The Philippines is busy building the first of two casino resorts—but will tourists come?

‘Build it and they will come’ was more or less the mantra of Las Vegas Sands Corp. in Macau. They did, but ‘they’ didn’t—or at least not in enough numbers and not quite quickly enough to keep nervous bankers happy. To be fair to LVS, the company had a once in a lifetime run of bad luck with world economics, compounded by some microeconomic and political issues unique to China.

So if Macau is struggling to find success with the brave new world of Asian integrated resort gaming in the present global downturn, what are the chances of a secondary market such as the Philippines making a success of it?

Broadly speaking, the plan of the Philippine Amusement and Gaming Corporation (Pagcor), the government-owned gaming operator-cum-regulator, is to marry the market experience, relative liquidity and local fundraising skills of domestic real estate developers with the operational and equipment manufacturing expertise of foreign gaming companies by building two integrated gaming resorts in Manila.

Making plans

Part of the difficulty for outside investors and analysts in assessing the medium to long-term prospects of these schemes is that the details appear to change on an almost daily basis. Even the names of the projects vary depending on to whom you talk.

The scheme that’s already well under way—Newport City, near Manila’s international airport—has been touted by the country’s president and central government as an economic regeneration project. Nowhere on Newport City’s website however will visitors find the word ‘casino’. There’s lots of talk about hotels, an ‘entertainment complex’, a ‘sports complex’ and a golf course, but the ‘c’ word is notable by its absence. In the Philippines it appears that gaming is often a product that dare not speak its name for fear of offending opponents. This is in stark contrast to Macau where gaming is at the heart of the economy.

Newport City (also sometimes referred to as Newport Entertainment City) covers a 25-hectare site in the Pasay City district of Metro Manila within sight of the international airport. Building work on the gaming resort portion (about eight hectares) is already well under way and that part of the scheme is touted for completion this year. Inside Asian Gaming understands it will have a casino (though the precise branding of the casino is yet to be confirmed officially) as well as a Marriott Hotel (understood to be the first Marriott-branded property in Metro Manila) and a suites-only Maxims Hotel—a Genting branded product.

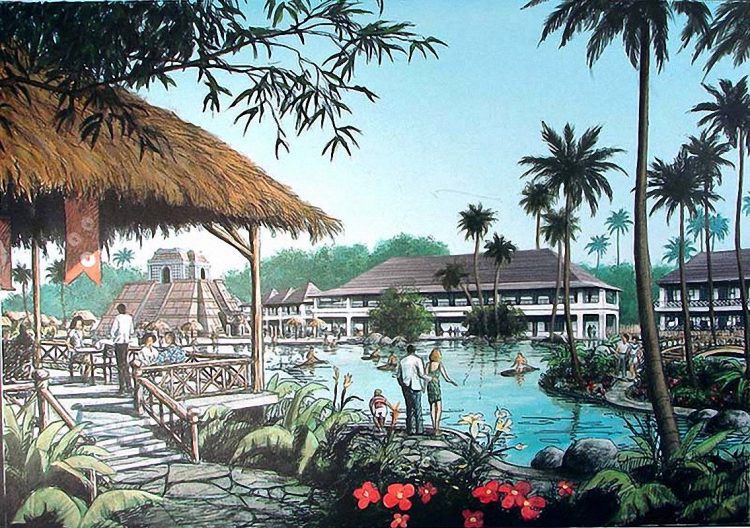

The second gaming resort project is a more ambitious 40-hectare site on reclaimed land at Manila Bay near to the SMX Convention Center. This site has been referred to at various times in various ways as: Bagong Nayong Pilipino—Manila Bay Integrated City; Bagong Nayong Pilipino—Entertainment City Manila; Pagcor City and just plain ‘Manila Bay’. What does seem clear is that it will have a casino resort under the branding ‘Okada Resort Manila’ or possibly ‘Okada Resort Manila Bay’, in recognition of Kazuo Okada, founder and chairman of ARUZE Corp., which has confirmed it will be the gaming partner for the second scheme.

Funding is still being finalised for the second scheme, says one of the partners, SM Investments Corporation, the holding company of the Philippines-based SM Group, although no clear guidance has so far been given to the media on the budget. In September last year, a figure of US$1.1 billion was mentioned in the local media in relation to development of an area referred to as ‘Manila Bayshore’, a zone that forms part of the Manila Bay regeneration area. It seems reasonable to assume that this budget may well have been revised downward in the wake of the global credit crisis that gripped financial markets soon afterwards.

SM Group’s parent company was publicly listed in 2005 and is now one of the Philippines’ biggest conglomerates, occupying a leading position in shopping malls, retailing, banking, finance and property.

The success of both Manila schemes may depend on how much the two business models rely on foreign visitors and how much on home-grown customers. Those numbers will in turn be influenced by what happens in the regional economy.