StarWorld is Galaxy Entertainment Group’s fifth casino in Macau, but the first property the company actually owns in the city. StarWorld will show whether Galaxy is right to claim it better understands the sensibilities of local gamblers than its US rivals

In July 2004, Hong Kong-listed Galaxy Entertainment Group became the second new casino licensee to begin operating in Macau following the end of Stanley Ho’s 40-year casino monopoly in 2002.

“The property features a 34-storey hotel offering 500 rooms, and the exterior boasts a huge LED wall that creates a stylish shifting pattern of lights on the building’s exterior”  |

Galaxy’s Waldo Casino featured a mere 38 gaming tables and 150 slot machines at opening, and paled in comparison to the first new foreign-operated casino, Las Vegas Sands Corp’s Sands Macau, which opened two months earlier with its spacious and glitzy gaming floor featuring 277 tables and 405 slots at opening. Sands Macau now has over 700 tables and 1,254 slots.

In contrast to the market-revolutionizing Sands Macau, Waldo was hastily converted from an office building. Still, its concentration on VIP gaming enabled Waldo to outgross Sands Macau in its first months of operation. Galaxy’s fortunes reversed drastically in 2005, however, as Sands Macau began courting VIP customers, taking a big bite out of Waldo’s share of the business, and driving up junket commissions, which further ate into the Galaxy’s profits. Furthermore, Las Vegas Sands Corp owns Sands Macau, but the Waldo property is not owned by Galaxy and sees the company retain a mere 4% of gross gaming revenue, owing to the large commissions offered to junket operators to bring VIP players to Waldo. Sands Macau also offers hefty commissions on VIP play, but retains over 60% of revenue from its mass gaming tables.

The standard breakdown of VIP revenue is known as the 40/40/20 model – pioneered by Stanley Ho’s SJM – and generally sees the concession holder receive around 20% of gross gaming revenue, while the government receives 39% as gaming tax (35% as direct tax, and an additional 3-4% as compulsory social and welfare contributions). The VIP room operator takes around 40% of gross gaming revenue from which a distribution needs to be made for commissions.

In Waldo, the bulk of revenue is generated in the VIP rooms, with the room operators taking over 39% of gross revenue. An important variation is that Galaxy pays 12% of revenue to the Waldo Hotel for rent of the hotel/casino operation and for being responsible for the overall marketing of the operation. Other charges bring Galaxy’s take of revenue at Waldo to a mere 4%.

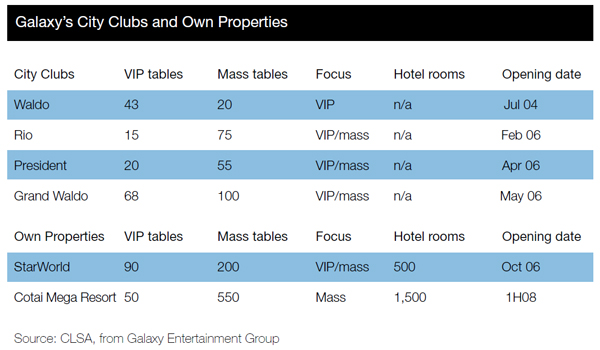

Galaxy’s star resumed its ascent following the opening of three further Galaxy-operated casinos in 2006 – Rio, Grand Waldo and President. As with Waldo, none of these properties is owned by Galaxy, and sees the company retain an average of 6-7% of casino revenue.

Keeping More

Galaxy is headed by Hong Kong construction tycoon Lui Che Woo, who said the three Lui Che Woo, who said the three additional properties almost tripled Galaxy’s share of Macau casino revenue to 20% in August from 7% in January.

On October 19, Galaxy opened its fifth property, the US$385 million StarWorld, which is the first property Galaxy actually owns. Galaxy will therefore retain a much higher proportion of casino revenues at StarWorld than at its four so-called city clubs, especially since the StarWorld targets both VIP and mass gaming, whereas the city clubs focus primarily on VIP play. Mass gaming is rapidly growing in importance in Macau, with main-floor gaming only contributing 23% of the city’s casino revenue in 2003, but 37% in 2005.

StarWorld’s casino offers close to 300 gaming tables, including 200 mass gaming tables, and 371 slot machines. The property features a 34-storey hotel offering 500 rooms, and the exterior boasts a huge LED wall that creates a stylish shifting pattern of lights on the building’s exterior – a marked departure from the gaudy neon that dominates the exteriors of the city clubs. StarWorld also offers the usual range of entertainment and leisure facilities available at a five-star hotel.

