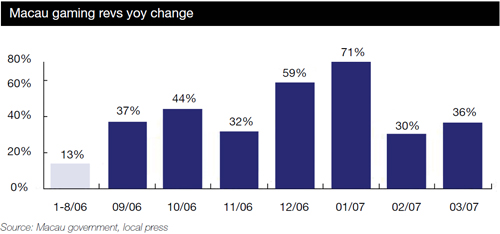

Macau gaming revenue soared in the first three months of 2007. Deutsche Bank’s Karen Tang looks at the numbers and explains why Chinese New Year may not be good for overall casino revenues.

Local press reported Macau’s February gaming revenues grew 30% year-on-year to US$700 million despite the high year-ago base of comparison. Feb also saw the highest average daily win on record. We think Feb growth is good, and in line with expectations, as Chinese New Year historically has an overall negative impact given reduced VIP play.

The CNY Effect

We believe comparing February growth with that in December and January is unfair because the latter two months had easy year-ago bases of comparison. We think Feb growth has been achieved despite tough, unfavourable calendar effects with Chinese New Year (CNY) having fallen in Feb, but in January last year. Unlike Las Vegas, in Macau casino wins are normally the lowest on CNY Day (and the day before and after) as VIPs are absent. Gaming wins averaged US$12 million on these three days this year – only half of the normal level. That said, this year the negative effect is muted as the Wynn and Grand Lisboa openings have boosted strong mass market growth to compensate for slower VIP play.

According to the local statistics office, over the seven-day CNY period, Macau visitation reached 767,000, a 17.8% increase over CNY last year, of which 55% came from China, and 35% from HK, in line with trend. High tourist flow benefited hotels. For 3-5 star hotels, occupancy is high at 95%. The average daily rate (ADR) also rose 17% year-on-year to HK$1,155.

Another record high in March

In March, gaming revenues surged 36% year-on- year to US$770 million in March, against the relatively easy comparison in March 2006, when revenues grew 16%. This sets another month of record high. We are encouraged to see demand remaining so strong, even seven months after Wynn Macau opened, though we suspect part of the strength comes from wealth effects from strong equity markets in China.

Upward revision of full-year growth

Year-to-date gaming revenues as of March were 46% higher year-on-year, at US$2.23 billion. Macau should be particularly busy in April as Hong Kong enters into a 5-day long Easter weekend. That said, we will not be surprised if growth slows slightly in the second quarter before picking up again mid-year after the openings of Melco-PBL’s Crown Macau and Las Vegas Sands Corp’s sprawling Venetian Macau resort. We think our original full year 2007 market growth assumption was too conservative, and revise it up from 20% to 25%.

VIP vs mass market mix

The market is concerned about the shift in growth from the high-margin mass segment (which grew 10% year-on-year in 4Q) to the low-margin VIP segment (which surged 66% year-on-year in 4Q), after the government restated statistics. The business mix in the first quarter of 2007 will be announced around April 16-26. This time, mass market growth should catch up slightly as Chinese visitor growth outpaced Hong Kong visitor growth in Jan-Feb (24% vs 19% year-on-year). In 4Q, the reverse was true (16% vs 36% year-onyear). If correct, this may prove market concerns are overblown. We value our Macau stocks on a combination of PE, EV/EBITDA, and NAV bases. Gaming and hotel stocks are exposed to Chinese leisure spending cycles. As such, key sector risks include a slowdown in the Chinese economy, its money supply, and disruptions to travel.