, it depends on the risk appetite and patience of the investors.

“From our perspective, we accept there will be challenges in terms of funding and credit tightening,” says Mr Sian of Alliance Global.

“But fortunately for us, we were able to bring in a very strong partner [at Newport Entertainment City] and we were able to close a deal prior to the global meltdown.

Funding has been secured for that first project,” he adds.

Local funding

“Although credit has tightened globally, I think in the Philippines liquidity is still there for good projects,” says Mr Sian.

“We’re looking to go out into the market and raise something like US$150 million to US$200 million dollars. We believe we will be able to secure that entirely in the Philippines. And so, for well developed projects with good proponents, people should be able to get credit still in the Philippines market.”

“Pagcor has done a wonderful job in laying out the foundations for attracting investors,” he adds.

“The proof is that ARUZE is here. Our partner Star Cruises has also invested here. In fact, Star Cruises have not only invested in us, in terms of Travellers’ International [a joint venture company between the two to run the hotels on the Newport City site] but they have also decided to move their entire back office to the Philippines. We’re talking about regional surveillance, their legal centre, their training centre—so that is the kind of commitment they are putting into this country after they have seen the quality labour we have in the Philippines. I think the incentives and the policies have already been well laid out by Pagcor. I think it’s time for us as investors to actually execute it, so we’re doing just that,” asserts Mr Sian.

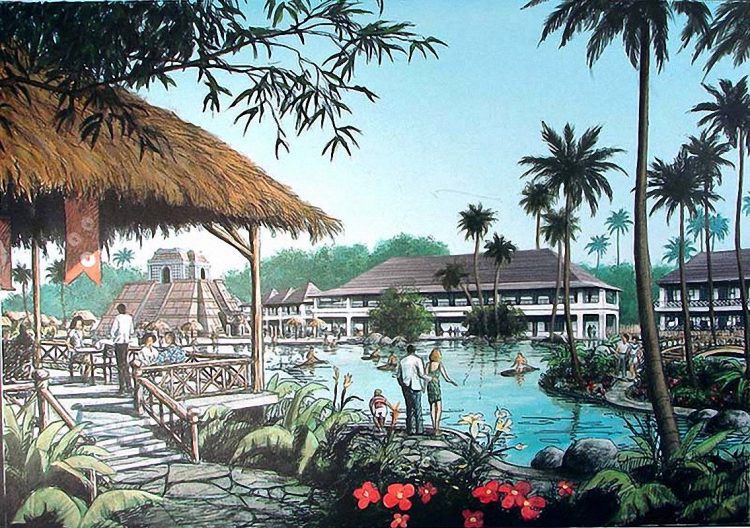

Manila Bay

“The other project we will start this year is what is called the Bagong Nayong Pilipino project and we have a 40-hectare development there. This will be part of a larger vision of the [Pagcor] chairman [Efraim Genuino] in that area. We will start this year on that project. Since that is a larger project, it will obviously be completed over a number of years,” explains Mr Sian.

Merril F. Yu, President of the Philippines company SM Hotels, part of the SM Group, is another participant in Bagong Nayong Pilipino. SM’s parent company SM Investments Corporation is through its other subsidiaries the developer and operator of the SMX Convention Center and the Mall of Asia near to the proposed Manila Bay gaming resort site.

“We have a very aggressive schedule in terms of supporting tourism around the country,” says Mr Yu.

“We want to develop the Mall of Asia as a tourist and entertainment hub in Manila. That supports Pagcor’s drive to make Manila a competitive centre that draws its fair share [of visitors] against the other short haul Asian markets, including Macau and Singapore when eventually it [the casino resort sector] opens.

“There are fairly extensive designs for the casino as well as the existing SMX [Convention Center] which we plan to expand. It is aggressive, but we are taking the extra time to make sure that what we build is competitive and augments the existing Mall of Asia complex,” adds Mr Yu.

“We are one of the three licence holders [in the Metro Manila gaming market expansion]. And SM even before this has always been a firm believer in the natural talent of the Filipino people. We hold the greatest strategic location in the short haul market in Asia. For that reason we’ve supported the initiatives,” he explains.

“We’re in the process of executing a development plan that will fulfil our requirements to really achieve this dream in the near horizon. Specifically we have already announced a rather large project which is a Radisson Hotel which will augment our SMX [Convention Center] operations. We also have planned a secondary hotel to support the casino operation as well as some other things in the pipeline. We are really quite excited about getting started on this. When you look at the horizons past the present financial crisis—within say a 24-month horizon—we’d expect our operation to be open.”