With StarWorld, Mr Lui believes Galaxy could further raise its market share to 25% of Macau casino revenue, and start to develop its non-gaming revenues. Mr Lui points out that with 95% of visitor arrivals to Macau hailing from Asia, Galaxy has a distinct edge “as a company owned and operated by Chinese,” giving it a better understanding “of the specific tastes of Asians for hotel, entertainment and dining.”

In July and August, prior to the opening of StarWorld, 90% of gaming revenue from Galaxy’s casinos came from the VIP segment according to calculations by CLSA, giving Galaxy a 30% market share in the VIP segment (assuming this segment accounted for 60% of industry revenue in these two months). According to CLSA, “this demonstrates the strength of local operators over US ones, as the latter are governed by the more stringent regulations in their home country, as well as Galaxy being a key competitor to SJM in the VIP segment.”

Local Sensibilities

Galaxy believes its local experience and affordable prices will secure it a niche and perhaps even an edge over foreign casino operators in the booming Macau tourism and gaming market. StarWorld aims to provide what Galaxy refers to as “affordable luxury,” adhering to the company’s concept of an “Asian price point.”

According to Galaxy CEO Anthony Carter: “This is not Las Vegas; Asians want to gamble, not go shopping or see Celine Dion shows. That will come in due course. But right now I just don’t see that the demand for these new facilities the Americans are building will meet the cost.” Mr Lui further asserted that with 95% of visitor arrivals to Macau hailing from Asia, Galaxy has a distinct advantage because it “understands the specific taste of Asians for hotel, entertainment and dining.”

For their part, the US operators deride Mr. Carter’s assertion that their offerings will be too expensive for mainland Chinese. Steve Wynn responded: “To look at the high level of shopping and consumer taste in Shanghai and Hong Kong and still suggest that the Chinese won’t care about luxury is a ridiculous denial of reality.”

StarWorld sits adjacent to the swanky US$1.2 billion Wynn Macau, which opened a month before StarWorld on September 6 with 600 deluxe hotel rooms and suites, about 220 gaming tables and 380 slot machines over approximately 100,000 sq ft of casino gaming space, seven restaurants, approximately 26,000 sq ft of retail space, a spa, a salon, entertainment lounges and meeting facilities.

With discounts, rooms at StarWorld can be had at around US$100 a night, while rooms at Wynn cost twice as much. There is demand for both properties, showing the Asian price point is merely one segment of a broader market. Meanwhile, there is also likely to be demand for even more budget-conscious offerings.

Morgan Stanley research analyst Rob Hart said StarWorld’s impact on its US rivals will only be “marginal,” with StarWorld posing a greater threat to Stanley Ho’s SJM, the other local operator. Mr Hart believes “Star- World will do very well. It’ll be able to fill itself up basically at the expense of SJM.”

Morgan Stanley predicts both StarWorld and Wynn will outperform the overall hotel market as junkets prefer to bring their customers to the best properties in town. The investment bank is negative on Macau’s oversupplied hotel sector as a whole, with massive supply coming in 2007 onwards.

In the Pipeline

Galaxy’s most ambitious mass-market project is under construction – the Cotai Mega Resort, slated to open in 2008. The Mega Resort will be completed in four phases by 2009, and will house 600 tables – including 550 mass and 50 VIP tables – and 1,000 slots in a 250,000 sq ft casino, in addition to providing a full array of dining, retail and entertainment facilities. Galaxy is planning to invest a total US$1.02 billion in Macau by 2008, and Morgan Stanley points out that Galaxy may be running into cost overruns at the Cotai Mega Resort, which raises the company’s risks.

There are some distinct Asian touches at StarWorld, and the bulk of its restaurants serve Asian cuisine. However, Wynn has plenty of Asian touches and dining options too, as will future properties like Las Vegas Sands Corp’s mammoth Venetian Macau.

Both StarWorld and Wynn offer the best products and services at their given price points. Both will also find greater competition at their respective price points in the near future. Told that Mr Carter believed the “Asian price point” for a hotel room is about US$100, LVS Chairman Sheldon Adelson responded: “I’m going to have five price points in Cotai. I want the mass-market and the high-roller market. My target is to maximize every opportunity.”

There are several Asian price points, and in each segment, customers will seek the best value for their money. StarWorld offers a stylish package and high-quality amenities at its price point. It also benefits from the critical mass of customers drawn by Wynn Macau next door and Lisboa across the street, creating a second locus of mass-gaming concentration along Macau’s Friendship Avenue – at the other end of which sits the crowd-pulling Sands Macau.

Galaxy has thus far profited at the expense of its local rival, SJM, which has yet to completely shed its monopoly-era complacency. Going forward, Galaxy will further establish its identity and prove its worth when it opens the Cotai Mega Resort and competes more directly with international rivals to retain its niche.

StarWorld Casino